Overtime usually appears easy on the surface. A worker takes up additional time, gets higher wages, and the task is completed. Behind those additional hours is an increasing price that most individuals fail to calculate or challenge.

The cost of overtime extends way beyond time and a half. To business, it involves increased payroll costs, decreased productivity, and strain on long term workforce. To the employees, it may translate to temporary financial benefit at the expense of long-term exhaustion and work-life disequilibrium. The knowledge of these costs assists individuals in making better choices on when overtime will be of benefit and when it will be costly.

In this guide, we dissect the actual cost of overtime, its impact on employers and employees, respectively, and what can be done to control it in a better way. To begin with, we will explain what overtime is and how it is computed before passing on to the actual financial and operational implications.

What Is Overtime and How Do We Calculate It?

Overtime is the number of hours an employee works outside his or her working schedule. These additional hours are usually paid at a higher rate than the normal working time. This is aimed at rewarding the employees who put in extra time and effort.

Although the overtime laws may differ depending on the country or contract, the general concept is the same. Overtime compensation is imposed after an employee exceeds a normal number of hours in a week or a day. This is a background that should be known before considering the actual cost of overtime.

Explained Simple Standard Overtime Rules.

In most workplaces, an employee is on overtime once he or she has exceeded 40 hours in a week. Any working time exceeding this is regarded as overtime and is remunerated at a premium rate. This increased rate is typically 1.5 times the normal hourly salary, commonly referred to as time and a half.

As an example, when one has an hourly rate of $20, the overtime rate will be $30. This growth might appear insignificant on an hourly basis, but it will accumulate very fast when overtime is a common occurrence.

Simple example

Regular pay: $20 per hour

Overtime pay: $30 per hour

10 hours of overtime per week = $300 as opposed to 200.

Overtime Pay vs Regular Pay

Regular remuneration is used to compensate the hours worked by an employee, which is expected to be part of their job. Overtime pay applies only after those standard hours are exceeded. The difference between the two is not just the hourly rate, but the impact on total labor costs.

Here is a simple comparison to make the difference clear.

| Type of Pay | Hourly Rate | Cost for 10 Hours |

|---|---|---|

| Regular Pay | $20 | $200 |

| Overtime Pay | $30 | $300 |

This difference shows why overtime can quickly raise payroll expenses. When overtime becomes a routine solution instead of an occasional one, the cost of overtime grows faster than many businesses expect. We can use overtime calculators to calculate the total amount of overtime.

The Direct Cost of Overtime to Employers

Overtime not only does it impact the salary of an employee. To employers, it directly raises labor costs and strains the payroll. These expenses are short-term, quantifiable, and in most cases underestimated when overtime turns out to be common.

Knowing the actual cost of overtime makes businesses realize why the use of additional hours may be more costly than it may seem.

Increased Wage Expenses

Overtime is the most noticeable expense in the form of increased wages. At time and a half, or higher, each additional hour will be much more expensive than a normal working hour. A little overtime in a week can result in a huge cost every month.

To illustrate, in case an employee is paid 25 an hour, his overtime rate will be 37.50. When they have 8 overtime hours in a week, this translates to 300 additional dollars in weekly wages. In a month, that one employee will cost the business over 1200 dollars.

When a number of employees work overtime on a regular basis, the overall cost of the overtime might increase at a rate that is greater than anticipated.

Example:

- Regular hourly rate: $25

- Overtime rate: $37.50

- Weekly overtime hours: 8

- Overtime monthly expenses: approximately 1200 per employee.

Benefits and Payroll Taxes Add Up

Related payroll costs are also increased by overtime pay. This is a significant aspect that is not taken into consideration by many employers despite the fact that it contributes to the overall cost.

Increasing the overtime pay usually causes companies to pay higher:

- Social contributions and payroll taxes.

- Wage-based retirement or pension contribution.

- Earnings-based insurance or benefits.

This implies that the actual cost of overtime is more than the overtime rate itself. What may appear to be an overtime payment of $300 may be a lot more when all the associated costs are factored in.

- Higher hourly wages

- Increased payroll taxes

- Other benefit contributions.

The Unseen Costs of Overtime that Most People Miss.

The direct cost of overtime is simple to gauge. The hidden cost is not. Such expenses are not felt immediately, and in most cases, the working environment has already developed the overtime habit.

Although overtime can be a quick fix to the immediate workload challenges, it can silently lead to long-term problems that will be reflected in productivity, quality, and retention of employees.

Staff Burnout and Reduced Efficiency.

The long working hours cause fatigue. Workers who are exhausted tend to perform more slowly, become unconcentrated and require increased time to do work. Consequently, the additional hours do not always generate additional output.

As an illustration, a worker working 50 hours per week might do lower-quality work than they would do in a concentrated 40-hour plan. This makes the payback of every overtime hour less and the actual cost of overtime higher.

Micro example

- 40 concentrated hours = steady production.

- 50 fatigued hours = reduced work and increased breaks.

- Increased Error and rework expenses.

Mistakes are also caused by fatigue. Depending on the position, mistakes result in rework, customer complaints, or compliance issues. Any error is a waste of time and money that would otherwise have been saved.

Even minor mistakes in the position related to data entry, finance, or operations may cause a domino effect. The overtime expense increases even more when it is necessary to employ extra hours to repair the issues that were created due to overwork.

Checklist: Costs associated with errors.

- Time for correcting errors.

- Late projects/deliveries.

- Customer dissatisfaction

Burnout, Absenteeism, and Turnover

In cases where overtime is a permanent phenomenon, burnout is probable. Exhausted workers will tend to take sick leave, become uninterested in the job, or quit the company altogether.

It is costly to replace an employee. Recruitment, orientation, and training are time and cost-consuming. The replacement cost of a single employee in most instances is more than the overtime expenses that caused burnout to the employee in the first place.

Cost of Overtime for Employees

The impact of overtime on employees is not the same as that of the employer. Although additional hours may boost take-home pay, they also have personal expenses that do not always seem apparent initially. Knowing both sides enables the people to make decisions regarding when it is acceptable to take overtime and when it is not.

Short-term Financial Gains

Overtime is a quick fix to a financial strain to many employees. Additional income will be able to offset the increased cost of living, pay off debt, or save. Overtime may be satisfying and convenient in the short run.

This is more so where overtime is incidental and not compulsory. Several additional hours during a rush time might not seem that stressful and can provide valuable financial assistance.

Example

- 5 overtime hours per week at an increased rate.

- Additional earnings without switching.

Long-term Health and Work-Life Costs.

The effect is different when overtime is a routine. The working hours are long, so there is less time to rest and to spend time with family and personal activities. In the long-run, this may result in stress, sleeping problems, and deteriorating health.

Employees can also be less motivated or attached to their work. The overtime expenditure, in this instance, is compensated in terms of energy, well-being, and personal time instead of money.

Checklist: Effects common to the long-term.

- Chronic fatigue

- Reduced personal time

- Increased stress levels

When Overtime Is No Longer Worth It

At some stage, additional compensation does not cover the personal cost. Overtime is no longer valuable when it impairs health or performance.

This breaking point is represented to many employees when overtime is not optional anymore. The overtime cost is no longer financial only at that point. It is individual and enduring.

Industries Where Overtime Costs Are Highest

- Manufacturing and Operations

- Common reason: production deadlines and equipment schedules

- High-cost factors: increased wages, higher error rates, accident risk

- Hidden costs: repetitive tasks amplify fatigue and mistakes

- Healthcare and Essential Services

- Common reason: staffing shortages and critical patient needs

- High-cost factors: employee fatigue, higher turnover, mistakes in care

- Hidden costs: burnout affecting long-term staff retention

- Tech, Agencies, and Knowledge Work

- Common reasons: project deadlines, product launches, client demands

- High-cost factors: reduced creativity, errors, disengagement

- Hidden costs: lower team efficiency and retention over time

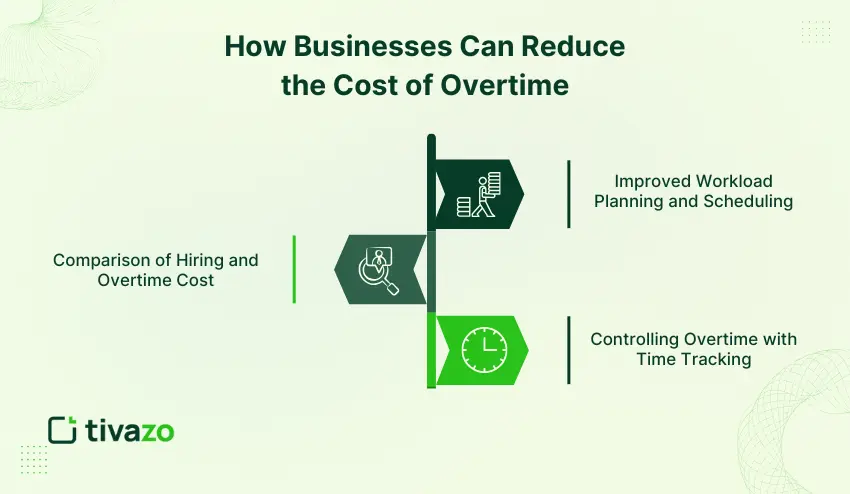

How Businesses Can Reduce the Cost of Overtime

Overtime is not always avoidable, but there are things that businesses can do in order to reduce the occurrence and expense of overtime. Prevention is not only cost-efficient, but it also safeguards the health and efficiency of the employees.

- Improved Workload Planning and Scheduling

- Plan the future workloads in advance to predict when it will be busy.

- Share work to avoid having few employees who always work overtime.

- Plan shifts so that there is no need to use overtime frequently.

- Comparison of Hiring and Overtime Cost.

- Compare the cost of overtime payment with the cost of temporary or permanent employees.

- Hiring more workers is in most instances cheaper than recurrent overtime.

- Calculate indirect costs such as benefits, onboarding and training.

- Controlling Overtime with Time Tracking.

- Install time tracking software to track actual working hours.

- Determine trends in which overtime is experienced and rearrange schedules.

- Encourage transparency: workers and supervisors will have an opportunity to observe the piling of additional hours.

How Tivazo Helps Reduce the Cost of Overtime

Effective management of overtime needs visibility, planning, and good data. Tivazo offers solutions that can enable companies to know where additional hours are occurring and intervene before the expenses get out of control.

Real-Time Time Tracking

- Tivazo automatically monitors the hours of employees, and thus the managers are always aware of those who are on the verge of working overtime.

- Offers dashboards to identify patterns and avoid extra hours that are not necessary.

- Helps make sure that there is adherence to the labor laws by checking on the total work hours.

Smarter Workload Management

- Balance team workload by assigning tasks and projects with definite deadlines.

- Determine overworked employees before overtime is a routine.

- Predict staffing requirements and schedule changes in advance using reporting tools.

Data-Driven Insights

- Create comprehensive overtime reports to get a week or month-by-month trend.

- Compare the overtime expenses within the departments or teams to make effective decisions in staffing.

- Link with payroll to determine the precise cost of additional hours, including taxes and benefits.

Conclusion

Extra pay is not the only thing that constitutes overtime. Its actual expense is an increase in wages, payroll taxes, reduced productivity, and fatigue of employees in the long run. Knowing these costs and planning on this helps both the employers and the employees.

Through time tracking, application of tools such as Tivazo, and better management of workloads, companies can avoid unnecessary overtime and keep their workers active and healthy. To the employees, it is beneficial to know when overtime is worth taking so as to achieve a balance between additional earnings and personal health.

Finally, the secrets of overtime management are visibility, proactive planning, and data-driven decisions. By doing overtime in a strategic manner, businesses are able to save money, safeguard their teams, and still be productive without affecting the satisfaction of the employees.