Paying employees can be difficult, especially in the case that the employee worked more than 40 hours in a week. Understanding the different types of pay are important, and double time pay is sometimes the most difficult situation, when, if ever, is it required, who gets it, and how do you calculate it?

Understanding double time pay is extremely important for employers and employees alike. It ensures compliance with labor laws and proper compensation for employees committing extra time. While some companies choose to pay extra time, other employers are mandated to pay double the hourly rate for a required number of hours.

In this article, we will break down everything you need to know about double time pay, how it differs from overtime pay, how to calculate it, who is eligible, and established standards for compliance. Whether you are an HR professional, a payroll manager with responsibilities for employee pay, or an employee looking to understand your rights about when you may be entitled to extra pay or double-time pay, this article will provide a straightforward overview.

What is Double Time Pay?

Double-time pay is a pay rate that is double an employee’s standard hourly rate. It is usually paid when employees work over a certain threshold on special occasions or for specific reasons that warrant them getting paid more.

Double time is different from regular overtime pay, a rate that is one and a half times the employee’s normal pay. Double time means you are getting paid twice the base hourly rate. Higher rates of pay for longer hours of work, or work at times that are normally “off” scheduled hours, such as holidays or consecutive long hours of working, are a reward to the employee.

For example, if a person makes $25 per hour as their regular hourly rate, then their double-time pay will be $50 per hour. If a person is requested to work three (3) hours of “double time,” then they will receive an additional $150 in pay for those three hours.

As a note, not all employers are required to use double-time pay. Some states, such as California, have laws governing double-time pay under specific sets of circumstances. Many businesses embrace double time pay into practice because it maintains fairness, encourages employee morale, and reduces fatigue and burnout when working long hours, and/or working two or more days a week of back-to-back long hours.

Double Time Pay vs Overtime

Many people confuse double time pay with overtime pay, but they are not the same. Both recognize employees for time worked outside of their normal scheduled hours but have differences in the rate, eligibility, and application.

Overtime pay is typically received when an employee is working more than 40 hours in a week or exceeding 8 hours in a single workday, dependent on state laws, regulations and industry practice. Overtime pay is commonly referred to as “time and a half,” which is 1.5 times the regular hourly rate.

Double time pay, on the other hand, is 2 times the regularly hourly rate. Double time pay typically only applies in specific instances, including:

- Working more than 12 hours in one day

- Working the seventh consecutive day in a workweek

- Any work performed on applicable holidays or another scheduled out-of-the-ordinary day

For example, if someone works 40 hours a week at $20 per hour, their overtime pay would be $30 per hour ($20 x 1.5) and their double time pay would be $40 per hour ($20 x 2).

In other words, overtime pay is compensation for additional hours worked beyond the employee’s normal coverage or flexibility. Double time pay is an award an employer renders for extra, typically inconvenient, effort. Clarifying the definition and understanding the difference assists employers with equitable payroll policies and keeps employees advised of bonus pay opportunities.

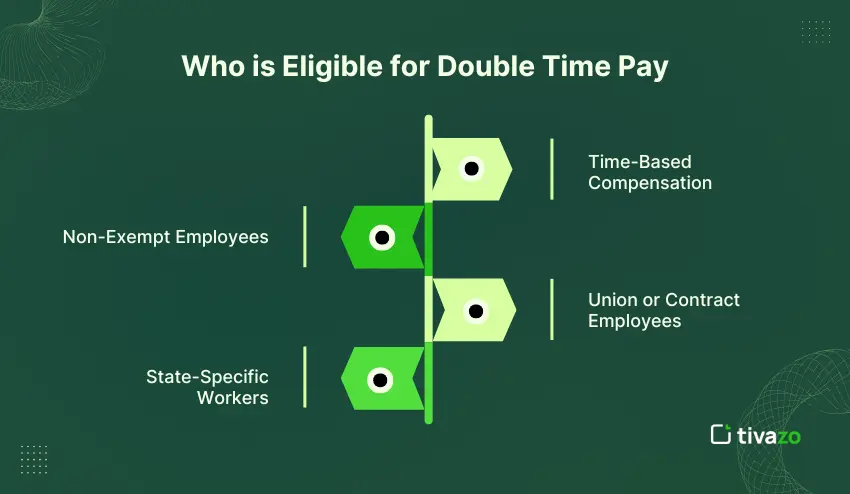

Who is Eligible for Double Time Pay?

Whether or not a worker is eligible for double time compensation will depend on their employment classification, the nature of their work, and the laws in the state. The Fair Labor Standards Act (FLSA) – a federal law outlining payment expectations – has a requirement for non-exempt employees to receive overtime compensation, though it does not require a specific form of compensation called double time. Many employers and states include double time in their employee compensation policies even though it is not required by federal law.

In general, the following types of workers may be eligible for double-time compensation:

1. Time-Based Compensation

Hourly or non-exempt employees will be the most likely to qualify for double time compensation. Because their income is based on hours worked, employers can easily implement double time when the employee or worker moves into a different type of earnings threshold, whether daily or weekly, or under special circumstances, namely holidays and consecutive long shifts.

2. Non-Exempt Employees

Specified by the Fair Labor Standards Act (FLSA), Non-Exempt Employees are entitled to pay for all overtime hours worked – they may also receive double time if required by your company policy or under state law. Exempt workers – typically executive level, professional workers, and some salaried employee classifications – are usually omitted.

3. Union or Contract Employees

Employees that are members of a union or covered by a collective bargaining agreement often have double time addressed in their respective contracts. Contractual obligations may require double pay over and above regular pay when an employee works shift hours exceeding a certain length, and/or during weekends and/or holidays.

4. State-Specific Workers (e.g., California)

Certain states, notably California, have rigid rules that assign double time pay under specified circumstances. For example, California requires employees to receive double time for:

- Hours worked over 12 in a day, or

- Hours worked over 8 hours on the 7th consecutive workday in a week.

While no double time pay is required by federal law, businesses will often elect to have double time pay, to reward their employees for loyalty or provide equity or remain competitive in their industry.

Double Time for Hourly Workers

For hourly employees, double-time pay can have a major effect on total income. Because hourly employees get paid based on hours worked, it is important for employees and employers to understand how double time is applied, so that it can be fairly and correctly recorded for payroll purposes.

Sometimes, Hourly Employees Qualify for Double time

There are times when hourly employees may qualify for double time if they work days defined as such. Double time may apply if an hourly employee works more than twenty-four hours; twelve hours in one day; over eight hours on the seventh consecutive day of the work week; if an employee works on holidays, weekends, or other special project requiring long hours; or if referred to in their employment contract or company policy.

Example Calculation for Hourly Workers

Let’s say an employee earns $22 per hour and works 13 hours in a day.

- The first 8 hours are paid at the regular rate: 8 × $22 = $176

- The next 4 hours (overtime) are paid at 1.5x: 4 × $33 = $132

- The final 1 hour (double time) is paid at 2x: 1 × $44 = $44

So, the total pay for that day would be $352.

| Hours Worked | Pay Rate Type | Multiplier | Earnings |

|---|---|---|---|

| 8 hours | Regular | 1× | $176 |

| 4 hours | Overtime | 1.5× | $132 |

| 1 hour | Double Time | 2× | $44 |

| Total | $352 |

This framework allows employees to be compensated for legitimate extra work and incentivizes employers to effectively manage their schedules.

For many organizations, especially those with unpredictable workloads or shift work, automatic time-tracking systems help track when double-time wages apply, cut down on manual errors, and ensure adherence to state laws.

Double Time for Salaried Employees

When your employees are salaried employees, it can be slightly more complicated to calculate double time, because they do not get paid on an hourly basis. However, there are circumstances in which salaried employees can receive double time payroll pay, if the employee is considered non-exempt under the Fair Labor Standards Act (FLSA) or applicable state law, depending on the circumstances.

When Salaried Employees Qualify for Double Time

Exempt salaried employees like managers, executives, and professionals are generally not entitled to be compensated at all for overtime or double time. However, salaried employees whose salaries are compensation based on a fixed salary for a potential maximum hours limitation could be considered non-exempt employees and be entitled to double time pay.

This usually applies when:

- Applicable state law ( California is an example) requires double time for specified hours worked.

- The employment agreement or company policy states that double time is required.

- The employee is consistently working beyond a previously predetermined amount of hours (daily or weekly).

Calculating Double Time for Salaried or Payrolled Employees

To calculate double time for a nonexempt salaried employee, first, the employer must derive the employee’s hourly rate by taking their weekly salary and divide that by the total hours in a standard workweek. Any hours worked above that amount (which typically is 40 hours) would qualify for double time if they are legally considered overtime hours.

Example:

If an employee are paid $1,000 per week, based on working 40 hours:

Employee salary ÷ Standard hours = $1,000 ÷ 40 = $25 per hour x 2 = $50.00 per hour in double time.

So, for any hours of double time worked, take the rate of $50×2=2 The employee will then receive an additional pay of 3 x $50 or $150 for those hours of double time worked.

To provide transparency as well as to ensure compliance, employers should consider documenting all hours worked, develop a clear double time policy, and/or verify that the double time rate is consistent with the company policy and state requirements or laws regarding wage and hour.

Are Employers Required to Provide Double Time Pay on the Job?

According to federal labor law, specifically the Fair Labor Standards Act (FLSA), employers do not have to pay double time. To put it another way, the FLSA only requires that non-exempt employees receive pay for overtime hours (those worked over 40 hours a week) at a rate of 1.5 times the hourly rate.

Logically speaking, some states and contracts have a requirement for double-time pay in certain situations. California law, for example, requires double time to be paid for hours worked over 12 hours in a day and over eight hours for the seventh consecutive day.

Double time is also required when stated in:

- Collective agreements or union contracts

- Contract

- Company policies

In most states, double time pay is discretionary. Employers choose to offer it to compensate for extra work or holiday work. If, however, an employer does decide to pay double time in certain situations, it must be enforced uniformly and consistently within the organization.

Is Double-Time Pay Required on Holidays?

Many people mistakenly think that double time pay must be given on holidays according to federal law; this is not true. Under the Fair Labor Standards Act (FLSA), there is no law that requires double time pay on holidays, weekends, or nights these things are left to employers and/or state laws.

While some employers and/or labor agreements do offer double time pay for working on holidays as part of their company’s, or union contract, policy, this is much more common in industries that operate 24/7 such as healthcare, retail, and transportation.

A good example of this is when an employee is scheduled to work on Christmas Day or New Year’s Day; an employer might pay the employee double time to cover a major holiday.

In California and a few other states, there is no requirement for double time on holidays; however, most businesses do offer double time pay as a gesture of goodwill to their employees or to help encourage employees during busy seasons.

In the end, whether an employee gets paid, double time, or an alternative for working on a holiday, will depend on the employment contract, state law, and company policy.

What is Triple Time Pay?

Triple time pay is a type of premium pay rate that allows workers to be paid at a rate that is three times their standard hourly pay. This rate is significantly more unusual than overtime or double time and would usually apply in exceptional circumstances.

When Does Triple Time Pay Apply?

You may receive triple time pay for one of the following circumstances:

- Working hours that are in excess of double time hours set by certain state laws

- Working critical holiday shifts, or responding to emergency/additional staffing needs

- Contracted or union agreements for triple pay for designated hours or occasions

For example, if the employee’s regular hourly rate is $20 per hour, their triple time would equal $60 per hour.

Triple pay is not required by federal law; however, some organizations use it as an incentive to employees when performing work that is extreme, or for undesirable shifts when staffing needs are high.

Conclusion

Double-time compensation can be an important benefit to provide compensation for long hours, time worked on holidays, or other unusual circumstances. Federal law does not require paying double the regular rate of pay; however, some states, contracts or company policies provide some extra compensation for working additional hours to reward the extra effort and maintain fairness.

Understanding the eligibility for double-time pay, documenting double-time pay calculations correctly and clearly, and consistently applying your policy when it is time to pay your employees will help employers avoid disputes regarding double-time pay and stay in compliance with labor law and policy. Whether your workers are hourly or salaried, documenting the reason why double-time pay was earned at least indicates transparency to your employees and builds trust.

In closing, by paying double-time, or candidate triple times in some circumstances, an employer can contribute to employee job satisfaction, open the potential for employee retention, and support a productive and fair work environment.