Oversight of investments or business portfolios is rarely a simple task in a spreadsheet. With complexity increasing due to more risk factors to consider and the need for millisecond insights, PMS or Portfolio Management Systems are rising in popularity among organizations. Portfolio management systems integrate analytics, automation, and reporting to enable better decisions and returns.

In this blog, you will learn about portfolio management systems, their benefit, features, tools, costs, and going forward so that you can decide if PMS is right for you.

Key Highlights:

- Definition of Portfolio Management Systems

- Key Benefits of Portfolio Management Systems

- Core Features of Portfolio Management Systems

- Who Needs Portfolio Management Systems

- Choose the Right Portfolio Management System

- Common Challenges of Portfolio Management Systems

- Tools for Portfolio Management Systems

What Are Portfolio Management Systems?

A portfolio management system (PMS) is a software solution that enables a business, investor, or financial advisor to track, research, and optimize their portfolios in one place. PMS can replace manual spreadsheets with real-time dashboards, risk management, with audit, and automated reporting to make decision-making easier.

PMS eliminates redundant tasks like data entry, compliance reviews, and performance tracking, to reduce errors, plus save time, while also providing the benefit of linking with other financial software, providing a complete view of your assets while ensuring you are making smarter, quicker, and informed investment decisions.

Key Benefits of Portfolio Management Systems

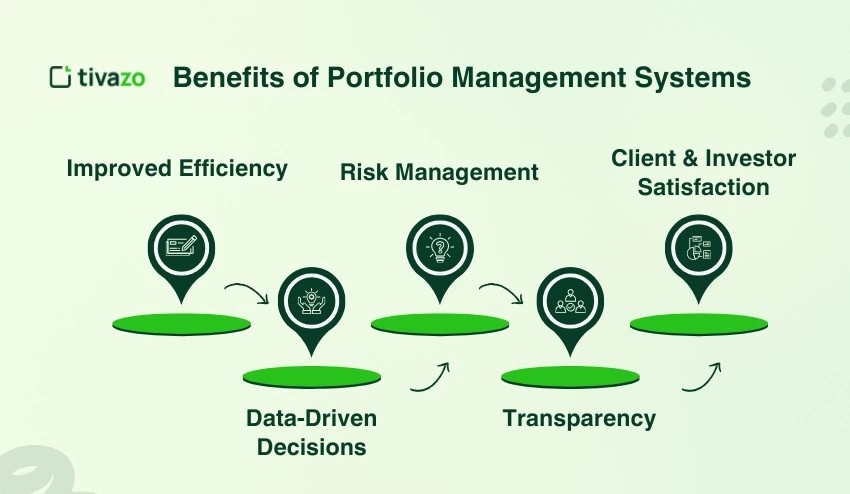

Listed below are five solid benefits that will provide insight into the importance of PMS:

1. Improved Efficiency

Traditional manual portfolio management can be lengthy and has a large scope for human error. A PMS will automate mundane tasks such as asset rebalancing, performance monitoring, and compliance monitoring, allowing you to spend more time on higher-value-added activities. This improved efficiency not only reduces fixed operations costs but also allows both advisors and managers to devote more time to strategic growth that can lead to profit, as opposed to repetitive administrative tasks.

2. Data-Driven Decisions

Using dated spreadsheets means your decisions are sometimes based on incomplete or outdated information. PMS solutions include readily available data, interactive reports, and predictive analytics that help investors and managers to identify trends, like tracking Key Performance Indicators and ensuring they take action quickly. A data-driven portfolio strategy and management style gives both individuals and businesses more confidence to pivot and take advantage of opportunities or avoid unnecessary risk.

3. Risk Management

Every portfolio will have some uncertainty; however, ePM tools come with capabilities that include sophisticated risk modeling and scenario analysis to determine level of exposure, run ‘what if’ scenarios, and how fluctuating market conditions impact price. Proactive risk management allows businesses and investors to minimize losses alike, protect returns, as well as remain compliant with existing standards.

4. Transparency

Transparency is a trust builder, whether you’re giving updates to your clients or investors or your team. A PMS provides clear and concise dashboards and flexible reports on the portfolio, expenses, and risks. Rather than having to manually update lengthy specifications, decision-makers have accurate, current information at their fingertips, which increases accountability and already stressed resources.

5. Client & Investor Satisfaction

Clients want timely answers and plain language reports. PMS solutions improve client experience by offering polished, personalized dashboards and the ability to receive updates at any time. This level of service will improve your customer retention, good relationships, and position you as the advisor who provides them with result after result.

Core Features to Look for in Portfolio Management Systems

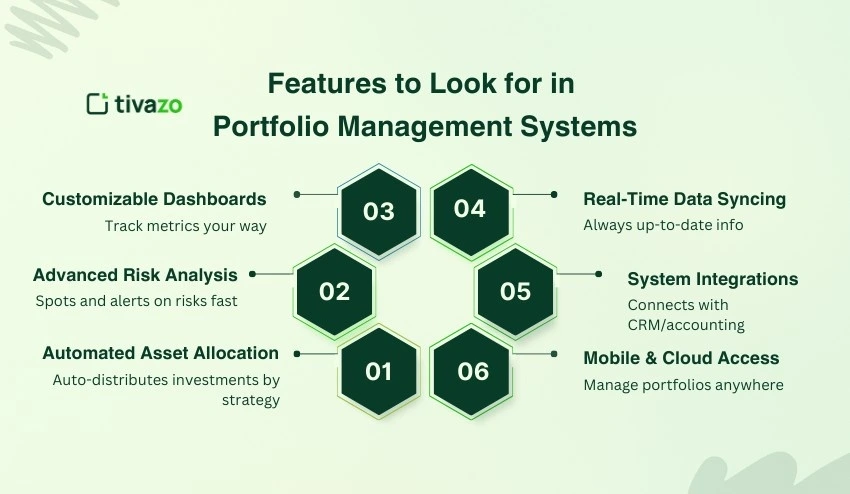

Here are some important features to consider when selecting a portfolio management system. These are the features that will make the most difference:

1. Automated Asset Allocation

A PMS can allocate assets in your portfolio across multiple asset classes, based on an investment strategy or risk profile. This means less manual work for you, a broader investment diversification, and a healthy portfolio without extra work involved.

2. Advanced Risk Analysis

Modern PMS tools include integrated risk models and built-in capabilities to do stress-testing and scenario analysis. It not only identifies levels of exposure but also estimates market impact, as well as alerts you when you exceed acceptable risk. A solid PMS will allow you to react quickly when emerging problems could cost your investors more down the line.

3. Customizable Dashboards and Reporting

Every investor or investment business may have different priorities. A good PMS should allow you to build a custom dashboard along with the ability to set up custom reporting needed to highlight essential metrics like performance, expenses or compliance. Good reporting allows for easy tracking and keeps all involved parties on the same page.

4. Real-Time Data Syncing

Unlike static spreadsheets, PMS platforms will sync data continuously. An investment professional should have up-to-the-minute asset values and market performance resulting that regulators or competitors are not making decisions based on stale data.

5. Integration with CRM or Accounting Platforms

The best PAM systems do not operate in isolation. The best PAM system integrates with CRMs, accounting systems, and trading platforms. The best PAM system integrates with CRMs, accounting systems, and trading platforms. This promotes a connected workflow, enables collaboration, and eliminates silos of data.

6. Mobile and Cloud Accessibility

When utilizing cloud-based PAM systems, you will not be tied to a desktop. Mobile apps and cloud access can provide you with portfolio monitoring and oversight from anywhere and at any time. This flexibility is essential for a modern team and for investors alike.

Who Needs Portfolio Management Systems?

Portfolio management systems are not just for big financial institutions. A portfolio management system can help anyone who has to manage multiple assets, is looking to monitor performance in real-time, or wants to make informed investment decisions. Portfolio management systems can be utilized for professionals with client portfolios, to the individual wanting to grow their wealth. Portfolio management systems deliver efficiency, transparency, and control.

- Financial Advisors & Wealth Managers: The ability to manage a number of client portfolios easily and efficiently, provide automated reporting, and offer timely insights helps build client trust.

- Investment Firms: Portfolio Management Systems carry out the heavy lifting for difficult-to-handle multi-asset portfolios with surety, compliance and calculable risk models.

- Corporations & Enterprises: Corporations can track capital projects, budgets and other company-owned investments across departments using a portfolio management system.

- Individual Investors: Individual investors also leverage PMS to diversify, track, and, it lets you leverage external investment decision-making while reducing your own manual work.

How to Choose the Right Portfolio Management System

Selecting the right portfolio management system is based on your different types of goals, team size, and types of portfolios. The best PMS will strike a balance between price, functionality, and usability while ensuring your data is safe.

1. Budget Alignment

Not every organization requires an expensive enterprise system. Plenty of PMS are cloud-based and have powerful capabilities for a fraction of the cost. This is usually best for individual investors or small organizations. Enterprises require more ergal solution that can be customizable will ultimately be more expensive.

2. Security

Your portfolio data is sensitive to your investors. Finally, choose a portfolio management system that has strong encryption and compliant with various standards like GDPR, SOC 2, as well as robust features like multi-factor authentication. Security ensures both parties trust each other, as well as remain compliant.

3. Scalability

As you are developing your portfolio today, it may be smaller, but it will also grow over a period of time. A scalable system will let you start small, it’ll be important to know your scales up without needing to switch systems after. Look for systems that can scale with your assets, users, data, etc.

4. Ease of Use

No matter how top-of-the-line a PMS is, if your people cannot use it, the PMS becomes useless. Look for platforms with a clean, user-friendly interface and an intuitive workflow. User-friendly systems make it easy for employees to start adopting and using the tools and processes, ultimately leading to significant reductions in total cost of training and onboarding.

5. Integration

A PMS must be integrated with other systems. The best systems easily integrate with general purpose CRM software, accounting tools, even with trading systems. Integrated systems deliver the ultimate workflow, reduce duplicate entry of the same data, and give you a single source of truth.

Common Challenges and How to Overcome Them

You will face unique policy dilemmas with your portfolio management system, but knowing these in advance helps unfolding a better way around them.

- High Initial Costs

- The cost of a PMS system will depend on whether the system is enterprise-wide; however, either way they are costly. If you can use the cloud or a subscription model, you can pilot with a lower price threshold and limited fees up front.

- Data Migration Issues

- Importing legacy data can be problematic; however, make sure to listen to vendor technology support, and do some cleaning of your data before a possible import. This way, your efforts are not wasted

- For safer cutovers and quick rollbacks during PMS onboarding, Acronis data migration through imaging lets teams snapshot full systems, validate imports, and restore environments if issues surface

- Resistance to Change

- There can be skepticism by certain individuals; however, by encouraging training on the features, these users will become accustomed to and appreciative of the software. A slow and steady introduction will build comfort.

- Security Concerns

- Data security is sensitive information. There are certain fundamentals to be followed. Ensure there is encryption and multi-factor authentication, and you will be safe.

Future Trends in Portfolio Management Systems

The portfolio management space is continuously changing, and new systems will incorporate technology to further increase innovation and efficiency. Here are some of the key tours to watch for in the near future:

1. AI & Machine Learning

PMS systems utilize AI and machine learning to help users determine how their portfolios will perform based on their analysis of information. This added dimension of predictive insights allows users to make more informed investment decisions based on data.

2. Cloud-First Adoption

More and more PMS providers are rolling out solutions in the cloud, allowing access anywhere and anytime remotely. Cloud-first PMS is advantageous because of scalability, quicker updates that are available to all users, and collaboration ranging from staff level to companies in unison.

3. Mobile-Friendly Dashboards

The need for portfolio access on the go is growing. Mobile dashboards will allow investors, managers, and staff to check for updates, alerts, and analytics quickly and in real-time. Information will be accessible via smartphone or iPad.

4. Personalized Investment Insights

Investment systems today are providing the ability for AI-enhanced recommendations. In the future, PMS platforms will enable clients to receive customized strategies based on their risk profile, objectives, and portfolio activity.

Portfolio Management Systems vs. Traditional Tools

Most traditional portfolio record-keeping relies on spreadsheets or other manual forms, leaving users exposed due to manual tracking. Portfolio management systems allow users to take advantage of automation, real-time information, advanced analytics, and scalable solutions. The comparison highlights why PMS platforms are increasingly important to investors and companies.

| Aspect | Traditional Tools (Spreadsheets) | Portfolio Management Systems |

|---|---|---|

| Accuracy | Manual errors likely | Automated, error-free tracking |

| Efficiency | Time-consuming | Streamlined workflows |

| Insights | Limited | Advanced analytics |

| Scalability | Hard to manage | Scales easily |

Tools for Portfolio Management Systems

Numerous portfolio management systems are available to best suit a wide variety of users and needs. Selecting a portfolio management tool is dependent on your portfolio’s size and complexity, as well as whether you are an individual or an organization. Here are some of the most common PMS tools:

1. Morningstar Direct

This is a professional-grade portfolio management tool that investment firms use for sophisticated research and analytics. Morningstar Direct offers professional-grade direct portfolio reporting and analytics for performance monitoring and risk management.

2. Personal Capital

Personal Capital was created for individuals and provides budgeting, investment tracking, and retirement planning all on one platform for individuals. Users can monitor their personal portfolios and have easier access to analyze and optimize.

3. eToro

eToro is also well known for trading and social investing. eToro allows investors to follow traders on the platform and copy their investment strategies. eToro allows individuals to create a multi-asset portfolio of assets such as equities, crypto, and ETFs.

4. Mint

Mint is a personal finance tool. Mint helps users track spending habits, budgets, and investments all in one app. Mint is a good tool for people to use who just want a simple tool to begin tracking their portfolio and expenses.

5. Bloomberg Portfolio & Risk Analytics

Bloomberg provides an enterprise-level portfolio management system that allows users enhanced analytics and risk modeling and leverages live market data, providing ideal market conditions for enterprise decision-making. Bloomberg is typically used by financial institutions and large investment firms.

Cost of Implementing a Portfolio Management System

The cost of a portfolio management system depends on your business. Cloud-based PMS for small companies and individual users is usually offered for $10-100/month with basic reporting and tracking tools built in.

- Small businesses/individuals: $10-100/month (cloud PMS)

- Mid-sized firms: $200-1,000/month (multi-user systems)

- Enterprises: Custom pricing (usually a minimum of $5,000/year)

Conclusion

A portfolio management system (PMS) is more than software; it is a strategic system that changes how you manage investments and portfolios for your business. It automates tasks, provides instant reporting and better visibility, and allows users to interactively make smarter decisions more quickly and transparently.

Whether you are an individual investor, financial advisor, or enterprise organization, they are time savers and help deliver a better, more reduced-risk product that aims to maximize portfolio performance. The right PMS will streamline your workflows, increase client satisfaction, and give you a complete view of your financial health