Are you finding it difficult to keep your project budget under control? Do you think your project accounting could be improved to handle your finances better? Project accounting is an important component of the overall success of any project, and plays a key role in cost tracking, revenue management, and financial health. In this article, we look at the 7 best practices for project accounting that can restructure your financial control strategy and ultimately help you achieve financial success.

When you master these best practices you will be armed with information, knowledge, and all of the financial controls you need to be sure that your projects remain financially aligned, while avoiding overspending and project failure.

Key Highlights:

- What do you mean by project accounting

- Why Project Accounting Matters

- Proven Best Practices for Project Accounting Success

- Key Features of Project Accounting Software

- Common Mistakes in Project Accounting

- Prepare for a Project Audit

What do you mean by project accounting?

Project accounting refers specifically to an accounting discipline that tracks the financials of individual projects. It is different than general financial accounting, which accounts for the financial position of the business, while project accounting focuses on costs, revenues, and resource allocation for an individual project. Project accounting helps managers keep a close eye on budgets and allows them to track progress against financial goals while adjusting spending within a project’s financial boundaries. Through project accounting, project managers will determine whether or not each project is financially feasible and while ensuring that projects align with company financial goals.

Why Project Accounting Matters

Effective project accounting is crucial to achieving successful project outcomes. Effective project accounting gives organizations financial control of every project and the visibility of costs and revenue over the project lifecycle. If you do not have a budget for the project, your project will likely go over budget, take its eye off key financial milestones along the way, and ultimately will not be financially viable. By understanding the financial aspects of your project (or tracking the financial health of it), project managers will identify potential risks well in advance, be able to make informed decisions, and ultimately be able to deliver successful projects on time and on budget.

Effective project accounting helps you:

- Tracking Your Project Costs: Task project managers with tracking the costs of the project and monitoring features that prevent cost overruns and ensure the project does not exceed the budget.

- Cash Flow Management: Creating a system for tracking your revenue and your payments will prevent any cash shortage.

- Profitability Assessment: This is the main component of accounting. The overall financial viability of the project is the income and the expenses the project is generating.

This is an example of project accounting. Not only will you keep your projects under budget, but you will also contribute to the overall successful and profitable project outcome, which ultimately will be a contribution to our organization’s bottom line.

7 Proven Best Practices for Project Accounting Success

Effective project accounting is essential for the successful management of projects and financial control. If you implement these best practices, you’ll improve your cost management and tracking capabilities, keep your projects financially on track, and in turn, achieve enhanced project outcomes and profitability.

1. Create a Detailed Budget from the Start

The first step in any successful project is to develop a reasonable budget. A full budget gives you a game plan on how the resources will be used on the project. It allows project managers to foresee or plan for budget constraints while staying within the boundaries of money spent, limiting the project’s financial exposure to potential cost overruns.

- Estimate all costs associated with the project: Labor, materials, equipment, and outside services.

- Build in contingency funds for project issues: Something always comes up, or the scope of the work changes.

- Reassess and update: Update the budget as the project proceeds.

2. Use Project Management Software for Real-Time Tracking

Project Management Software, like ProjectManager or QuickBooks, has transformed project accounting. Project management software provides real-time automated data collection in regard to cost tracking, resource utilization, and project performance. So much goes into managing any project, and having data on debt due diligence is invaluable in assessing problems and allocating resources promptly.

- Track expenses when they occur: Routinely monitor spending for expenses that occur.

- Monitor work progression: Make sure ways are being used as planned.

- Review financial activity in real time: It’s easy to identify trends or discrepancies aligned with objective financial measures.

3. Regularly Track and Compare Planned vs. Actual Costs

It’s not uncommon for project budgets to change over time due to scope creep, unexpected expenditures, or changes in project priorities. Regular comparisons of planned costs and actual costs ensure there are no surprises. This comparison is referred to as a variance analysis process and is very important to stay within budget.

- Compare planned vs. actual costs regularly: Track the cost variance to highlight trouble early..

- Adjust forecasts as needed: Adjust your estimate during project execution when the variance has changed your cost estimate for resources.

- Perform milestone reviews: Assess a project at each milestone relating to financial performance.

4. Align Revenue Recognition with Project Milestones

Revenue recognition is key to accurately reflecting a project’s financial health. By aligning revenue recognition with project milestones, you ensure that the financial data reflects the progress of work completed. For example, the Percentage of Completion method allows you to recognize revenue as milestones are achieved, rather than waiting until the project’s completion. Using a reliable revenue recognition solution ensures milestone-based income is recorded accurately, stays compliant with accounting standards, and reflects a project’s true financial position in real time.

- Embrace milestone-based revenue recognition: Align acknowledgment of income with each stage of project completion.

- Match costs with acknowledged revenue: Ensure that your financial reports make sense to you and the reader.

- Ensure compliance: To complete project revenues, be sure to apply the appropriate accounting standards for recognizing revenue.

5. Monitor Cash Flow Continuously

Cash flow is the lifeblood of any project. It’s crucial to be sure that there is money available when you need it for the project to be a success. Monitoring cash flow helps the project manager to avoid delays when there are no more funds available for an extension of a project, while ensuring well-timed payments to all vendors, employees, and sub-consultants. Real-time cash flow tracking tools can alert a project manager when they may not have enough cash.

- Track cash inflows and cash outflows: Make sure the project will not run out of money.

- Use cash flow forecasts: Anticipate financial needs timely.

- Maintain ample liquidity: Maintain an appropriate amount of funds to pay day-to-day expenses.

6. Stay Transparent with Stakeholders

Transparency is a key to trust and collaboration among project stakeholders, and sharing financial reports routinely with stakeholders, clients, and team members keeps everyone informed about the project’s financial health and its progress through the engagement. Projects are far less likely to encounter issues and problems along the way if your clients and team members are informed and fairly visible into their financial snapshot.

Tip: Making use of information visualization graphs, dashboards, and charts facilitates the digestion of financial information for stakeholders.

- Give consistent financial updates: Keep stakeholders informed for each phase

- Use good charts, visuals: Scientific information needs to be processed.

- Communicate openly: Address concerns.

7. Plan for Contingencies

Even the best-laid plans can become disrupted by unexpected events e.g. scope changes, delays, or unanticipated costs. Contingency funds are essential to the success of a project so that individuals can address issues without jeopardizing the project with potentially increased costs. Contingency funds are money set aside to mitigate risks identified during the project execution and provide a descriptive safety net should something go wrong.

- Designate Contingency Fund: Designate 5-10% of the overall budget to cover an emergency or unexpected costs.

- Monitor Risk Factors: Keep an eye out for risk factors ahead that may reduce the likelihood of a surprise.

- Use Judiciously: Use the contingency fund only when necessary.

The Role of a Project Accountant

The project accountant serves a significant role in making sure the project is managed in a financially accountable way. They are responsible for financial integrity and keeping the project “on budget” financially. The project accountant makes sure all costs are posted, and the budget is being followed, and that all financial transactions are former, and prescribed means. The project accountant works closely with project managers, actors, and others in the financial world to provide the necessary input into the financial side of the project in a way that minimizes chances for budget overruns and validates project financials.

Key Responsibilities:

- Track the project and usage of the budget

- Draft or contribute to the creation of financial reports

- Ensure that the project costs align with the project budget

- Identify and resolve financial issues.

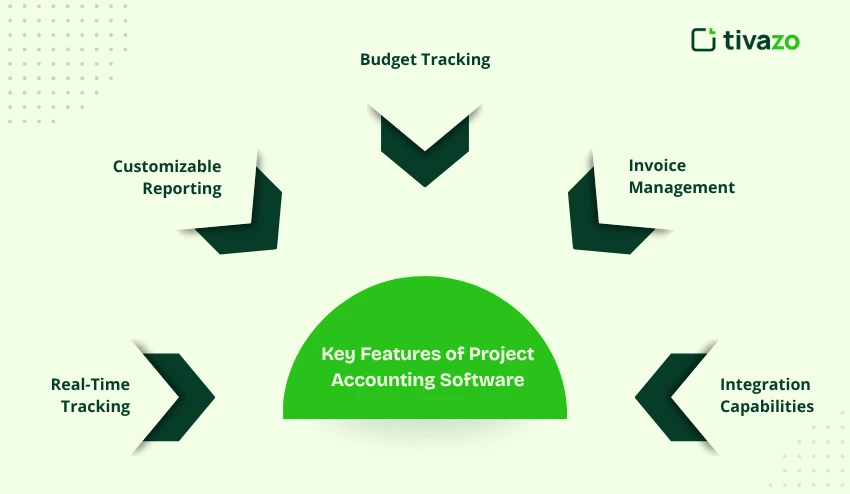

Project Accounting Software: Key Features to Look For

Picking SaaS financial software for project accounting is essential for ensuring the project stays on budget. The right software will help the project accounting processes, will increase accuracy, and even provide some automated and in-depth financial perspective. Here are some features to think about when selecting project accounting software:

- Real-Time Tracking: This capability allows project managers to maintain current visibility into project costs and revenue by monitoring expenses as they happen. In addition, this feature allows you to identify potential delays before they become an issue.

- Customizable Reporting: No two projects are alike; therefore, the ability to build customizable financial reports is a necessity. Tailored reports allow users to hone in on any specific financial reports, preventing the oversaturation of data from obscuring performance and adjustments.

- Budget Tracking: Track current expenses and projected expenses moving forward. This will verify that your project stays on budget, but also will allow for adjustments along the way if needed.

- Invoice Management: This feature will create and send invoices for your clients with an automated process, helping the user always keep up to date on invoices sent, which also helps with reducing delayed income due to invoices not being sent in a timely manner.

- Integration Capabilities: A project accounting software should be able to smoothly integrate into the other business tools in your organization, like project management software, CRM system, or payroll systems for a better flow utilizing departments.

Top Tools to Consider:

Choosing the right project accounting software is important for keeping your project’s finances on track. The software you choose will help streamline your accounting process, create greater accuracy, and enhance financial oversight. Many teams also rely on specialized AI platforms for project-level finances to consolidate budgets, forecasts, and reporting in one place. Here are five features to think about when you are considering project accounting software:

- Project Manager: A robust tool that provides you with real-time tracking, budget monitoring, or even seamlessly integrates with your other business tools.

- QuickBooks: this is a popular accounting application, in part due to its user-friendly interface, customizable reports, and solid financial management features.

- Xero: a cloud-based accounting software that is designed for small to mid-sized projects with robust billing and reporting features.

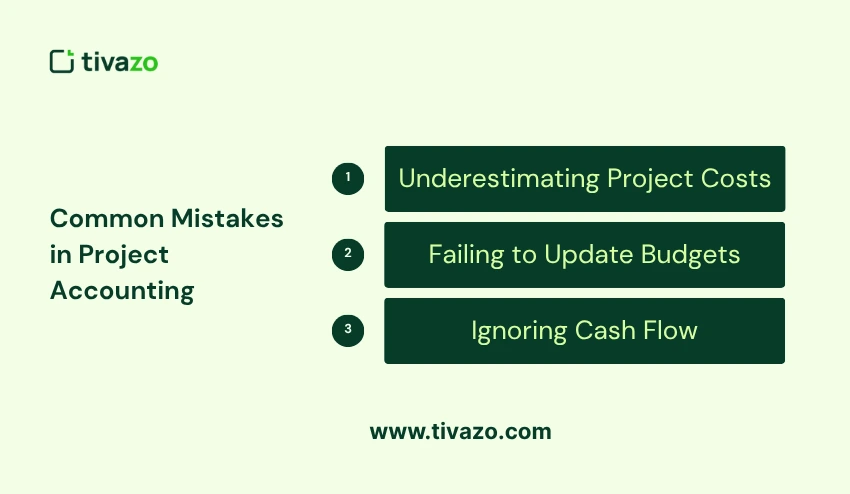

Common Mistakes in Project Accounting to Avoid

Even experienced project accountants can make mistakes that can affect your project’s financial success. Mistakes generally occur by not paying attention to detail, poor planning, or using accounting that is not responsive to changing project conditions. Recognizing and trying to avoid these common mistakes will keep your project on track without budget overruns or financial issues. Understanding these specific reasons will help you build prompt strategies to help you achieve financial success.

- Underestimating Project Costs: It is important to consider all costs so that you are not surprised in the end by the project being more expensive than anticipated.

- Failing to Update Budgets: Up to Date: At different stages of the project, budgets should be reviewed periodically to capture scope or cost changes.

- Ignoring Cash Flow: Monitoring cash flow is important throughout a project so that the project is not delayed because of a cash shortage.

How to Prepare for a Project Audit

Project audits are a routine process that needs to be done to verify financial compliance for reporting purposes, maintain transparency, and measure the financial health of the project. If you are completely prepared for the audit you will not experience delays, you will experience less stress and anxiety, and it will allow for a higher level of detail and broader understanding of the financial aspects of the project. Taking a proactive approach to the audit in its preparation can not only streamline auditing processes, but it can also increase the overall financial integrity of your project.

Steps to Prepare:

- Organize Financial Records: File all financial documentation, including invoices and receipts, in a manner that is ordered and easy to access. If everything is easy to access and neatly organized, it may speed up the audit and minimize discrepancies.

- Verify Accuracy: Review financial entries to avoid discrepancies while the audit is taking place. Make sure to double-check the accuracy of recorded costs, invoices, and payments that reflect substantive financial transactions during the audit.

- Work with an Auditor: Work with auditors to guarantee they have all the information they need. Provide any documentation requested in a timely manner, and be open about any problems occurring in the audit.

Conclusion

Mission-based project accounting is an important reliability marker to ensure project success. By adopting these 7 true best practices, you will be able to not only more easily track project costs, but also manage revenue, and keep your project on budget. Transparent reporting, real time monitoring or contingency planning are just some things you can be doing to avoid non-compliance and prevent you may be facing in project finances.

Simply mastering mission-based project accounting, isn’t really just for compliance purposes or to avoid lleporate standing to avoid financial issues.