Consider the following scenario where someone is planning their payroll budget in 2026, only to discover midway through the year that they owed their employees an additional paycheck, which they had not factored in. It occurs more frequently than you imagine – and it can affect cash flow, as well as employee satisfaction. Understanding how many pay periods are in a year is essential for businesses, HR professionals, and employees alike.

You might have 12 pay periods, 24 pay periods, 26 pay periods, or even 27 pay periods, depending on the frequency of your payroll in 2026, and knowing how many pay periods in a year can make all the difference for budgeting and payroll planning. This guide also disaggregates all types of pay schedules, the reasons why certain years have an additional paycheck, and guides you to select the appropriate payroll cycle for your business.

How many pay periods per year, then? The solution is not always as clear as you may assume. Although most organizations have a regular weekly, bi-weekly, semi-monthly, or monthly payroll period, the calendar date arrangement of 2026 could lead to the creation of more pay periods, particularly those with weekly or bi-weekly payroll periods.

👉You May Also Like: Semi-Monthly vs Bi-Weekly with This Powerful Guide in 2025

Whether you are an employer and have to plan the payroll costs, an HR manager and have to prepare annual payroll calendars, or a worker and would like to know how many pay periods in a year in 2026, this knowledge can assist you in planning ahead. There are various types of pay periods in this guide, the advantages and disadvantages of each schedule, and what to expect in 2026 – whether a 27-pay-period year will impact your organization or not.

What is a Pay Period?

A pay period is the recurring timeframe during which an employer tracks an employee’s hours or salary to calculate wages before issuing payment. Common pay schedules include weekly, bi-weekly, semi-monthly, and monthly, each affecting how often employees receive paychecks.

Different Types of Pay Periods

Pay periods denote the frequency of payment of employees and are a major component of payroll planning. Knowing the various types will enable businesses to control budgets, legal requirements, and the question of the number of pay periods in a year, per schedule.

1. Weekly Pay Period

A weekly pay period indicates that employees receive a salary after every week, usually on the same day, e.g., Friday. This pay period leads to an approximation of 52 pay periods per year, which is the most common payroll period. Hourly workers are usually paid weekly to make the payment level in proportion to the number of hours worked, and because it is simple to compute overtime.

Weekly pay period gives the employees a flow of cash that may assist with budgeting and day-to-day expenses. Nevertheless, weekly payroll processing may be more administrative and expensive. In case you are keeping a record of the number of pay periods in a year, the weekly schedules have the largest number of paychecks in comparison to other types of payroll.

2. Bi-Weekly Pay Period

Pay period is bi-weekly, which is every two weeks, and this is about 26 pay periods per year. There are also years that will have 27 pay periods based on the calendar, which is vital in determining the number of pay periods in a year in order to budget and plan payroll. Bi-weekly compensation is common among both the hourly and the salaried employees.

📖Read More: What Is Biweekly Pay in 2025? A Smart Guide You’ll Love

This plan compromises with the weekly payroll, where the administrative load is heavy and the employee pay is minimal. Employees would also love to get the paychecks more frequently than semi-monthly or monthly payrolls, and the employers would save time and resources on payroll processing. The most common decision is usually a weekly pay period that companies use in calculating the number of pay periods in a year.

3. Semi-Monthly Pay Period

Semi-monthly pay period is the remuneration of employees on a twice-monthly basis, which is usually on predetermined days such as the 15th and the end of the month. This translates to 24 pay periods per year and is a little less than the bi-weekly schedule. Understanding how many pay periods are in a year helps employers plan cash flow accurately under semi-monthly schedules.

The semi-monthly pay rates would enable the employees to budget the monthly bills and expenditures since the payment dates are predictable. But in the case of hourly workers, it may be a little more complicated to calculate the overtime. Employers must be keen on the number of pay periods per year in order to have the right budgeting and payroll preparation.

📖Read More: Semi Monthly Pay: 5 Powerful Benefits

4. Monthly Pay Period

A monthly pay period implies that the employees receive payments after every 1 month, which gives them 12 pay periods annually. This is the most prevalent type of schedule used with salaried employees and makes the work of the employer in payroll processing easier. It is important to know the number of pay periods in an annual year in order to plan the payment of salaries and cash flow.

Employees may find it difficult to have monthly pay periods because they have to plan on a 30-day or longer basis between paychecks. To the employer, however, this timetable helps to reduce payroll expenses and administrative efforts while still staying in line with wage statutes. Understanding how many pay periods are in a year under a monthly pay system helps businesses manage finances efficiently.

Difference between a Pay Period and a Payday?

| Aspect | Pay Period | Payday |

| Definition | The recurring timeframe during which an employee’s hours or salary are tracked and calculated. | The specific date on which an employee receives their paycheck for the work completed during the pay period. |

| Purpose | Determines how many pay periods in a year and helps plan payroll schedules, budgeting, and compliance. | Marks the actual payment of wages to employees; signals the end of payroll processing for that pay period. |

| Frequency | Can be weekly, bi-weekly, semi-monthly, or monthly. | Matches the employer’s payroll schedule; occurs at the end of each pay period. |

| Impact on Employees | Helps employees understand how often they earn wages. | Determines when employees actually get access to their pay. |

| Impact on Employers | Essential for payroll planning, labor law compliance, and cash flow management. | Ensures payroll processing is completed on time and employees are paid accurately. |

Summary:

While a pay period defines the timeframe employees work and are paid for, a payday is the actual date they receive their wages. Understanding both is essential for managing how many pay periods are in a year and keeping payroll organized.

Advantages and Disadvantages of Different Pay Schedules

Choosing the right pay schedule affects how many pay periods in a year, payroll costs, employee satisfaction, and overall cash flow. Each schedule has its own advantages and disadvantages, as detailed below.

Weekly Pay Schedule

Advantages

- Provides employees with frequent paychecks, improving cash flow.

- Easy tracking of hours and overtime for hourly employees.

- Helps employees manage short-term budgeting and daily expenses.

Disadvantages

- High administrative workload for payroll processing every week.

- Increased payroll costs for employers.

- Frequent calculations for taxes, benefits, and deductions can be complex.

👉You May Also Like: What is the difference between gross and net pay?

Bi-Weekly Pay Schedule

Advantages

- Employees get paid regularly while reducing payroll processing frequency compared to weekly schedules.

- Works well for both hourly and salaried employees.

- Balances employee cash flow needs with administrative efficiency.

Disadvantages

- Some years may have 27 pay periods, affecting budgeting and payroll planning.

- Paychecks may not align perfectly with monthly bills, which can complicate personal budgeting.

Semi-Monthly Pay Schedule

Advantages

- Predictable pay dates (e.g., 15th and last day of the month) help employees plan monthly expenses.

- Fewer payroll runs reduce administrative work compared to weekly or bi-weekly schedules.

- Easier for employers to manage deductions and salary calculations for salaried employees.

Disadvantages

- Calculating overtime for hourly employees can be more complicated.

- Pay periods may not align with actual workweeks, causing minor discrepancies.

- Limited flexibility for handling variable hours or special payroll adjustments.

Monthly Pay Schedule

Advantages

- Lowest administrative burden and payroll costs for employers.

- Simplifies salary payments, deductions, and benefits management.

- Ideal for salaried employees with predictable income.

Disadvantages

- Employees must budget for longer periods between paychecks, which may be challenging.

- Less frequent pay reduces flexibility for hourly or variable-hour employees.

- Cash flow management can be more difficult for employees who rely on regular paychecks.

How Payroll Frequency Affects Taxes and Deductions

The paycheck frequency, such as weekly, bi-weekly, semi-monthly, or monthly, impacts not only how many pay periods in a year but also the level of paycheck tax withholdings, benefits deductions, and retirement contributions. Workers in weekly or bi-weekly shifts can have smaller withdrawals per paycheck, whereas monthly compensation will have greater withdrawals, but the yearly tax will be the same. Health insurance, 401 (k) contributions, and other benefits are also deductions that are influenced by the payroll frequency, affecting cash flow and employee budgeting. The knowledge of the pay schedule on taxes and deductions assists the employers in ensuring proper withholding, compliance, and enables the employee to better manage his or her finances during the year.

Is it possible to have 27 pay periods in a year?

Yes, one can have 27 pay periods annually, but this is only common with the weekly or bi-weekly pay schedules. Although a typical bi-weekly plan leads to 26 pay periods, the additional week during a year or two in a leap year may sometimes provide an additional paycheck. This is significant to employers and employees in planning the number of pay periods in a year since it may have an effect on payroll, budgeting, and financial forecasting.

Which pay period type is right for your business?

The decision as to the selection of the pay period will be based on the requirements of your business, cash flow, and the preference of your employees. Hourly workers and companies that prefer to pay their employees regularly should use weekly and bi-weekly pay schedules. Such schedules make employees happier and assist in cash flow among employees, yet they raise the payroll processing expenses and administration. Knowing how many pay periods in a year each schedule generates can assist you in budgeting and predicting the payroll.

The semi-monthly and monthly pay schedules are more appropriate for salaried employees and businesses that would wish to minimize administrative work. Semi-monthly schedules offer certainty in payment dates to employees and moderate frequency of payment to employers, whereas monthly schedules offer minimal processing to companies, but employees are forced to deal with extended periods between checks. Assessing the frequency of payment period, payroll expenses, and employee requirements will assist you in selecting the most appropriate payroll schedule to use in your organization that will allow the organization to operate successfully on payroll and be financially stable throughout the year.

What happens when paydays fall on weekends or holidays?

In case a scheduled payday falls on a weekend or public holiday, the employers generally change the day to the previous or next working day to make sure that employees receive their payment in time. This has a minor influence on knowing how many pay periods in a year and payroll processing schedules. To the employees, it can affect their budgeting or bill payments, and to the employers, one must be keen to ensure compliance, deductions, and to prevent late payments. This is because weekends and holidays have to be accounted for in order to have a smooth payroll operation and pay on time throughout the year.

How Many pay in a Year When Paid Monthly?

In the case of a monthly payment, the employee will get 12 paychecks in a year, one per month. This is the easiest payroll cycle, and it is easy to budget and process payroll by the employers. Nevertheless, workers have more time to live between payrolls, and it may impact their personal cash flow. Knowing this helps businesses plan how many pay periods in a year and ensures smooth financial management for both employers and staff.

What are the three paycheck months in 2026?

Three-paycheck months will be observed in 2026, when businesses have a bi-weekly payroll, and employees will receive three paychecks a month rather than the normal two. Such months usually occur because of the calendar effect, and the interaction of the calendar with the payroll cycle may impact budgeting in both the employer and employee. Being able to know the months that have an extra paycheck assists in the planning of cash flow, spending, and tracking how many pay periods in a year accurately for payroll forecasting.

How many pay periods are in a year biweekly?

A Biweekly pay schedule implies that employees receive a salary after every two weeks, so that in a normal calendar, there are 26 pay periods each year. Due to the dates of various years, there can be 27 pay periods, and this should be taken into account when making payroll and budgeting. Understanding how many pay periods in a year for a biweekly schedule helps employers manage cash flow, process payroll efficiently, and ensure employees receive accurate and timely paychecks throughout the year.

How Many Pay Periods are in a year Federal Government?

The U.S. federal government employees are generally paid every two weeks, and this makes the number of pay periods a year 26. This is a regular schedule in most of the federal agencies, and therefore, it is simpler to have control over the payroll, benefits, and tax withholdings. Sometimes the calendar effect may cause a 27th pay period, and it may impact the budget of both the government and the employees. Knowing how many pay periods are in a year helps federal employees plan their personal finances and helps agencies forecast payroll and maintain smooth operations.

Comparison of How Many Pay Periods in a Year Across Industries

| Industry | Common Pay Schedule | Pay Periods in a Year |

| Retail & Hospitality | Weekly or Bi-Weekly | 52 or 26 |

| Corporate & Professional | Semi-Monthly or Monthly | 24 or 12 |

| Federal Government | Bi-Weekly | 26 (occasionally 27) |

| Small Businesses / Startups | Weekly, Bi-Weekly, or Monthly | Varies depending on business needs |

| Healthcare | Bi-Weekly or Semi-Monthly | 26 or 24 |

| Manufacturing & Production | Weekly or Bi-Weekly | 52 or 26 |

| Education | Semi-Monthly or Monthly | 24 or 12 |

| Technology & IT | Semi-Monthly or Monthly | 24 or 12 |

| Construction & Trade | Weekly or Bi-Weekly | 52 or 26 |

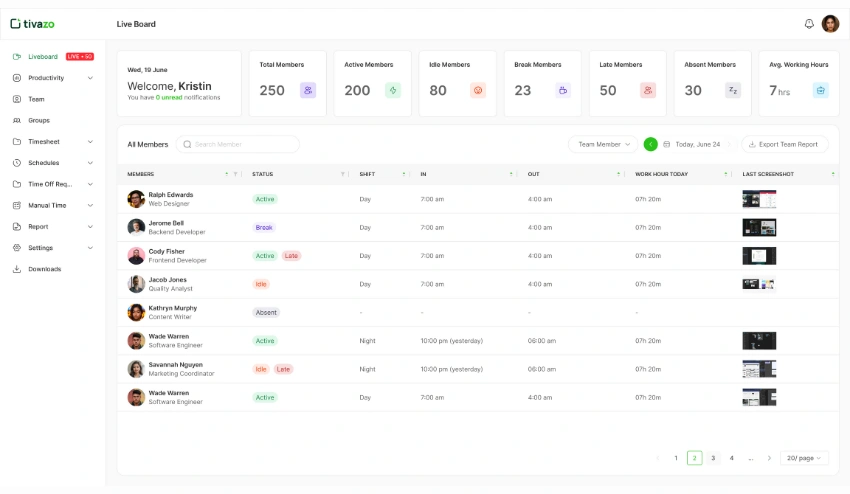

How Tivazo Simplifies Payroll for Employers

Tivazo simplifies the payroll with proper time tracking and automated timesheets so that employers can accurately compute wages, overtime, and deductions. By automatically tracking the number of hours, idle time, and manual records of employees in real-time, Tivazo prevents payroll errors and ensures adherence to labor laws. Detailed reports may be created and exported to audit, approvals, or work with payroll systems, which saves time and effort of the HR team and enhances accuracy.

In addition to time tracking, Tivazo is also compatible with payroll platforms, where the hours are automatically transferred into the payroll computation. Its automation capabilities lower the possibility of manual errors, automatic tax rule updates, and safeguard sensitive information. Moreover, online employee self-service will enable employees to see their hours, make changes, and track the time recorded, enhancing visibility and decreasing administrative tasks. Overall, Tivazo simplifies payroll operations, enhances compliance, and helps businesses manage how many pay periods in a year efficiently.

Conclusion

Understanding how many pay periods are in a year is crucial for both employers and employees to manage payroll, budgeting, and cash flow effectively. The number of pay periods can change depending on the payroll schedule: weekly, bi-weekly, semi-monthly, or monthly, and each year may have an additional paycheck. Pay period frequency affects administrative workload, employee satisfaction, and financial planning in many industries such as retail, hospitality, manufacturing, healthcare, corporate, and government. With the information on the number of pay periods in a year, businesses can simplify the payroll processing, remain in line with labor regulations, and correctly calculate benefits and deductions, and employees can manage money better and can predict paychecks.