Payroll automation has become a necessity, rather than a luxury. By embracing AI-driven payroll automation, organizations can reduce errors, increase efficiency, and future-proof their pay processes. Payroll automation allows for much more than speeding up payroll processing. It also allows for compliance with tax laws that may change at any point. A move away from manual data entry – which is often a cause of payroll errors – is enabled, while also providing real-time analytics that inform better-informed business decisions.

These businesses, which focus not only on what, but how payroll can be automated, will benefit competitively, incur less operational and employee costs while providing employees value-added work via accurate and fast payments. This blog discusses payroll automation to explain its meaning, how it works, implications beyond payroll system efficiency, what features are must-haves, and actions to take towards effective payroll automation to make it a success.

Key Highlights:

- What is Payroll Automation?

- Advantages of Payroll Automation

- What To Look For In Payroll Automation Software

- The Impact of Artificial Intelligence on Payroll Automation

- How AI is creating efficiencies in payroll

- What is RPA in Payroll?

- Processing Payroll in 5 Simple Steps

- Is AI Capable of Handling Payroll?

What is Payroll Automation?

Payroll automation is the use of software-enabled systems to automatically process payroll calculations, tax filings, reporting, and direct deposits, typically as part of a larger payroll application that integrates time tracking, benefits, and human resource systems. It replaces manual work with workflows that are seamless and error-free.

Why is payroll automation a must?

- Reduces manual errors: It eliminates the manual calculations to mitigate mistakes in employee pay and tax deductions.

- Saves time: Payroll automation software takes care of repetitive tasks, allowing HR teams to move to more strategic work.

- Improves compliance: Payroll automation automatically updates tax rules and regulations for compliance.

- AI for payroll: Using AI to detect anomalies, predict labor costs, and schedule payroll for optimal efficiency. I

- Integrated systems for payroll: Payroll automation works in tandem with an organization’s HR, benefits, and accounting functions, enabling payroll data to flow smoothly between systems.

- Better employee experience: When employees are confident, they will always be paid correctly, on time, and can easily access their payroll information.

- A solution that scales: Payroll automation simply gets bigger with the growth of your organization, without the addition of employees.

Advantages of Payroll Automation

Here are 10 game-changing benefits of payroll automation

| Number | Advantage | Description |

| 1. | Time Savings | Eliminating manual and time-consuming repetitive work and data entry. |

2. | Improved Accuracy | Minimize human error – a significant factor for compliance |

| 3. | Cost Effectiveness | Potential to reduce labor and error-related costs. |

| 4. | Compliance | Ensure those dreaded tax rules are updated automatically |

| 5. | Integrated Data | With all data systems integrated, payroll can talk to HR, accounting, and attendance, This type of integration is similar in principle to scenarios where backend scripts must adapt across environments like when developers need to change user agent nodejs to simulate browser requests during automated workflows |

| 6. | Data Security | Fewer opportunities to handle data manually mean you have decreased chances of a data breach. |

| 7. | Less opportunity | To handle data manually means you have decreased chances of a data breach. |

| 8. | Scalability | If payroll volume continues to grow, your organization can handle a greater volume of payroll—without having to hire more payroll staff. |

| 9. | Smart Recommendations | AI can detect anomalies and then provide recommendations to resolve them—before they become payroll issues. |

| 10 | Employee Happiness | The average employee is happier as they receive their pay faster and more accurately. |

| 11 | Future Proof | AI and RPA place organizations in the profitable position of being ready for the next generation of workforce technologies. |

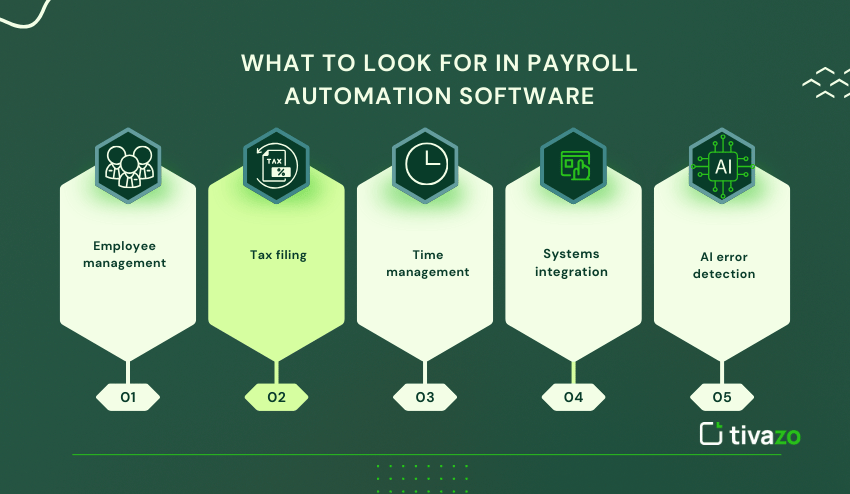

What To Look For In Payroll Automation Software

Here’s a list of items to look for when evaluating payroll automation systems:

- Employee management/employee self-service portals: Employees will access their pay stubs, change personal information, and view their benefit accommodation materials.

- Tax filing (local, state, federal) and automation updates: helps maintain compliance and minimizes chances for human error and just plain human intervention.

- Time management, PTO, and direct deposit make payroll processing easy, and employees are paid accurately and on time.

- Systems integration (HRIS, accounting software, time systems): makes for seamless flow across departments.

- AI error detection, exceptions, and support for audit: Systems use AI to identify errors and alert on discrepancies.

The basic features listed above, as well as other features that can add value with payroll automation, include:

- Custom reporting dashboards: complete real-time analysis of payroll costs, payroll trends, and employee profiles.

- Support for multiple locations: includes standard payroll objects that apply to your employees across regions & jurisdictions with specific tax rules.

- Security, data protection, and privacy; the employee and employer personnel files & financial data are sensitive information.

- Scalability: new employees can be added without changing the existing payroll process.

These features show how payroll automation not only returns a better margin of error but also streamlines payroll processing to improve HR operations overall.

The Impact of Artificial Intelligence on Payroll Automation

- Artificial intelligence has changed payroll automation for the better by making the payroll process faster, smarter, and increasingly accurate. The impact of AI in payroll comes from the ability to do such things as:

- Identifying anomalies and errors before they spiral out of control. AI algorithms will quickly review the payroll data against normal historical patterns in real-time. They will identify inconsistencies, duplicates, or unusual deductions before they become an expensive headache.

- Providing data-driven insights and optimizations to processes. AI will evaluate payroll trends and help HR departments budget expenses, optimize staffing, and increase efficiencies, all from one utilization of HR payroll data.

- Providing AI agents. For instance, Workday’s Illuminate Payroll Agent automates your pay inputs. The agents will take care of compliance calls and give suggestions on how to adjust payroll based on coworkers’ inputs.

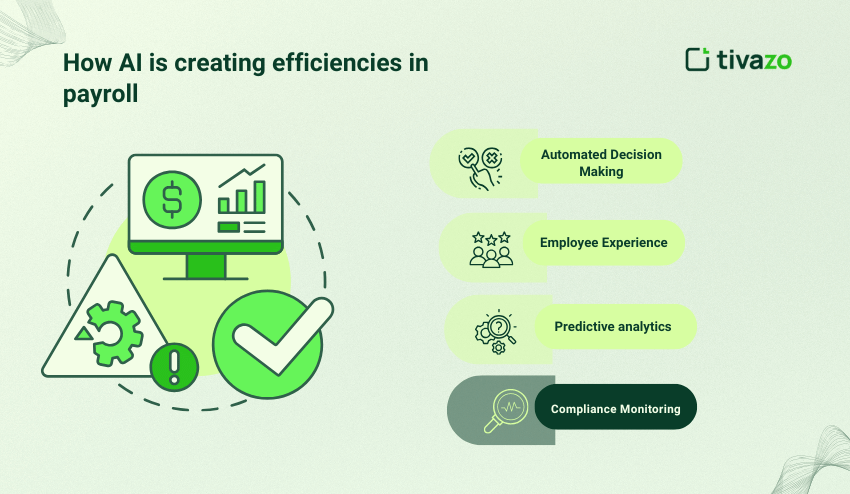

How AI is creating efficiencies in payroll

Automated Decision Making: AI can help suggest corrective action for missed hours, overtime, or adjustments related to benefits updates, and help to circumvent the manual phase for payroll processing.

Better employee experience: With AI chatbots, employees may have answers to their payroll-related questions instantly, and your organization will benefit from improved employee satisfaction.

Predictive analytics: Employers can utilize AI to predict payroll costs for their upcoming periods, enhancing the budgeting process from a financial forecasting perspective.

Compliance Monitoring: AI can automatically take into consideration new taxes, regulations, and law changes to ensure that your automated payroll is the best execution possible and is legally compliant.

In short, AI transforms payroll automation from a calculation tool to a strategic force for optimization, correctness, and workforce practice.

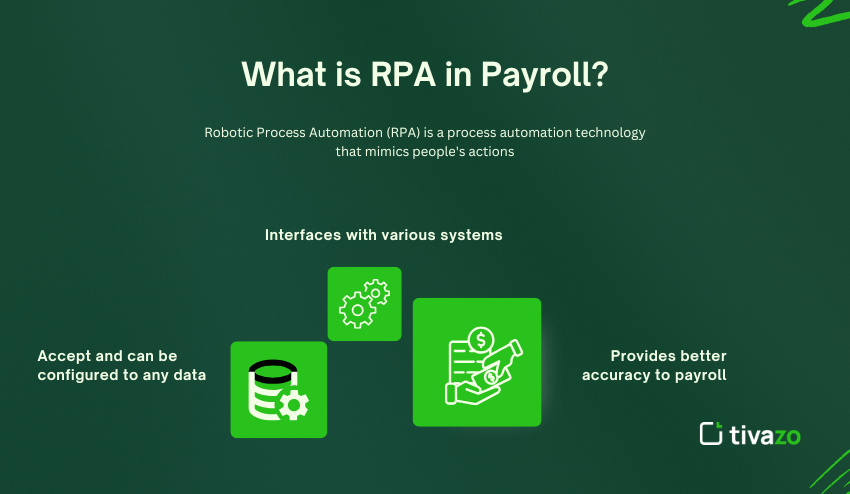

What is RPA in Payroll?

Robotic Process Automation (RPA) is a process automation technology that mimics people’s actions (such as copying payroll information from one system to another) to improve payroll process automation. RPA:

- Interfaces with various systems (such as HR and accounting) seamlessly

- Can work with unstructured data, or will accept and can be configured to any data

- Provides better accuracy to payroll and faster payroll cycles while maintaining compliance

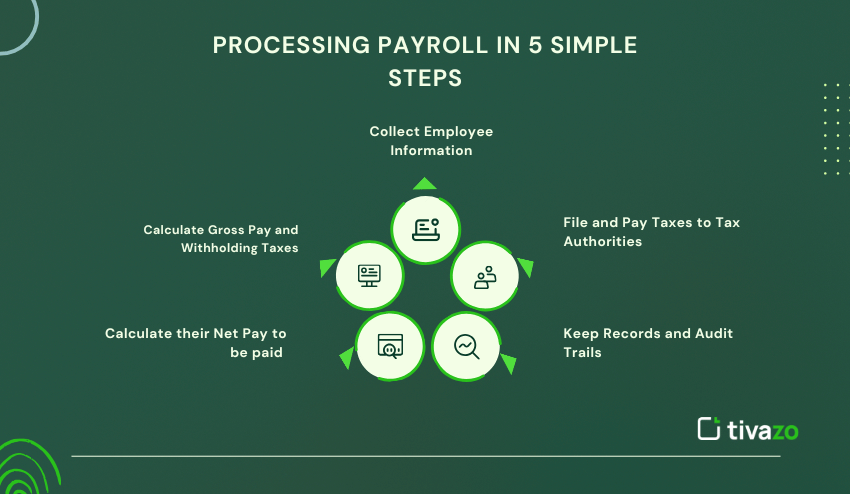

Processing Payroll in 5 Simple Steps

Counting payroll manually can take hours, and mistakes can happen easily. Payroll automation simplifies each step to ensure accuracy and efficiency. Below are the 5 simple steps in payroll processing with more detail

1. Collect Employee Information

- Collect hours worked, overtime, absenteeism, benefits, and deductions.

- Use your payroll software to import employee information automatically from your time tracking and human resource systems.

- You can be sure your payroll calculations are based on the correct information to begin with.

2. Calculate Gross Pay and Withholding Taxes

- Determine the employees’ total earnings, including any salary, bonuses, and commissions.

- Deduct federal, state, and local withholding taxes, as well as social security and other mandatory deductions

- Payroll AI can provide validation on the calculations made and immediate notification where discrepancies arise, further reducing errors in processing payroll.

3. Calculate their Net Pay to be paid

- Determine what the final amount of money will be received by each employee after deductions.

- Make their pay either through direct deposit or check.

- Payroll software does this instantly by doing all the calculations and generating payslips (which also promote the transparency of your payroll).

4. File and Pay Taxes to Tax Authorities

- Accurately and timely pay taxes to the government agency.

- With payroll automation, you can ensure compliance with newly enacted tax rules to avoid penalties.

5. Keep Records and Audit Trails

- Keep complete records for audit, compliance purposes, and financial management analysis.

- AI-based analytics gives information on payroll patterns and planning for the future.

When payroll automation is leveraged, the entire process results in quicker, more accurate, and less frequent human error. This makes it easier for HR teams to focus on strategic initiatives, rather than perform repetitive calculations.

Is AI Capable of Handling Payroll?

Yes, AI can fully support payroll automation by:

- Automating calculations and spotting errors: Removing associated manual mistakes in pay and deductions.

- Getting the most out of tax withholdings whilst flagging without arbitrary nuances: AI learns the order of events in a payroll pattern to avoid pitfalls.

- Handling inquiries and exceptions on an independent basis: AI Agents can receive employee questions and process exceptions on their behalf.

- Improving payroll processing options: Payroll cycles improve in speed, which increases the speed of paying employees.

- Encouraging predictive analysis: Enabling means of predicting payroll costs supports budgeting.

- Maintaining compliance: Payroll computations align with tax calculations and applicable labour laws.

Thus making automated payroll efficient, precise, and trustworthy.

What is ADP, and can it automate payroll?

ADP (Automatic Data Processing) has provided payroll and HR software for over 75 years (1949). ADP’s current AI-based payroll automation capabilities can:

- Automate payroll and HR processes, leveraging 75 years of workforce data.

- Anticipate needs, discover anomalies, and provide intelligent reminders, recommendations, and insights to an HR team.

Additionally, ADP provides:

- Smooth integration with time and attendance, benefits, and accounting systems to facilitate the payroll process.

- To allow for real-time reports and analytics to support effective decision-making regarding employee compensation and managing people.

- The scalability and flexibility to support organizations of all shapes and sizes, from small to multinational.

- Compliance and security programs to support regulatory compliance and protect against a cyber breach.

So, with that in mind, ADP is the solution for automated payroll and can help organizations reduce errors and time while improving employee experience and satisfaction!

Conclusion

Are you ready to turn payroll into a competitive advantage instead of a burden? Take advantage of top payroll automation solutions that utilize automation, robotic process automation (RPA), and trusted applications like ADP based on AI. You will be able to ensure accuracy, compliance, and strategic insights. Using these solutions allows companies to minimize retention mistakes, save time, improve employee engagement, and provide analytical opportunities in real-time to make better decisions.

Moreover, payroll automation will ensure your human resources (HR) staff can focus on strategic initiatives instead of mundane administrative tasks. Once workflows become automated, increases in workflow can become second nature for the business; they will always be able to pay employees accurately and on time and be compliant with the ever-changing tax laws. Using these automated systems and processes can create a more productive workforce that is happier with their jobs, while also significantly decreasing operational risk for the company. Moving towards an artificial intelligence-powered payroll solution positions companies for efficiency, improved margins with time savings, and takes payroll to the next level of competitive advantage.