Project management is never about time lines and tasks only, but money is also involved. Regardless of how well a project may be on paper, it may easily collapse unless the budget is managed effectively. This is the reason why project budget management is a very crucial factor in effective project delivery.

Consider it as the financial support of a project. In the absence of a clear budget with no cost estimation, the expenses go out of control, resources are wasted and deadlines are missed. It brings you control, clarity and confidence that you are spending every dollar wisely.

In this blog, we shall deconstruct all that you need to know about project budget management; what it actually is, why it matters, the major steps to consider, and some of the tips that you can apply to ensure that your projects are financially fit. You can be working on small internal projects or major projects involving many stakeholders, but either way, this guide will provide you with a structure to organize budgets in an effective and efficient manner and prevent expensive errors.

What is Project Budget Management?

Project budget management is a process that involves planning, controlling and tracking financial resources of a project so that it can be delivered within the allocated cost. In a basic definition, it involves ensuring that the financial aspect of your project does not run out of track.

A project budget usually consists of:

- Direct expenses such as labor, equipment and materials.

- Things like administrative costs or utilities.

- Emergency funds to cater to unforeseen problems or risks.

Project budget management is not a one-time thing, and it involves number crunching at the beginning. Monitoring costs, making adjustments and reporting such costs to the stakeholders should be done as the project advances.

Practically, proper budget management assists teams:

- Estimate financial requirements with greater precision.

- Invest in areas where they are likely to make the greatest difference.

- Eliminate cost overruns and delays.

- Develop trust amongst stakeholders through financial transparency.

In simple terms, project budget management provides you with the map on which the money will be used and keeps the project within financial bounds, both at its beginning and at its end.

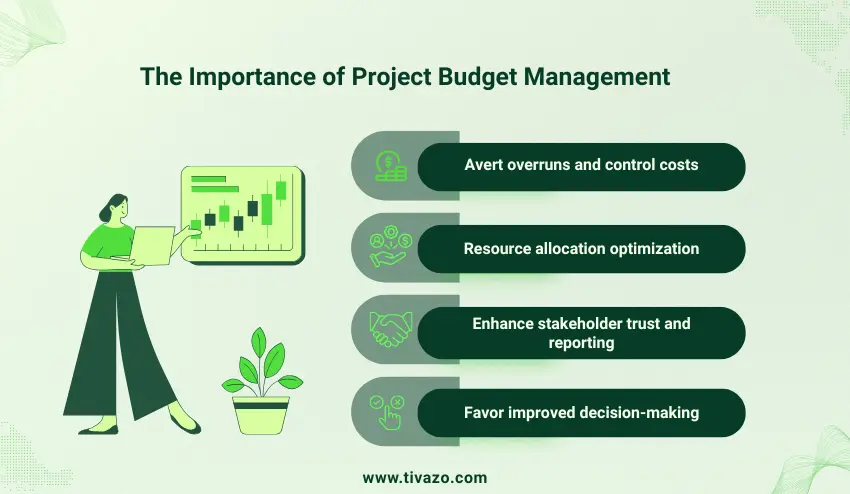

The Importance of Project Budget Management to Project Managers.

To project managers, project budget management is not a choice, but a necessity. Even well-planned project may go into serious financial problems without proper budget management.

A good project budget management assists project managers:

1. Avert overruns and control costs.

When you know where your money is going, you can know when you are spending excessively. As an illustration, the number of labor hours can be monitored against the scheduled budget to ensure that payroll does not explode at any time.

2. Resource allocation optimization.

Knowing about budget constraints, project managers will be able to distribute resources effectively. This is to make sure that the critical tasks receive the funding that they require without spending money on the less important things.

3. Enhance stakeholder trust and reporting.

Budgeting and updating on time demonstrates to the stakeholders that the project is in control. Open budgeting reports are able to enhance client trust and justify subsequent funding. This is a crucial part in project budget management.

4. Favor improved decision-making.

Knowing the budget in and out, the project managers will be able to make sound decisions, including approving the scope changes or investing in more tools.

Projects which are not managed well in terms of budgets tend to get delayed, compromise quality and develop poor relationships with the clients or other team members. Conversely, projects that have a good budget structure have the ability to deliver on time, scope and cost.

Concisely, it is not only the mastery of project budget management but also the enhancement of the success and credibility of your projects.

Types of Project Budgets

Project budgets are not all created equal. Various types of budgets may be applied depending on the size, complexity, and flexibility of the project. The selection of the appropriate type assists the project managers to manage costs.

The most common types are the following:

1. Fixed Budget

- There is a fixed sum that is assigned to the whole project. This is the maximum that costs can go beyond without approval. Best in projects that have a clear scope.

- Advantages: Simple to operate, distinct financial boundaries.

- Cons: Stiff when there are changes in project scope.

2. Flexible Budget

- Modifies according to project activity or scope change. Best suited to projects that have changing needs.

- Advantages: Flexible to changes, enables dynamic projects.

- Cons: Has to be constantly monitored and adjusted.

3. Rolling Budget

- Reflects actuals and forecasts updated on a regular basis (monthly, quarterly). Helps maintain the cost consistency of long-term projects.

- Advantages: Maintains a current budget, brings trends to the fore.

- Cons: It takes more administrative work.

4. Zero-Based Budget

- Begins with zero in each project phase, and each expense will need to be justified. Eliminates the tendency of unnecessary expenses to creep in.

- Advantages: Cost awareness, wastage.

- Cons: Time-consuming and consumes resources.

Knowing these types, project managers are able to select the most appropriate one to use in their project, which would be cost-controllable but at the same time flexible to accommodate changes. This will help managers to conduct project budget management effictively.

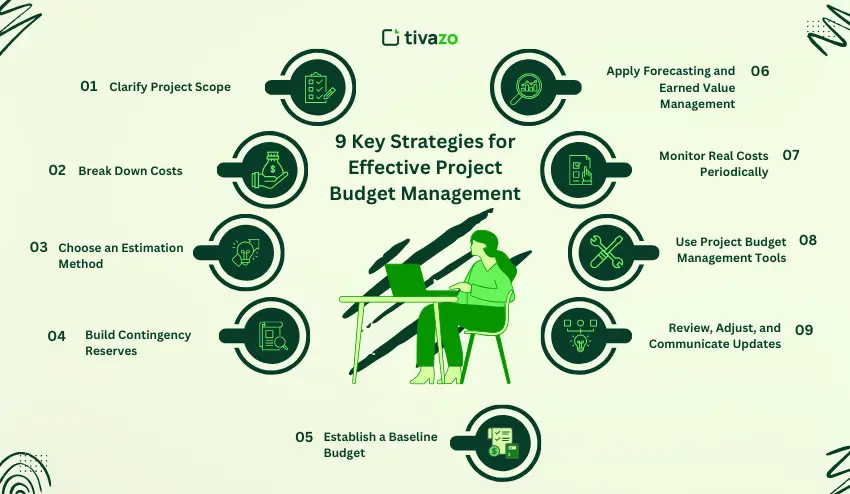

Step-by-Step Framework: 9 Key Strategies for Effective Project Budget Management

A project budget should be managed in an organized way. The following are the nine strategies that a project manager must adhere to:

1. Clarify Project Scope.

- Definitely list the contents of the project, and what they do not contain.

- A clear scope eliminates cost surprises and scope creep.

- Example: In the case of a software project, determine which modules are to be developed during the current phase without having to incur additional work that adds to the cost.

2. Break Down Costs (WBS and Cost Categories)

- Use a Work Breakdown Structure (WBS) to break the project into smaller tasks.

- Assign estimated costs to each task, including labor, materials, and overhead.

- Tip: Include contingency costs in each category to prepare for surprises.

3. Choose an Estimation Method

- Analogous Estimating: Relies on historical information of similar projects.

- Parametric Estimating: Rely on statistical relationships (e.g., cost per square foot).

- Bottom-Up Estimating: This involves computing the cost of each activity and adding them up.

- Three-Point Estimating (PERT): It involves optimistic, pessimistic, and most likely costs.

| Method | When to Use | Pros | Cons |

|---|---|---|---|

| Analogous | Quick estimates | Fast, easy | Less accurate |

| Parametric | Large datasets | Data-driven | Needs reliable historical data |

| Bottom-Up | Detailed planning | Accurate | Time-consuming |

| Three-Point | Risk-adjusted | Balances uncertainty | Requires multiple estimates |

4. Build Contingency Reserves

- You should always set aside 5-15 percent of the total budget to be used in unforeseen events.

- Helps absorb minor scope changes or unforeseen costs without bringing the project to a halt.

5. Establish a Baseline Budget

- Establish a standard against which performance can be measured.

- Compare the actual spending with the baseline to determine the variances.

6. Apply Forecasting and Earned Value Management (EVM)

- Forecasting is an act of predicting the costs in the future on the basis of the existing trends.

- EVM determines the performance of the project:

Cost Variance (CV) = Earned Value (EV)-Actual Cost (AC).

Positive CV = under budget; Negative CV = over budget. - Example: A project with 100k EV and 110k AC has a CV -10k = over budget.

7. Monitor Real Costs Periodically

- Document expenses per week or month, as per the size of the project.

- Compare the actuals to the estimates and baseline.

- Checklist item: Have a table of task, estimated cost, actual cost, variance.

8. Use Project Budget Management Tools

- Suggested project management tools:

- Microsoft Excel / Google Sheets (neutral templates)

- ProjectManager.com (visual tracking & dashboards)

- Asana (task-level cost tracking

- These are designed to reduce costs by automating calculations, creating reports and also visualising where spending is occurring.

9. Review, Adjust, and Communicate Updates

- Periodically analyze budget performance and make forecast changes.

- Keep the stakeholders informed about the changes as soon as possible so that the changes are transparent.

- Hint: Monthly budget review meetings allow avoiding project end surprises.

With this framework, project managers have a good roadmap to plan, track, and control project finances leading to good project budget management.

Case Study: A Real-Life Project Budget Management.

To illustrate project budget management, we will use an example of a mid-sized IT project whose initial budget is 500,000 dollars. The project was the creation of new internal software tool in a period of more than six months.

- Step 1: Preliminary Planning and Estimation.

- A bottom-up approach was used to give costs on labor, software licenses, and hardware per task.

- It was estimated to have contingency of 10 percent (50,000) in case of any unforeseen problems.

- Basic budget established at 500,000+ 50,000 contingency = 550,000.

- Step 2: Tracking Actual Costs

- At month three, the actual expenditure was 320,000 which was slightly higher than the planned expenditure of 300,000.

- Variance was also found in the labor costs in terms of overtime on urgent tasks.

- Step 3: Forecasting and Adjustments.

- Based on Earned Value Management (EVM):

Earned Value (EV) = $300,000

Actual Cost (AC) = $320,000

Cost Variance (CV) = EV -AC = -20,000 $ = over budget. - Managers reallocated the remaining tasks through resource allocation and minimizing unnecessary features.

- Based on Earned Value Management (EVM):

- Step 4: Final Outcome

- Project completed at a total spend of $540,000,000.00, 10,000.00 below contingency limit.

- Lessons learnt: timely tracking, distinct cost categories and contingency reserve avoided a budget overrun.

Key Takeaways:

- De-aggregate tasks and costs to make accurate estimates.

- Regularly test actuals against baseline.

- Make adjustments using forecasting and EVM.

- The contingency funds play a vital role in absorbing the unforeseen costs.

This example demonstrates how well-organized project budget management helps to keep project budgets on track even in case of unforeseen difficulties. on track, even when unexpected challenges arise.

Project Budget Management Tools and Templates

The availability of the appropriate tools and templates can make the project budget management easier, more precise, and time-saving. The following are some of the viable alternatives to project managers:

1. Microsoft Excel / Google Sheets

- Use case: Develop a customized budget template to monitor costs, contingency and variances.

- Hint: Add columns such as task, estimated cost, actual cost, variance and notes.

- Example template:

| Task | Estimated Cost | Actual Cost | Variance | Notes |

|---|---|---|---|---|

| Design | $50,000 | $52,000 | +$2,000 | Overtime hours |

| Development | $200,000 | $198,000 | -$2,000 | Efficient task allocation |

| Testing | $50,000 | $55,000 | +$5,000 | Additional QA cycles |

| Contingency | $50,000 | $35,000 | -$15,000 | Unused funds |

| Total | $350,000 | $340,000 | – $10,000 |

2. ProjectManager.com

- Application: Web-based application to budget, monitor activities, and create real-time reports.

- Characteristics: Gantt charts, automated tracking of variances, dashboard views.

- Hint: Establish budget overrun and monthly cost reporting alerts.

3. Asana

- Application: Monitor task-level expenses and resource assignment.

- Features: Custom fields of budget, time tracking, and task assignments.

- Hint: Asana can be used together with Excel in case you need to track your finances in a more detailed manner.

How to avoid mistakes in Project budget management (Top Ten Common Mistakes).

Budget traps can befall even the experienced project managers. The following are the most frequent mistakes during project budget management and the ways to avoid them:

1. Ignoring Scope Creep

- Error: Permitting the introduction of new tasks or features without changing the budget.

- How to Prevent: Have a clear scope definition in advance and make changes formally approved.

2. Oversight: Not to do Contingency Planning.

- Error: Failure to budget contingency problems.

- How to Prevent: Set aside 5-15% percent of total budget as contingency reserve.

3. Tracking Costs Too Late

- Error: It is possible to wait until the end of a project to compare actual and estimated costs.

- How to avoid: Track costs on a regular basis, preferably weekly or monthly and revise forecasts.

4. Ineffective communication with Stakeholders.

- Error: Not communicating the changes of the budget to the stakeholders.

- How to prevent: Have regular meetings to review the budget and report.

5. Excessive Dependence on a Single Tool or Template.

- Error: Using a software or spreadsheet on its own without cross validation.

- How to eliminate: Integrate and cross check (Excel + project management software)

Project Managers can eliminate these errors at source, at the start of the project, control costs, avoid surprises, and deliver successful projects.

7 Quick Steps to Manage Your Next Project Budget

The following is a checklist that project managers can use practically and copy ready in order to manage budgets effectively:

- Identify the scope of the project.

- Define what is and what is not in scope to avoid scope creep.

- Break down tasks and costs

- Apply a Work Breakdown Structure (WBS) and allocate approximate costs to every task.

- Select an estimation method

- Select the type of Analogous, Parametric, Bottom-Up or Three-Point Estimating depending on the requirements of the project.

- Add contingency reserves

- Set aside 5-15 percent of total budget as unforeseen expenses.

- Set a baseline budget

- Create a point of reference to monitor real expenditures and variances.

- Monitor real expenditures on a regular basis.

- Take weekly or monthly records and compare with estimates.

- Check, revise and report changes.

- Revise predictions, make relevant corrections, and communicate to stakeholders.

Conclusion

Project budget management is one of the foundations of successful project delivery. Planning, tracking, and controlling costs will help project managers to avoid overruns, manage resources efficiently, and earn the trust of stakeholders.

With an organized structure, the appropriate tools, and definite templates, budget management is much less stressful and much more accurate. It is important to remember that early tracking, contingency planning, and frequent communication are the major steps in ensuring that your project is on track financially.

Having these strategies, project managers will be able to safely deliver the project on time, in scope, and on budget and make financial management their competitive edge.