Have you stopped to think about how your paycheck’s timing could affect your financial wellness? When both employees and employers can get on the same pay schedule, things generally improve for budgeting, financial planning, and the business in general.

One pay structure that has proven to be popular in recent years is semi monthly pay, which is simple and predictable. This is when employees get paid twice a month, usually on predetermined days on the calendar, such as the 1st and 15th, or the 15th and the last day of that month.

So, what makes this system so positive? In this post, we will walk through the five best aspects of semi monthly pay, how it works, and why it may be a win-win for both employees and employers themselves.

Key Highlights:

- What is Semi Monthly Pay

- How Semi Monthly Pay Works

- Key Benefits of Semi Monthly Pay

- Semi Monthly Pay vs. Biweekly Pay

- Common Mistakes to Avoid

- Considerations Before Implementing Semi Monthly Pay

What is Semi Monthly Pay?

Semi monthly pay is a pay structure where employees are paid twice a month, generally on a fixed day, like the 1st and the 15th of the month, or the 15th and last day of the month. This pays employees 24 paychecks a year, as opposed to biweekly pay, which can occur every two weeks.

For instance, if you have an annual salary of $48,000, it means you are earning $2,000 on each payroll date. The predictability in this biweekly pay system is advantageous for both personal finance and payroll administration purposes.

How Does It Differ From Other Pay Schedules?

- Biweekly Pay: This pay schedule occurs every two weeks leading to 26 paychecks in a year.

- Monthly Pay: One paycheck monthly.

- Weekly Pay: Paid every week, totaling 52 pay periods in a year.

How Semi Monthly Pay Works: A Breakdown

Semi monthly pay consists of getting paid two times a month on regular dates; the first and 15th of the month or on the 15th and the last working day of the month. This results in 24 pay periods in one year. Pay periods are always consistent, and since they are not based on weeks, the paychecks will always be the same. This makes it easier to budget.

Example:

If your salary is $60,000 a year, your semi monthly paycheck will total $2,500 a check before taxes or deductions. You will receive 24 paychecks throughout the year.

When calculating hourly employees and semi monthly pay it can get slightly more tricky due to not knowing how many hours will be worked every month. Payroll usually handles this function automatically.

5 Key Benefits of Semi Monthly Pay

1. Consistency for Employees

Employees know when they are paid because the pay dates are on a specific day each month. This allows employees to plan on making payments towards regular bills like mortgage, utility company, and savings. By receiving a check on a fixed day each month, employees can manage household finances without uncertainty.

- Fixed pay dates (1st and 15th) can help employees avoid surprises themselves.

- Employees can align paychecks with monthly allowances because of pay dates, and do not have to worry about being late since they will have the funds.

- Less chance of late fees or financial burdens.

Example: An employee has a mortgage due on the 1st of each month; they can budget because they receive a paycheck on the 1st of the month and know that they have the funds to pay the mortgage.

2. Simplifies Payroll for Employers

Employers enjoy a semi monthly pay schedule since payroll is easier to manage than weekly or biweekly. Payroll is simpler with only two paydays each month, which gives the employer time and administrative efficiencies. Although two paydays each month means bigger paychecks, employers can rely on fewer pay periods per month to help with budget management for the total monthly payroll expense. When the payroll expense is predictable, Human Resources can plan payroll processing a lot more efficiently with fewer errors.

- Only two pay periods each month, meaning less payroll processing time.

- Helps businesses to more accurately predict the total payroll expense.

- Less administrative labor and potential payroll error.

Example: HR can accurately forecast the total monthly payroll expenses every month, improving cash flow without surprises.

3. Financial Stability and Predictability

Employees benefit from knowing exactly when their paycheck will come in terms of financial stability. Because paydays are predictable, employees can avoid some of the issues surrounding cash flow, when to pay monthly bills, and when to save.

Once an employee knows their payday is a certain day of the month, they can count on receiving a paycheck to cover bills, food, and expenses, which is less stressful and enhances their valuation potential.

- Employees can budget by knowing exactly when their paycheck will be deposited.

- Reduces the likelihood of running out of funds during a pay period.

- Contributes to improving financial discipline, since income comes from one source in a relatively consistent manner.

Example: An employee with monthly bills like a mortgage or utility payments expects a timely paycheck to account for these expenses.

4. Easier for Businesses to Budget

Semi monthly payroll makes it simple for companies to project their payroll costs and manage their cash flow. When most businesses operate on a monthly revenue cycle, bi-monthly paychecks provide accurate cash flow management.

With only two pay periods in the month, companies know they can accurately project their payroll costs each month.

- Semi monthly pay is in harmony with the monthly cash flow.

- Encourages business owners and employers to budget and develop income forecasts that are more manageable.

- Easier cash flow management is the key selling point to semi monthly payroll, particularly for small businesses.

Example: A business can store its payroll funds at the beginning of each month, since the business will only have to account for payroll on two payday dates that month.

5. Better for Salaried Employees with Monthly Bills

Salaried workers with regular monthly payments, such as mortgages, student loans, and car payments, have an advantage when placed on a semi monthly pay schedule. The payment date is fixed, which allows employees to pay for all monthly obligations on time, rather than waiting to receive monthly income, helping with budgeting and managing cash flow.

Semi monthly payment dates help employees remember different money commitments, such as rent, loans, etc., without any interruptions in receiving their check monthly.

- Fixed and predictable paydays align well for employees with recurring monthly payments.

- Employees won’t worry about meeting their mortgage payments, insurance premiums, etc.

- Avoid missing payments or running late on payments.

Example: if someone has a monthly payment of student loan payment, they know they are being paid on the 1st and 15th of the month, which aligns their payment date.

Semi Monthly Pay vs. Biweekly Pay: Which is Better?

Semi monthly pay and biweekly pay are fairly common payroll schedules, but they typically differ significantly. Semi monthly pay is paid on fixed dates like the 1st and 15th of the month, leading to 24 pay periods in a year. Biweekly pay is paid every two weeks and leads to a maximum of 26 pay periods. Overall, your preference for pay dates is a little less stable depending on the option of getting paid every other week in some months of the year.

| Feature | Semi Monthly Pay | Biweekly Pay |

|---|---|---|

| Pay Frequency | 24 paychecks per year | 26 paychecks per year |

| Pay Dates | Fixed dates (1st, 15th) | Varies every two weeks (e.g., Friday) |

| Consistency | Consistent each month | Dates vary each month |

| Extra Paychecks | No extra paychecks | Two months with 3 paychecks |

| Payroll Size | Larger checks, fewer pay periods | Smaller checks, more pay periods |

Which one is better? It is determined by the needs of the business and its employees. Semi-monthly pays have more consistent dates, which serve as benefits regarding budgeting, while biweekly pays allow employees a benefit of having two months of additional paychecks sometimes; beneficial for businesses to financially prepare and plan.

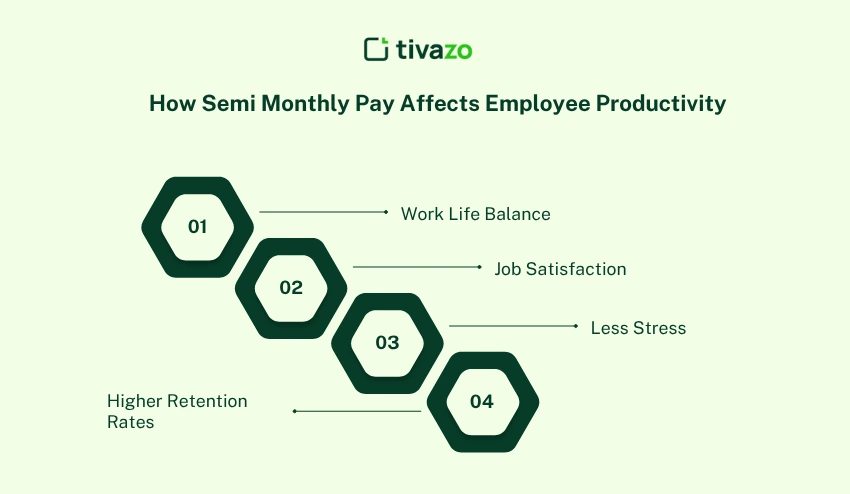

How Semi Monthly Pay Affects Employee Productivity

When employees do not have to worry about when their next paycheck is coming, they can better concentrate on their work tasks. Provided with the benefits of financial desirability, predictable scheduling gives higher employee morale, helps to increase productivity.

- Work Life Balance: Work-life balance can be a significant source of stress for employees financially. The regular, predictable pay gives the employee a higher likelihood of a healthier work-life balance.

- Job Satisfaction: Providing a predictable and reliable way for pay schedule that is consistent with your employees’ benefits, provides, and may lead to higher employee satisfaction, higher productivity, and loyalty to the company overall.

- Less Stress: Knowing the exact scheduling of when you get paid is less stressful than worrying when the next paycheck will be coming, allowing employees to have fewer distractions regarding financially managing their budgets outside of the workplace.

- Higher Retention Rates: A predictable pay schedule can help develop loyalty, as employees know that they can rely on it to provide some continued stability by staying with the company and providing a reduction in turnover rates.

Common Mistakes to Avoid with Semi Monthly Pay

While semi-monthly pay may be a good option, there are certain mistakes employers should avoid to ensure that semi-monthly pay runs as smoothly as possible. Proper communication, along with attention to detail, is vital for maintaining employee satisfaction as well as compliance with regulations. If any of these mistakes are made, it could lead to payroll confusion, payroll delays, or even legal issues.

- Confusing Pay Dates: Be sure employees are informed of the exact pay dates, especially when they fall on a weekend or holiday. Miscommunication could lead to confusion.

- Payroll Deductions: Incorrect deductions can cause tension for both employees and the employer. Be sure employee deductions (taxes or benefits) are calculated properly, especially since the pay periods do not match the weekly or biweekly calendar periods.

- State Regulations: Certain states have specific laws regarding payroll frequency. Always review local regulations for payroll compliance.

How to Transition to Semi Monthly Pay for Your Business

The process of changing over to a semi-monthly payroll system does not have to be complicated when done correctly. However, it is essential to plan for this change in advance to ensure proper communication and a smooth transition to semi-monthly pay, so that both employees and the business are aligned. The goal is to be proactive and learn how to accommodate the employees to your payroll system.

Follow these steps to ensure a successful transition:

- Evaluate Your Current System:

- The first step that you will want to take is to evaluate your existing payroll structure. You will want to determine whether your existing pay schedule is effective for both employees and the business as a whole and whether an improvement in efficiency can come from a switch to semi-monthly pay.

- Inform Employees:

- Communicating with employees is an absolute must. You will want to notify employees about the change in pay schedule well in advance, and how this will affect their pay date, and any other adjustments that need to be made.

- Adjust Payroll Software:

- You will need to modify your payroll software to accommodate the new schedule. You will also want to ensure that the software can calculate semi-monthly pay accurately, and it will be automated in the software to remove human error.

- Monitor and Adjust:

- After the first adjustment is made, you will want to watch closely for the next few pay periods. You will want to ensure that everyone is receiving their pay on time and that any measures are taken for deductions and/or pay dates or calculations that were incorrect.

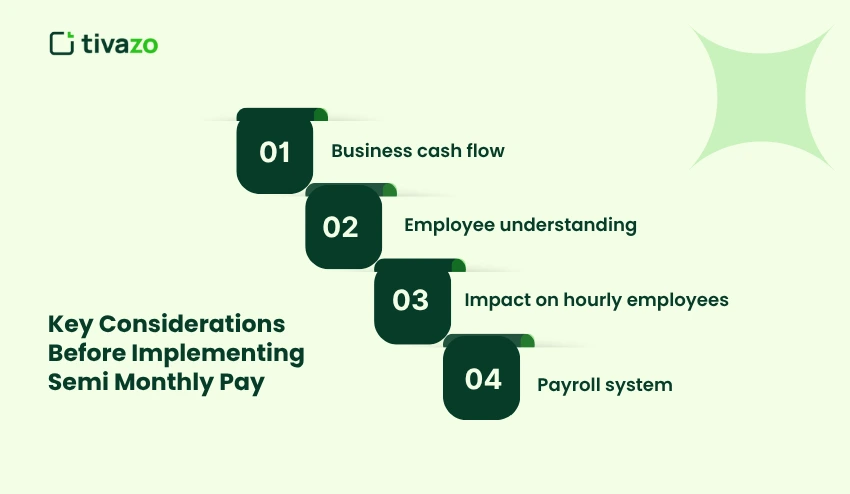

Key Considerations Before Implementing Semi Monthly Pay

Before you choose to make the transition to semi monthly pay, there is an important discussion to have to confirm that semi monthly pay will meet the business needs and also the employees’ needs. While semi monthly pay provides consistency, you will want to consider the pros and cons to evaluate if it makes sense for your company and the workforce.

The important considerations to include:

- Business cash flow: Confirm that your business can sustain two established payroll dates per month.

- Employee understanding: Employees will need to understand how the change will affect their budgeting.

- Impact on hourly employees: With hourly employees, semi monthly pay could become a complication with tracking hours.

- Payroll system: Confirm that your payroll system supports a semi monthly pay schedule..

Conclusion

To summarize, semi monthly pay can provide considerable value for employees as well as employers. Employees value predictable income, while businesses value simple payroll solutions; a semi monthly pay schedule can provide these outcomes and therefore create financial peace.

Whether you’re an employee trying to organize your finances or a business striving to ease payroll, semi monthly pay could be the solution you’ve been hoping for. Assess the pros and cons for both parties, and use effective communication to allow you to transition to a more predictable and efficient payment schedule.