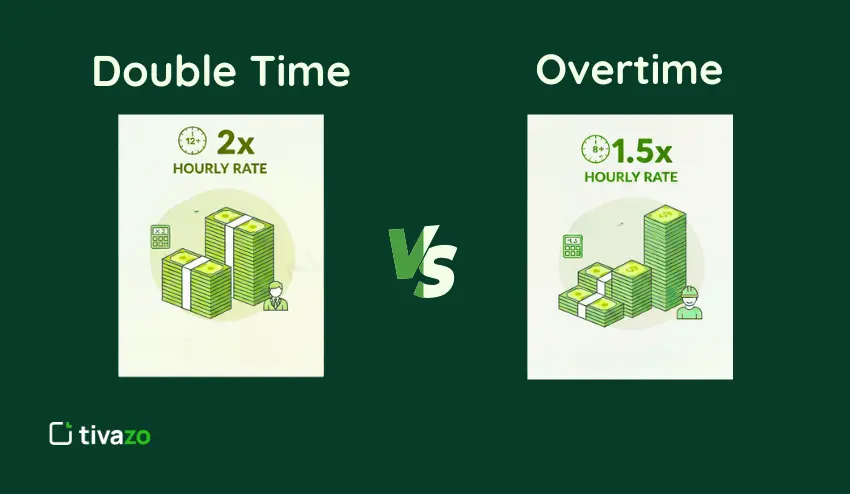

The key differences between double time and overtime need to be understood by both employers and employees. While these terms might seem similar, they actually refer to different rates of compensation for work done. If not understood correctly, it can lead to legal problems for companies and to employee disheartenment.

This guide breaks down everything you need to know about double time vs overtime, including how each is calculated.

Double Time vs Overtime: Key Differences

The first and foremost difference between overtime and double time is the salary multiplier. Overtime is calculated at 1.5 times your hourly salary, whereas double time is calculated at 2 times your salary.

Another significant difference is the legal requirement for overtime and double time. The FLSA clearly specifies overtime pay for non-exempt employees. Double time is not mandated at a federal level and is usually state-specific.

Double Time vs Overtime Comparison Table

| Feature | Overtime | Double Time |

| Pay rate | 1.5x regular wage | 2x regular wage |

| When applied | After 40 hours/week (federal) or 8 hours/day (some states) | After 12 hours/day or 7th consecutive day (varies by state) |

| Legal requirement | Yes, under FLSA | Only in certain states (e.g., California) |

| Common usage | Regular extra work hours | Extreme overtime or special conditions |

| Eligibility | All non-exempt employees | Depends on state law and employer policy |

The greatest difference is in the state laws. California is very strict with its “double time” rules, which require it after 12 hours worked in a single day. Most states do not require it at all.

When Does Overtime Apply?

Federal law requires overtime pay if an employee works over 40 hours in a single workweek. This is the most common rule throughout the US. A workweek is defined as any seven consecutive days, chosen by the employer.

Some states have their own rules that offer even greater benefits to workers. California requires overtime pay if an employee works over 8 hours in a single day. This means an employee could work 40 hours over seven days and still be eligible for overtime if they worked more than 8 hours in a single day.

Who Qualifies for Overtime?

Not all employees qualify for overtime. The FLSA categorizes employees into exempt and non-exempt employees based on duties performed and salary earned.

Non-exempt employees must receive overtime. These include employees who work on an hourly basis, mostly in retail and service industries, as well as manual laborers.

Exempt employees do not receive overtime. These include executives, administrators, and professionals. Exempt employees must also earn more than a certain salary, as prescribed by the FLSA.

When Does Double Time Apply?

Double time is usually applicable only in certain situations that go beyond regular overtime. In California, double time applies if an employee has worked 12 hours a day within a single day. In addition, double time applies if an employee has worked over 8 hours on the 7th consecutive day.

Holiday work may qualify for double time. However, this only applies if a company has a policy regarding this situation, not federal law. Many companies will choose to pay double time for holidays like Christmas or Thanksgiving as a reward.

States that have double time provisions:

- California: 12 hours a day or over 8 hours a day on the 7th consecutive day

- Alaska: After 8 hours a day for certain industries

- Nevada: Some limited provisions exist, depending on the situation

- Rhode Island: Sunday and holiday work for manufacturing only

Most states do not have a legal requirement for double time. In these areas, it is either voluntary or part of a union contract.

How to Calculate Overtime Pay (With Example)

Evaluation of overtime compensation is very easy, because it is calculated as a simple formula, and you only have to possess the following details: your hourly rate in general, the multiplier of the overtime hourly rate, and the number of overtime hours that you have worked.

The calculation of the amount to pay overtime follows:

- Step 1: Determine your daily hourly salary. In this case, suppose that you earn 20/hour as your regular hourly wage.

- Step 2: Multiply your normal one-hour wage by 1.5; this is the overtime multiplier. This calculation will help you find your overtime rate per hour: 201.5 $30/hour.

- Step 3: Multiply the rate of pay per hour of your overtime by the number of hours you worked in overtime. Suppose you had 5 overtime hours; then the overtime remuneration would be 30 x 5 = 150.

- Step 4: You must add your usual hourly earnings to your overtime earnings to see what your total pay would be during the overtime.

Overtime Pay Example

Sarah works as a manager in a retailing business and earns 18 per hour. She had spent 45 hours working last week.

- Regular pay for 40 hours: $18 * 40 = $720

- Overtime rate: $18 * 1.5 = $27 per hour

- Overtime hours: 45 – 40 = 5 hours

- Overtime pay: $27 * 5 = $135

- Total weekly pay: $720 + $135 = $855

This makes sure that Sarah will be compensated for the additional hours of her work.

You don’t have to calculate manually every time. You can quickly determine your overtime earnings using an online overtime calculator. It will save time and reduce errors.

How to Calculate Double Time Pay (With Example)

Double time is even easier to calculate than overtime. The multiplier is 2.0, rather than 1.5. This simplifies the mathematics and proves to be easy to confirm.

Follow these steps:

- Step 1: Begin with your usual hourly salary. We’ll use $20 per hour.

- Step 2: Divide the double time rate by the initial hour rate: $20 x 2 = $40/h.

- Step 3: Qualify hours worked multiplied by the rate of double time. In case of working 3 times the double time: 40 times 3= 120.

- Step 4: Combine this together with the other categories of pay that you have, such as regular hours and overtime, where necessary.

Double Time Pay Example

Marcus is employed in California, where he earns 22 per hour. Tuesday, he put in 14 hours shift to meet a deadline.

- Regular pay (first 8 hours): $22 × 8 = $176

- Overtime pay (hours 9-12 at 1.5x): $33 × 4 = $132

- Double time pay (hours 13-14 at 2x): $44 × 2 = $88

- Total pay for that day: $176 + $132 + $88 = $396

California law maintains twice the time after 12 working hours in one day. Marcus received much more as a result of his long shift.

Real-World Example: Overtime and Double Time in the Same Week

There are a lot of employees who are working double time and overtime during the same period. This occurs particularly in those states where the daily overtime regulations exist. Their mechanism of working together eliminates confusion in payroll.

Take the case of Jennifer, who is a warehouse employee in California with a salary of 25 per hour.

Monday: 10 hours worked

- Regular pay (8 hours): $200

- Overtime pay (2 hours at 1.5x): $75

Tuesday: 8 hours worked

- Regular pay: $200

Wednesday: 13 hours worked

- Regular pay (8 hours): $200

- Overtime pay (4 hours at 1.5x): $150

- Double time pay (1 hour at 2x): $50

Thursday: 9 hours worked

- Regular pay (8 hours): $200

- Overtime pay (1 hour at 1.5x): $37.50

Friday: 12 hours worked

- Regular pay (8 hours): $200

- Overtime pay (4 hours at 1.5x): $150

Total for the week:

- Total hours: 52 hours

- Regular pay: $1,000

- Overtime pay: $412.50

- Double time pay: $50

- Grand total: $1,462.50

The daily overtime regulations in California take effect after 8 hours a day. The double time is applicable for 12 hours on Wednesday. This is an insight as to why proper time tracking can be important in terms of payroll accuracy.

Common Payroll Mistakes With Overtime and Double Time

The overtime and double time payroll mistakes cost corporations thousands of dollars a year. They are also sources of employee dissatisfaction and lawsuits. Proper systems and knowledge of the laws of overtime prevent most mistakes.

The most common mistakes that employers commit include:

Categorizing employees as exempt: It is the leading error that impacts overtime eligibility. Exempt status is not dependent upon job titles. The real requirements and the salary level should comply with FLSA.

Overriding state-specific regulations: Federal law is the floor, but states can be more liberal. The daily overtime regulations in California often come as a surprise to many out-of-state firms.

Calculation of incorrect multipliers: Some payroll systems compute overtime as 2x rather than 1.5x. Other people might use 1.5x as a multiplier for double time. These mistakes accumulate very quickly over several pay periods.

It is better to forget about daily overtime: States such as California require overtime after 8 hours per day. This is unrelated to the weekly 40-hour rule.

Manual errors: When calculating overtime, errors are highly likely to occur. A single decimal place will affect the entire paycheck.

Failure to track hours properly: Ineffective time tracking is raising questions about third-party payments and compliance. The workers may also have hours of work that are not registered.

These errors can be prevented through good systems and training. Payroll software can minimize human error.

How Businesses Can Manage Overtime and Double Time Efficiently

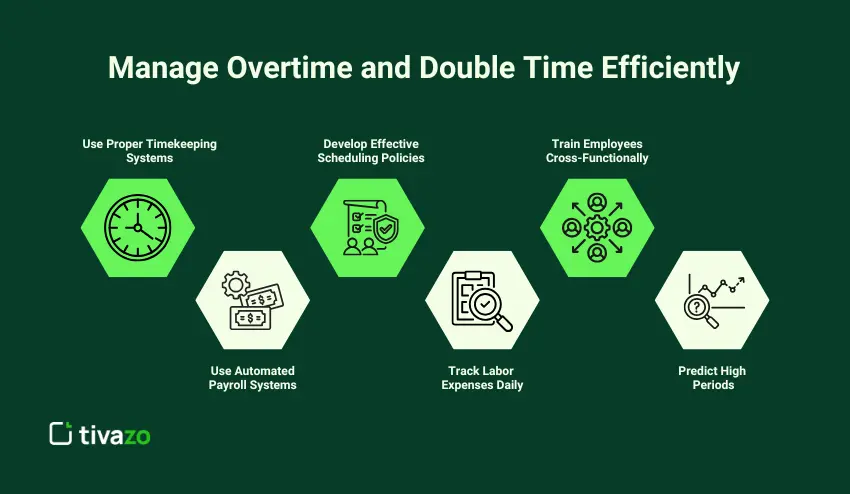

Overtime and double time are the two elements that need to be planned and equipped with the right tools. Companies that manage such expenses remain more profitable without compromising the satisfaction of the employees.

Use proper timekeeping systems: Digital time clocks eliminate human error and improve payroll accuracy. They take accurate start and stop times of each employee. Various systems will automatically calculate overtime limits and notify managers when double time begins.

Use automated payroll systems: Modern payroll systems automate complex calculations in accordance with labor laws. They are familiar with federal and state overtime regulations and the various overtime multipliers.

Develop effective scheduling policies: Inform all employees in advance about overtime. Approval procedures for overtime working to avoid the sudden cost of labor.

Track labor expenses on a regular basis: Read overtime reports weekly or monthly to identify patterns. Monitor the departments that cause the highest number of overtime and double time hours.

Train employees cross-way: versatile employees will decrease the number of overtime hours in the whole organization. When an individual is overpowered, others can assist.

Predict high periods: Anticipate high periods that need additional staffing. Bring in contractors rather than being dependent on overtime of existing personnel.

Tools such as Tivazo can help companies improve time management and scheduling. These platforms ensure employees receive the correct compensation for overtime and double-time hours, while helping employers manage costs.

Conclusion

The difference between overtime and double time is an important concept for both employees and employers to grasp to avoid costly mistakes. Overtime is paid at 1.5 times the hourly rate after working more than 40 hours in a week, while double time is paid at twice the regular hourly rate, depending onstate or company regulations.

The importance of accurate time tracking cannot be overemphasized to get the overtime and double time concepts right. It is advisable to seek advice from the HR department or a labor law expert in case of doubt.

Getting overtime and double time right is beneficial for everyone in the workplace.