What is arrears? Simply put, it is due to the overdue payments. This is an important financial term, whether in personal or business finance, because it may result in a poor credit rating, payment of late charges, or a lawsuit. It can be rent, loans, or even salary payments, but in any case, it is usually a pointer to missed or delayed payments requiring immediate attention.

An awareness of arrears is essential for financial well-being. Cash flow disruption could be prevented through effective management in business. Personally, it is better to know what constitutes arrears to avoid punishment and avoid financial difficulties in the long run.

Key Highlights:

- What Does Arrears Mean

- Common Examples of Arrears

- Payment in Arrears versus Advance Payments

- Key Insights to Manage Arrears Effectively

- Arrears vs. Paid in Advance

- How to Get Out of Arrears

- The Legal Implications of Arrears

2. What Does Arrears Mean?

To get a complete understanding of what is arrears are, one needs to define it within the context of finance. Some payments are due to be paid earlier, but have been delayed. E.g., when you do not pay your rent, loan, or utility bills at the right time.

There can be overdue payments or unpaid debts in a variety of areas in finance:

- Loans: When a borrower fails to make a payment, he or she goes into debt.

- Rent: The rent is any amount of rent that a tenant fails to pay past the due date, as delinquent rent.

- Bills: Utility companies can sign and record overdue bills with the accounts payable.

It would be vital to know what is arrears are and how they operate to be able to manage overdue payments efficiently and prevent severe financial implications.

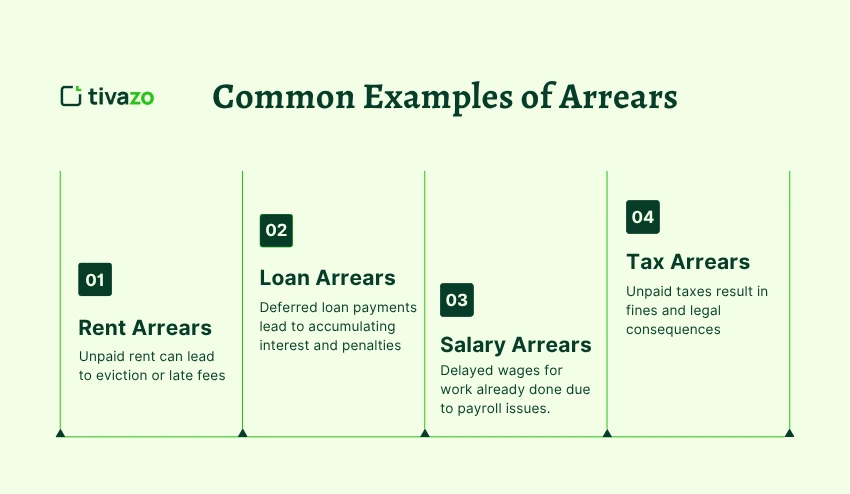

Common Examples of Arrears

What is arrears? It is considered to mean overdue payments in different fields of finance. It may take place in various settings, and the results may be disastrous in case it is not addressed. Some typical examples are these:

- Rent Arrears: When a tenant does not earn his/her rent as due, the unpaid debts is regarded as an outstanding payment. This may result in eviction or late charges.

- Loan Arrears: When one fails to pay back a loan, he or she builds up deferred payments, and the loan interest and penalties can build up.

- Salary Arrears: Employees can have salary delays when they are not given a salary due to the work they have already done. This may be because of mistakes in the payroll or a slow increase in salaries.

- Tax Arrears: In case of failure to pay taxes within the due date, the taxes become unpaid liabilities. This may result in huge fines and legalization.

These illustrations show the ways in which late payments or unpaid debts can affect your financial life in many ways.

Is Arrears Always Negative?

Although it can be regarded as a negative aspect of them, not all are harmful. In some cases, a reason behind the presence of an overdue payments can be reasonable delays or payment agreements. As an example, a negotiated payment term can include business arrears to assist in controlling cash flow.

The financial effect can be a light one in situations where they are not fined significantly like the agreed conditions of late payments. Nevertheless, when mismanaged, overdue payments will result into fines of late payments and would affect your credit rating.

Payment in Arrears vs. Advance Payments: Which is Better?

Each of the payment methods has its benefits.

| Criteria | Payment in Arrears | Advance Payments |

|---|---|---|

| Payment Timing | Payment made after the service or goods are provided. | Payment made before the service is provided. |

| Cash Flow Impact | Offers flexibility, allowing businesses to manage cash flow effectively. | Provides upfront cash for service providers, improving their liquidity. |

| Risk to Service Provider | Higher risk, as payment is deferred and may be missed. | Lower risk, as payment is received before services are rendered. |

| Preferred by | Ideal for businesses and individuals managing cash flow. | Preferred by service providers to secure payments and avoid defaults. |

How Are Arrears Calculated?

This is normally computed by the addition of any amount of interest charged or penalties to the outstanding amount. An example is whereby the amount of your loan is one thousand dollars, then the lender can impose an interest of 5 percent on every month of defaulting the payment.

An example would be to break it down:

- Two months of back payment of a rate of 5 percent and a back payment amount of 1,000 dollars would result in a total of an additional 100 dollars in interest. Therefore, one would have a balance of $1,100 at the end of the second month.

To avoid any unpleasant surprises in terms of the amount of debt, it is necessary to realize how arrears are calculated. Errors in calculation of arrears may result into overpayment, underpayment and or litigations.

6 Key Insights to Manage Arrears Effectively:

Some of the main lessons to be learned to be able to manage are:

1. Understand What is Arrears:

What is arrears? The first thing to do in dealing with overdue payments is to know what it is and in what context. It is knowledge that will enable you to be proactive and prevent surprises.

- Know when to make payment and the consequences of missing a payment.

- Get to know what happens when you fail to clear them within the stipulated time.

2. Calculate Arrears Accurately:

Know when to make payment and the consequences of missing a payment. Get to know what happens when you fail to clear them within the stipulated time.

- Make definite checks to make sure that you do not miss on the record.

- Include any interest or late charges on the outstanding payments.

- Monitor it more effectively with the help of online tools or calculators.

3. Consider Arrears vs. Advance Payments:

By comparing the advantages and disadvantages of arrears and advance payments, you can select the most appropriate variant regarding your financial condition.

- Analyze your cash flow to see whether it can be flexible in terms of paying in it.

- See whether pre-paying would get you out of fines.

- Talk to creditors or financial advisors to decide the best mode of payment.

4. Avoid Falling into Arrears:

By planning and controlling your finances in advance, you could succeed in being ahead of your financial liabilities and prevent going into financial arrears.

- Arrange automatic remittances on the regular bills and loans.

- Reminders on due dates will ensure that one does not miss payments.

- Observe your budget frequently to ensure that you have ample space to pay all of the bills.

5. Clear Communication with Creditors:

In case you are in it, you should discuss with the creditors so as not to frustrate matters. Early communication can sometimes lead to more lax terms of repayment.

- Contact the early stages in case you are sure that you will not pay.

- Compromise over conditions, including lowering of interest rates or payments.

- Share the truth about your financial status and be transparent to earn trust from the creditors.

6. Take Immediate Action:

It is easy to see a build-up in arrears, which may result in massive debts. The impact could be mitigated by acting early before the damage is done.

- First, focus on high-interest rates to cut the total debt.

- Establish a payment system that can deal with it over smaller, manageable units.

- Do not take in more debt as you pay the already accumulated unpaid debts.

Arrears vs. Paid in Advance: Key Differences

Knowing the distinction between arrears and advance payments will allow one to manage financial obligations.

| Criteria | Arrears | Paid in Advance |

|---|---|---|

| Definition | Payment is made after the service or goods are provided. | Payment is made before the service is provided. |

| Example | An employee receives salary in arrears for work done in the previous month. | Paying upfront for a vacation or membership. |

| Payment Timing | Payment is delayed until after service completion. | Payment is made ahead of time. |

| Cash Flow Impact | Offers flexibility, as payment can be postponed. | Immediate cash inflow for the service provider. |

| Risk | Risk of delayed payments or penalties if not paid on time. | Risk of service or goods not being delivered after payment. |

| Common Use | Loans, salaries, utility bills, and rent. | Vacations, memberships, subscriptions, or deposits. |

How Does Arrears Impact Your Finances?

It can be financially impactful to be in it. It can impact your other financial obligations in the short term. Over the long run, its accumulation may:

- Impacts your credit score: Non-payment of any debt indicated as unfavorable debt can reduce your credit score.

- Borrow more: The interest rates and charges would accumulate very fast and thus it would be difficult to repay the initial debt.

- Induce financial instability: Chronically incurring unpaid debts is likely to result in financial debts that will be hard to get out of.

- Restrict credit: Lenders might be unwilling to give you credit or a loan when you are in arrears as it shows financial risk.

How to Get Out of Arrears?

When you are already in it, it may look difficult, although you can solve the problem and avoid the additional economic burden by taking as many steps as possible right now. It is important to deal with them immediately to prevent further punishment, legal repercussions, or credit destruction. The faster you do it, the higher are your chances to come out without it escalating.

- Repayment arrangements: Collaborate with creditors to develop an arrangement to repay the Unpaid debts in installments.

- Negotiating with creditors: In some cases, creditors can lessen penalties or interest in case you negotiate.

- Paying out lump sum: In case they can, clear the outstanding debts at a single instance so that they do not start accumulating interest.

- Pay off arrears that have high interest rates: Pay off arrears that have high interest rates first in order to pay off all the arrears at a low-cost.

- Consult with a financial counselor: In case you are having difficulties with making payments, you may need to seek the advice of a financial counselor and work out a plan to resolve the debt.

The solution to arrears is in clear communication and prompt action.

How to Avoid Falling Into Arrears?

Becoming arrears can be a stressing event that can have both a short run and a long run impact on your finances. Luckily, there are a number of preemptive measures you can make in order not to fall behind in payments and accumulate it. Being conscious of your finances and being well-organized, you will be able to keep your finances under control and make sure that your payments are on time.

- Budgeting and financial planning: Maintain records of your monetary commitments so that you pay on time.

- Automatic payments: This will aid in avoiding late payments on loans or bills.

- Negotiate with creditors: In case you fail to pay the creditors in time inform the creditor and negotiate a payment plan.

With proper organization and proactivity, you will be able to avoid stress and have your finances in check.

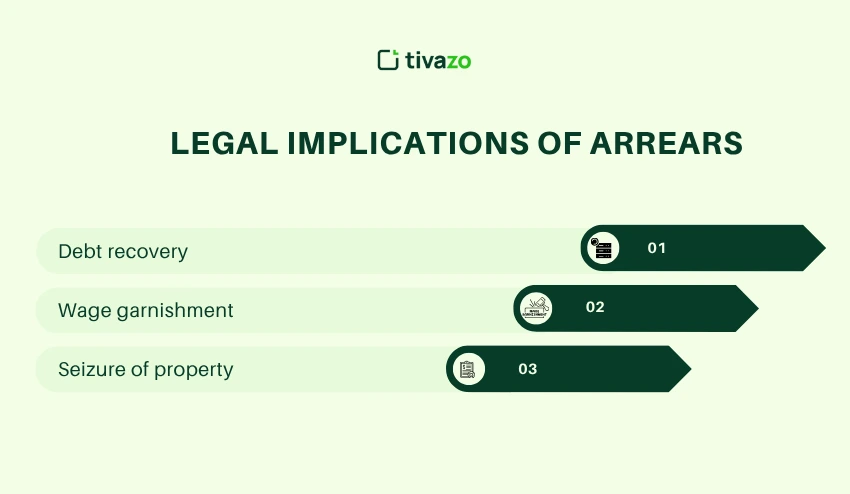

The Legal Implications of Arrears

Arrears which remain unresolved have grounds of developing into serious legal problems. Unpaid debts or overdue payments can lead to a lawsuit, such as suing, garnishing wages, or levying a lien on property. One should know the legal implications of the arrears accumulation to avoid financial harm in the long-term perspective.

- Debt recovery: The debtors can resort to legal action to recover outstanding sums, including court orders.

- Wage garnishment: The court can in a few instances direct that a part of your wages be deposited to towards paying off arrears.

- Seizure of property: Non-payment of debt may lead to asset or property seizure, particularly where the arrears are substantial.

By settling arrears early enough, you will get to save possible legal implications that can only worsen your financial position.

The Bottom Line

Finally, what is arrears? It is a debt that should be paid to prevent punishments and financial losses in the long term. It is necessary to know how they work and how to deal with them ,whether they be rent arrears, loan arrears or salary arrears. Monitor your financial commitments and make sure that it does not become a habit.

The negative consequences can be avoided by remaining proactive, communicating with creditors, and spending your money wisely. Also, it is always important to deal with them at an early age in order to ensure financial stability and tranquility.