Whether you are starting a business, finding investors, or growing your already existing business, one of the initial lessons you have to acquire is how to write a business plan. It is not merely a document, it is your map, your pitch and your strategy to success. A good business plan can enable you to find a source of funding, attract partners, and make sound decisions whether you are starting a business or expanding a small company.

You will get to know, in this guide, how to write a business strategy step by step, how to adapt it to seek funding and how to make a plan scalable, it is all 2026-ready using strategies, templates, and tools.

Key Highlights:

- Key Elements of a Business Plan

- Create a Business Plan

- Guide on How to Write a Business Plan

- Digital Tools and Templates to Build a Business Plan

- Best Practices for Writing an Effective Business Plan

- How to Make Your Business Plan Scalable

Introduction: Understanding the Importance of a Business Plan

Before you get to know how to write a business plan, you should know the reasons as to why it is important not only to the investors, but also to you as the owner of the business.

Business plan is a systematic document that provides your business objectives, tactics, financial forecasts, and industry knowledge. Imagine that it is the GPS of your business. It demonstrates your position, the direction you desire to take, and the path you must take precisely.

1. Obtain financing from investors, banks, or grant providers.

2. Manage your business with focus and a goal.

3. Determine risks, opportunities and competitive advantage.

4. Identify achievable objectives and measure your performance.

Simply, a business plan turns ideas into action.

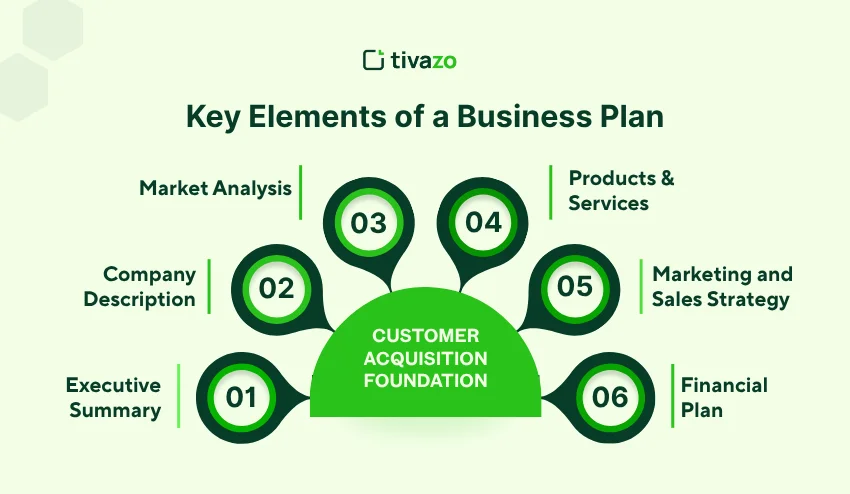

Key Elements of a Business Plan

The first thing to do before learning how to write a business plan is to know what is included in it. It is not simply a set of ideas, it is a document that consists of structured parts, all of which address a given purpose. These factors assist investors to analyze your company, shape your plan of action and stay in line your staff.

A good business plan has the following aspects:

1. Executive Summary

This is the introductory part that is read by the investors but the final part that you write. It gives a brief overview of your company, purpose, objectives, and profit perspective.

2. Company Description

It is a section where you are able to explain who you are, what you do and why you exist. Add your business model, business structure (LLC, partnership, corporation), mission and vision.

3. Market Analysis

Demonstrate to investors that you know your industry and competitors and customer profiles. Operate on facts rather than speculations.

4. Products & Services

Identify what you offer and how it is different. Determine how they solve problems of the customer or enhance existing solutions.

5. Marketing and Sales Strategy

How will you reach customers? What is your pricing, channel marketing and conversion strategy?

6. Financial Plan

Make predictions of revenue, expenditure, cash flow and profit margins. Add funding requirements where necessary.

Create a Business Plan to Run Your Business Effectively

Business plan writing is not simply getting the investors impressed, it is about providing your business with a clear direction on how to run daily and expand in the long term. Having a specific idea of what you are trying to achieve, how you will achieve it and how you will gauge the achievement, you can run your business much more effectively and efficiently.

A good business plan can assist you in:

1. Prioritize and prudently invest resources.

2. Monitor progress towards quantifiable objectives.

3. Recognize possible pitfalls before they are issues.

4. Be confident in the decisions made.

With your plan as a living document, you will be able to lead your team, change your strategies as the market evolves and make sure your business is on track toward success.

Step-by-Step Guide on How to Write a Business Plan

Are you willing to know how to write a business plan? And in the following manner:

Step 1: Write the Executive Summary (Last, But Place First)

The executive summary predetermines the atmosphere of your plan. This section is usually read first (by the investors or the lenders) and therefore it has to be good, short, and provide a good overview of what your business is and why it is going to be successful.

- Provide a brief description of your business, objectives, products, target market and financial forecast.

- Keep it brief, concise, and interesting elevator pitch.

Step 2: Create Your Company Description

This part is credible in the sense that it outlines clearly what is your business. It also demonstrates to readers why you company exists, the challenge you are solving, and the value you are making available to your customers and this makes the stakeholders realize your purpose and potential.

- Describe what your business is about, what your mission is, and what is your long-term vision.

- Use your business structure, location, and problem-solving style.

Step 3: Conduct Market Research & Analysis

Market analysis will indicate that your business idea is feasible. It shows that you are aware of your industry, competitors and customer needs which makes the investors sure that your plan is based on the real market data.

- Find your target customers, demographics and purchasing patterns.

- Competitor analysis (SWOT Strengths, Weaknesses, Opportunities, Threats).

- Talk about the market trends and opportunities.

Step 4: Define Your Products or Services

It is very important to define your products or services so that your business can be differentiated. It demonstrates to the stakeholders why customers would prefer whatever you offer to your competitors and how it would fulfill a particular need in the market.

- Key characteristics, advantages, and special selling points (USP).

- Development, delivery, and pricing model: Explain.

Step 5: Outline the Marketing and Sales Strategy

Good marketing and sales plan show that you are having a plan to capture and hold customers. It also demonstrates that you know the channels, price, and message that are required to increase profitability.

- Add promotion techniques (social media, SEO, paid advertisements, email marketing).

- How do you make sales: lead generation to conversion to retention.

Step 6: Establish Your Organizational Structure

The investors and partners would want to know the ones in charge of the business. Outlining your organizational structure helps to demonstrate the experience and expertise of your team that you have competent individuals who can implement your plan.

- Give your leadership team, positions, qualifications, and roles.

- State ownership of business and legal form.

Step 7: Describe Operations and Production

This section demonstrates that you have considered the practical side to running your business. In effective operation plans, risk minimization is achieved, and it will show that you are willing and capable of delivering goods or services effectively.

- Describe your day-to-day workflow, supply chain, vendors, tools, and technologies.

- Add logistics, quality control, and customer support.

Step 8: Prepare Financial Plan and Projections

Financial planning plays a critical part in cementing the sustainability of your business. Proper projections will aid the investor in knowing which kind of returns will be associated with the project and will also assist you in budgeting the expenses, cash flow and profitability.

- Included in this is income forecast, expense report, break-even analysis and funding requirements.

- Be realistic with the figures, not an approximation.

Step 9: Add Appendices and Supporting Documents

Supporting documents are verified documents that give support and evidences to your plan. They are sure to impress investors, banks or partners that you are adequately prepared and good.

- Attach resumes, legal documents, contracts, and images, etc.

Common Mistakes to Avoid When Writing a Business Plan

Despite knowing how to make a business plan, you can make mistakes that would derail your efforts and spend time, money or the interest of the investors. It is not a lengthy piece of paper but rather a piece of writing where all sections should be represented in a clear, realistic and strategic way. Most entrepreneurs are familiar with how to prepare it, yet end up costing a lot of money. Avoid these:

- Absence of clarity and discipline: An excess of jargon or lack of clarity may mislead investors.

- Artificially optimistic financial forecasts: Shattered hopes kill trust.

- Disregarding competition: no business is without competition. Acknowledge it.

- Lack of a specific target market: “Everyone is not a target market.

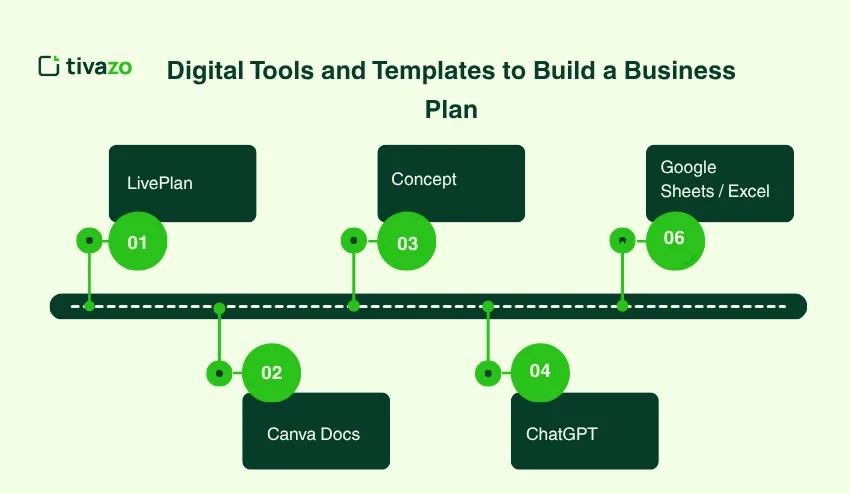

Digital Tools and Templates to Build a Business Plan in 2026

By 2026, digital tools and solutions based on AI have made the development of a business plan faster and smarter. These tools are not required to create something completely new, just choose pre-made templates, a step-by-step guide, and data-driven insights that assist the entrepreneur in not focusing on the formatting but on the strategy. Professional-looking and investor-ready plan: The right tools will do the trick.

Top tools include:

- Upmetrics – Designed for structured business planning & realistic financial projections, all in one place.

- LivePlan – The best for making sound financial forecasts and projections.

- Canva Docs – Customizable and stylish templates of business strategies to be attractive.

- Concept- Relaxed framework of agile planning and teamwork.

- ChatGPT – Helps in content creation, structuring and editing.

- Google Sheets / Excel – Strong in terms of financial planning, budget, and scenario modeling.

These tools save time, enhance accuracy and assist you to create investor-ready documents.

Business Plan Trends in 2026: What Investors Now Expect

Investors in the modern world do not simply see numbers. They desire innovativeness, sustainability, and scalability.

The main trends in planning in 2026 are:

- Data-driven decision-making

- AI-based automation and innovation.

- ESG (Environmental, Social, Governance) integration.

- Lean and agile business models.

- Subscription and recurring revenue plans.

Best Practices for Writing an Effective Business Plan

A business plan is not a matter of filling in forms; it is a matter of producing a document that is understandable, believable and doable. Adhering to the best practices will make sure that your plan becomes effective in conveying your vision, earning trust and becoming a means of leading your business to grow.

- Maintain it as data, rather than opinion-based.

- Make it reader-specific (investors, bank, internal use).

- Make it easy to digest with visuals such as charts, graphs and infographics.

- Keep it current, it is not a document but a living document.

How to Adapt Your Business Plan for Different Needs

No one plan suits all purposes. You might have to highlight various points of your business to appeal and be interesting depending on your audience. Your plan should be tailored to increase your chances of success it could be funding or loans or in-house advice.

For Investors:

Pay attention to scalability, possible returns, and the experience of the team.

For Bank Loans:

Pay attention to financial stability, ability to repay and security.

For Internal Strategy:

Emphasise on operational plans, objectives and performance monitoring.

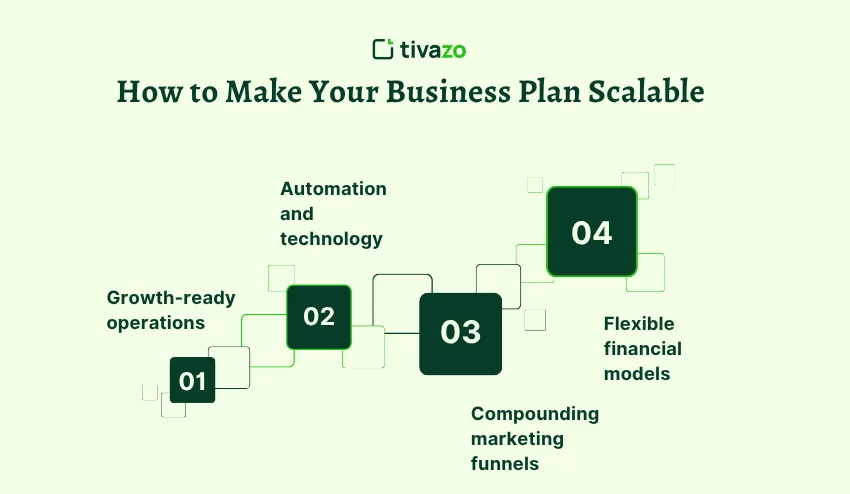

How to Make Your Business Plan Scalable

Scalable business plan is created to expand your business at an effective rate without need to increase resources or expenses in the same proportion. Whether you’re running an e-commerce store, a service-based company, or even a web hosting business, be fitted in the market when needed, and generate more profits in the most sustainable manner.

- Growth-ready operations

- Automation and technology

- Compounding marketing funnels.

- Flexible financial models

Scalable businesses are enjoyed by investors as they expand at a cheaper rate.

Final Thoughts on Writing a Business Plan

Knowing how to write the business plan is not only about creating a document but also about creating a vision, assembling people and making decisions. This is because your plan will keep on changing as your business expands, and therefore, update business strategy, make it realistic and strategic.

Seek mentor, investor or adviser feedback- and also keep in mind a business plan is never the final. It is you stepping into business.