Payroll errors are even worse than you may think they damage employee confidence, create accounting confusion, and can even lead to compliance fines.

It is at this point that payroll reconciliation comes in.

It is the process that makes sure that all the dollars you are recording in your payroll are the ones leaving your bank. Reconciliation ensures your books are correct, your staff is confident and your business is audit ready when done properly.

Here in the blog we are going to discuss seven effective payroll reconciliation techniques that you can implement today, whether you are using a simple checklist routine or an automated system that will identify an error before it reaches payday.

We can start by defining the meaning of payroll reconciliation and why it is important to all businesses.

What Is Payroll Reconciliation?

Payroll reconciliation is a process of verifying your payroll records with the financial information of your company to make sure that all the payments are correct, authorized and documented.

In more basic words, it is about ensuring that what you paid employees, deducted taxes and what you reported in your books all add up.

Unless payroll is reconciled, minor mistakes can develop out of proportion – paying employees more than they should, deductions overlooked, tax returns submitted with wrong amounts. Regular reconciliation assists you in identifying those errors early enough and rectifying them before they impact on your financial reports or compliance level.

Key things payroll reconciliation verifies

- Employee payment: Are gross and net payments right on each employee?

- Deductions and taxes: Have the right deductions and taxes been made to benefits and taxes?

- Bank transactions: Are the amounts in the payroll the same as your bank statement?

- General ledger entries: Do payroll expenses and liabilities reflect on the appropriate accounts?

Simply put, payroll reconciliation is your financial accuracy control gate – ensuring that all the numbers in payroll are adding up properly in all your systems.

When payroll data flows into broader finance operations, tools like accounts payable automation software can further reduce manual errors by ensuring consistent, traceable payment records across systems.

Why Payroll Reconciliation Matters

Payroll reconciliation is not only an accounting routine but a very important practice that keeps your business, employees and finances safe. Missing or doing it poorly may have grave consequences, including monetary mistakes or fines of non-compliance. To understand why payroll reconciliation is important, we are going to divide it into the following reasons:

1. Ensures Compliance and Avoids Penalties

Payroll entails a series of legal obligations such as income tax withholdings, social security contributions, retirement fund deductions among other statutory obligations. Errors in these computations may cause:

- Financial fines or fines on late payments by the government.

- Interest on the taxes not paid.

- Red flags on audits that raise eyebrows on your business.

Frequent reconciliation of payrolls will help you to remain in compliance with local and federal laws, as your payroll records will be in line with your tax returns and remittances. It also offers audit documentation, which minimizes the stress and possible liabilities.

2. Maintains Employee Trust and Satisfaction

Workers depend on proper and on time paychecks. Even minor mistakes underpayment, overpayment, or benefits that are missed can:

- Undercut HR and payroll procedures.

- Reduced work morale and productivity.

- Payroll disputes: increase HR workload.

Payroll reconciliation assists in the detection of errors prior to the release of paychecks. Checking gross pay, deductions, and net pay will ensure the employees are paid correctly each time creating trust and loyalty.

3. Improves Financial Accuracy and Reporting

Payroll is usually a large expenditure to any business. Payroll discrepancies may also misrepresent your financial statements, including:

- Accuracy of monthly and quarterly reporting.

- Decisions on budgeting and forecasting.

- Department, project, or team cost analysis.

Reconcil payroll balances employee costs against accounting records, and provides you with an accurate account of labor costs and financial health. The accuracy is essential to CFOs, controllers and business owners who depend on accurate financial data to make decisions.

4. Prevents Fraud and Reduces Errors

Errors in payroll are not necessarily accidental, they can also be signs of time fraud or abuse of the system. Periodic reconciliation assists in identifying:

- Pay to duplicate or ghost employees.

- Salary, bonus or hour changes that have not been approved.

- Deductions or contribution benefits that are posted incorrectly.

Reconciliation is a protective measure by the systematic check of the payroll records against the time tracking, bank statements and accounting data, which minimizes the possibility of expensive errors or fraudulent actions.

5. Optimizes Operational Efficiency

The process of rectifying manual errors can often be labor intensive and strenuous. By detecting problems early through reconciliation, these benefits will follow:

- The finance and payroll departments will waste less time correcting errors.

- Payroll cycles will close more quickly

- Teams can focus on strategic work rather than reacting to troubleshooting issues.

Automation and clear reconciliation processes allows efficiency to go even further, allowing companies to grow without growing payroll headaches.

Who Should Own Payroll Reconciliation & How Often to Run It

Due to many systems, sources of data, and approvals, it’s important to establish clear ownership and a consistent schedule for payroll reconciliation. We have detailed this process below:

1. Who Should Own Payroll Reconciliation

a. Payroll Team / HR Department

- Primary responsibility: Primarily responsible for payroll processing: Collecting time and attendance, calculating gross pay, deductions, and net pay.

- Tasks include:

- Reviewing employee hours and overtime

- Validating benefits, garnishments, and other deductions

- Creating a payroll register for a supervisor to review

b. Accounting / Finance Team

- Primary responsibility: Verifying payroll postings to GL accounts, accounts payable, and bank statement.

- Tasks include:

- Matching total payroll as an expense to GL accounts

- Reconciling tax liabilities and employer matching; contribution

- Approving adjusting journal entries

c. Controllers or Finance Leads (in small companies)

- Primary responsibility: Reconciles payroll and all adjustments, sign off for payroll use.

- Ensures segregation of duties — the same person shouldn’t process payroll and approve adjustments.

d. Management / CFO (optional, for large organizations)

- Periodic review the final reconciliation reports to ensure compliance and accuracy.

- KPI dashboards can be used to track accuracy and errors rates, time it takes to reconcile and exceptions.

2. How Often Payroll Reconciliation Should Be Performed

| Type of Reconciliation | Recommended Frequency | Notes |

|---|---|---|

| Pre-Payroll Check | Before each pay run | Confirms hours, rates, and adjustments; prevents errors from being processed. |

| On-Cycle Reconciliation | Same pay cycle | Ensures net pay totals match expected bank transfers. |

| Post-Payroll Reconciliation | Within 1–2 business days after payroll | Verifies bank transactions, taxes, deductions, and GL postings. |

| Monthly / Quarterly GL Reconciliation | Monthly / quarterly | Aligns payroll with general ledger and accounting reporting. |

| Annual Audit Reconciliation | Year-end | Provides documentation for audits and compliance review. |

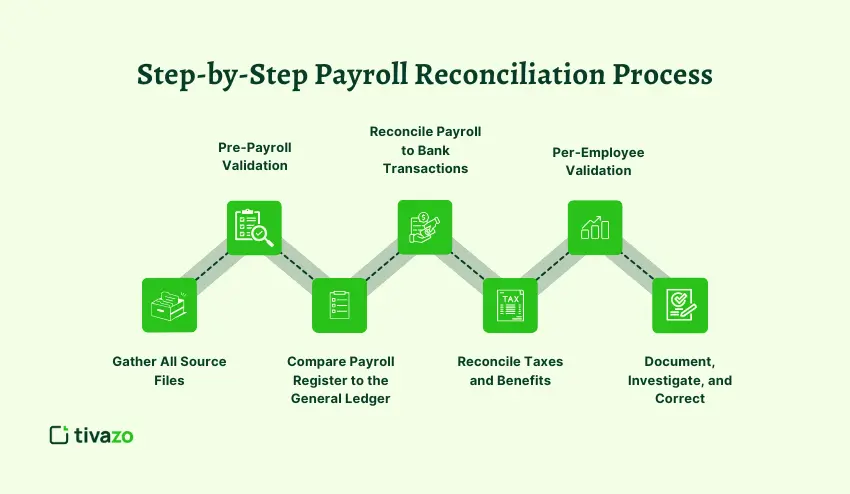

Step-by-Step Payroll Reconciliation Process

The process is organized, and it saves time, minimizes errors, and ensures accuracy. The following is an example of a workflow that can be repeated and used in every payroll cycle:

Step 1 — Gather All Source Files

To begin with, gather all the data required:

- Payroll report/payroll register of your payroll system.

- Timecards or attendance records of employees.

- Bank statements or ACH/cheques files.

- Tax and benefits reports

- General ledger payroll postings.

Step 2 — Pre-Payroll Validation

Check key entries prior to payment processing:

- Ensure that all timecards, overtime and paid time off are approved.

- Confirm pay rates, deductions and bonuses of employees.

- Freeze at least 24-48 hours prior to processing payroll master data.

Step 3 — Compare Payroll Register to the General Ledger

- Reconcile the match total payroll expense and liability accounts with the GL.

- Check tax, benefit and employer contribution breakdowns.

- Make sure that all journal entries are listed on the appropriate account.

Step 4 — Reconcile Payroll to Bank Transactions

- Compare totals of net pay, payroll register to bank transfers.

- Equalize the number of payments and individual amounts.

- Examine discrepancies as they arise (e.g. missing deposits or additional payments).

Step 5 — Reconcile Taxes and Benefits

- Ensure that all deductions (taxes, health, retirement) of employees are recorded.

- Check that employer contributions and tax liabilities on reports and GL are the same.

- Make adjustments where there are discrepancies to be filed or remitted.

Step 6 — Per-Employee Validation

- Sample check of employees to be accurate.

- Target high risk groups: new employees, dismissed workers, contractors.

- Check: Gross pay- deductions- net pay- bank deposit.

Step 7 — Document, Investigate, and Correct

- Note any differences with a root-cause description.

- Properly recorded payrolls through journal entries or off-cycle payments.

- Keep a good audit trail of approvals and changes.

This process will take you step by step to ensure that you identify mistakes, keep in line, and simplify payroll activities.

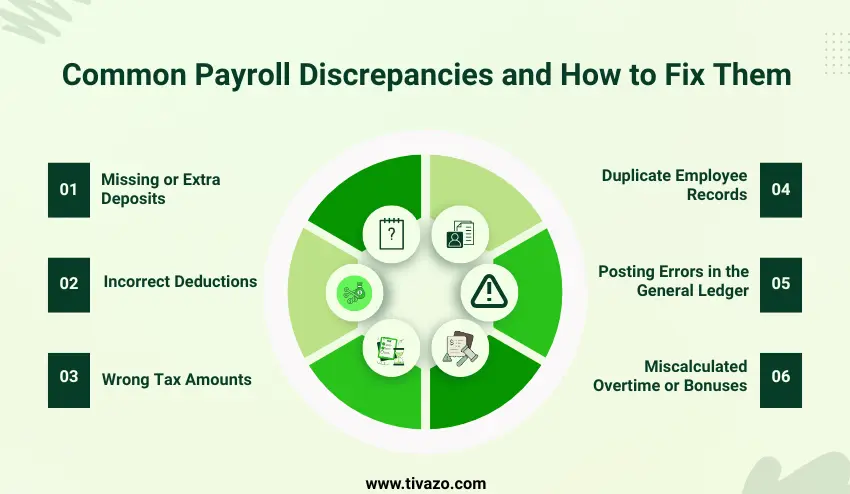

Common Payroll Discrepancies and How to Fix Them

The careful procedures may still result in payroll errors. In order to be accurate and compliant, one should identify common discrepancies and be in a position to resolve them in a small duration of time.

1. Missing or Extra Deposits

Issue: Net compensation of an employee is either absent or payment is duplicated.

How to fix:

- Compare bank files to payroll register balances and trace employee.

- Contact the bank immediately in case they are wrong.

- Correct internal mistakes by making an off-cycle payroll or reversal journal entry.

2. Incorrect Deductions

Issue: Taxes, benefits or garnishments are deducting/not deducting too much.

How to fix:

- Balance deductions to HR files, payroll set-ups and benefit providers.

- Adjust the subsequent wage of the employee where it is permitted to do so, or refund.

- Document the correction as a compliance and auditing measure.

3. Wrong Tax Amounts

Factors: Payroll taxes (federal, state, local) were computed wrongly.

Steps to resolve:

- Refer to payroll tax tables and payroll tax codes.

- Mend the records of payroll provider system.

- Prepare and submit amended tax returns and remittances.

4. Duplicate Employee Records

Issue: Two entries of the same employee are made and hence payment is duplicated.

How to fix:

- Identify duplication in the payroll or HRIS system.

- Pay back the extra amount and notify the employee.

- Enter the records to prevent the reoccurrence in the future.

5. Posting Errors in the General Ledger

Issue: The value of payroll expenditure or liability recorded in the wrong account.

How to fix:

- Identify lost journal records.

- Make record corrective journal entries of approvals.

- To prevent this, update mapping guidelines in your payroll or accounting system.

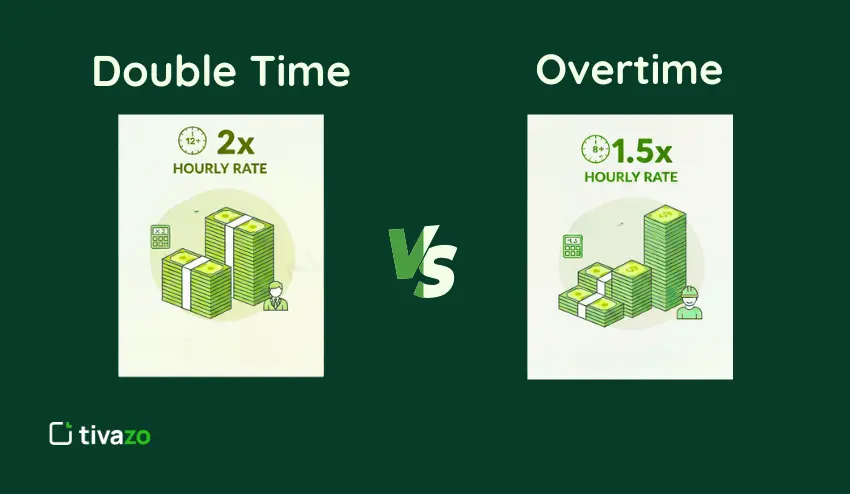

6. Miscalculated Overtime or Bonuses

Issue: The compensation given to the employees is less or more than the overtime or bonus payment.

How to fix:

- Verify check payrolls with accepted timesheets and bonus plans.

- As required, properly by way of an off-cycle payroll.

- Check overtime and bonuses in payroll program to eliminate repetition of errors.

Conclusion

Payroll reconciliation is necessary to ensure that your business is accurate, compliant, and trustworthy. With the help of a systematic approach, checking of employee payments, and using automation wherever feasible, you will be able to avoid mistakes, save time, and ease payroll pressure.

The first step is to create a basic checklist that will be used at the end of every payroll cycle, reconcile before and after payday, and find those tools that will allow combining payroll with your accounting and banking system. Through practice, the process of payroll reconciliation will be a smooth and reliable process that safeguards your business as well as your employees.