Twenty years ago, banks were not quite like they are today. Every transaction was manual, and data was stored on massive servers. As for customers, they often had to wait days, sometimes even weeks, for verification results to get a loan or access other services. Some probably still remember those times, while others may have forgotten them like a bad dream — after all, you get used to the good quickly.

However, there’s no denying this enormous transformation: financial services have undergone significant changes even in the relatively short span of recent years. The Role of Cloud Computing in Financial Services has been a key driver of this transformation. In reality, the cloud has penetrated all areas of business and life, so it’s no surprise that cloud computing financial services have also found their place in the financial sector.

For users of banking services, this provides access to fast payments, personalized apps, and a wider range of services. For financial service providers, it ensures scalability, flexibility, and the ability to implement innovations quickly without heavy investment in their own infrastructure. Who could say no to that? And more importantly, why would anyone want to?

Cloud technologies in finance started being used back in the early 2000s when major IT companies first offered them. If such financial solutions had appeared in the 1980s, banks could have avoided many crises thanks to fast analytics and flexible solutions, and financial markets would have become more transparent and stable. This is precisely why large market crashes and financial crises have occurred less frequently over the last 15-20 years. Thanks to proper data storage, data is easier to analyze, and easier analysis prevents more problems.

Today, cloud computing financial services are the foundation of the banking sector. In this article, we will examine in detail how clouds are transforming the banking industry, what challenges and opportunities they present, why delaying their implementation is no longer an option, and where to find companies implementing this in their businesses.

Cloud Technologies: Economics and Scalability

Just a few years ago, financial companies were forced to invest large sums in their own servers and data centers. The need for additional computing power meant months of waiting, thousands of dollars in equipment costs, hiring technical personnel, and endless concerns about maintenance. Often, the results still didn’t meet expectations. Then, cloud computing in finance changed the rules of the game. Today, the required resources can be obtained in just a few hours: a click of the mouse and the servers are ready to work.

The main advantage of cloud solutions in finance is scalability and cost efficiency. Companies pay only for what they actually use, and peak loads — such as quarter-end closing or processing thousands of transactions during holidays — are handled automatically. According to research, banks and financial institutions that migrated to cloud computing financial services saved 25-40% on IT expenses in the first year. These resources can be redirected toward developing new products, analytics, process automation, or cybersecurity — areas where they actually create value.

The historical context is also telling: cloud technologies in finance began to be implemented around 2005. If cloud for finance had existed in the 1980s, market crises could have passed much more easily thanks to instant analytics and flexible operational capabilities. Today, this has become the industry standard, although some companies are still in the process of migrating to the cloud.

Many companies today are developing software for banking systems, integrating cloud technologies into them. Notable companies in this space include DXC Technology, Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud, and Alibaba Cloud. All of them provide, develop, or configure cloud solutions for banks and other financial institutions for data processing, analytics, AI, and cybersecurity. Using such cloud platforms allows banks to quickly scale resources, optimize costs, and meet modern regulatory requirements. Read more about such services.

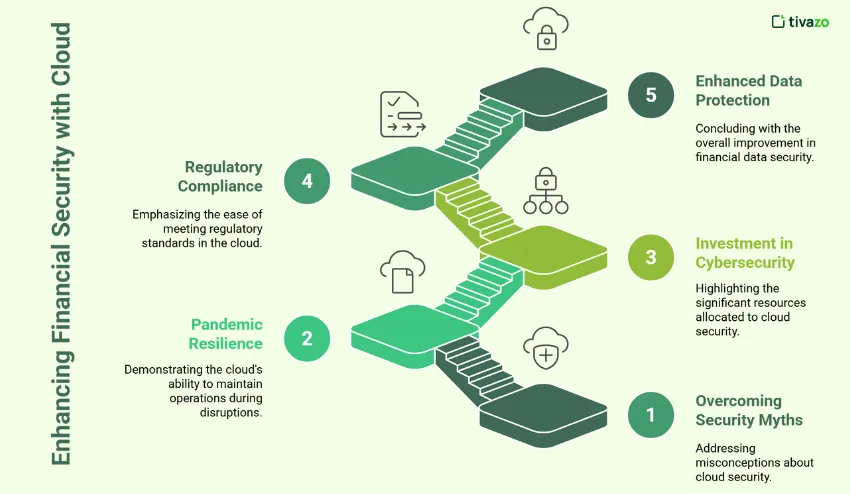

Security: When the Cloud Protects Better Than Closed Doors

Many people believe that the cloud is less secure than private servers. In reality, this is a myth. Leading cloud platforms demonstrate a level of security that significantly exceeds standard metrics for private data centers.

The pandemic in the early 2020s illustrated this advantage: banks with local servers found themselves in trouble when employees worked from home and access to critical systems was limited. Financial institutions that were already using cloud computing in finance continued operations without interruption. The cloud has allowed them to quickly scale resources, enable remote work, and at the same time, provide stability and continuity for core business processes.

Major cloud service providers invest billions of dollars in cybersecurity by building multi-layered protection systems, undergo regular independent audits, and even maintain backup centers around the world that operate in parallel with their main facilities. Not even a private bank with the most modern equipment can compete with such comprehensive infrastructure.

Regulators also recognize the cloud’s advantages: compliance with GDPR, PCI DSS, and other requirements is easier to ensure in certified cloud environments. If a bank chooses its own data center, it must constantly “play catch-up,” updating equipment and security. Thus, cloud for finance not only simplifies operations and saves money but also increases the level of protection for financial data.

Speed of Innovation and Modernization

One of the greatest advantages of cloud computing in finance is the incredible speed of integrating new services. Developers can deploy applications in days rather than months, accelerating the emergence of innovative financial products and services.

A prime example is fintech startups. Many of them would not exist without cloud technologies. Building their own IT infrastructure would be too expensive, and they simply wouldn’t have the resources to fund it. Instead of spending their own resources on creating and maintaining servers, they can focus on the idea itself — developing new and convenient products for customers and driving the market forward. The result: even large banks began to buy such startups or partner with them, gaining immediate benefits from their innovations.

Cloud infrastructure also enables specialized financial software for smaller institutions. Loan management solutions now allow private lenders and community finance organizations to deploy in under 30 minutes and scale with portfolio growth, eliminating the need for custom-built systems or enterprise-level infrastructure investments.

It’s not just startups that benefit from this. Traditional financial institutions that transitioned to cloud computing financial services gained the ability to experiment quickly and painlessly. A new mobile application can be launched in a day, feedback from clients received, changes made overnight, and updates published the next morning. For a traditional development cycle, this is almost magic—and this is exactly how most advanced banks in the world operate today.

Regarding modernization. Most large banks still operate systems created decades ago, written in programming languages like COBOL. This is truly a “code from the last century,” and updating it without risking disrupting all financial operations is no simple task.

This is where cloud for finance comes to the rescue. The cloud allows systems to migrate gradually, keeping old systems running in parallel while new ones are being prepared for full operation.

Real Examples: From Theory to Practice

The transition to the cloud is not a theory but already a proven business practice. Deutsche Bank, for example, after a strategic partnership with Google Cloud, reduced the deployment time for new financial services from nine months to just a few weeks. Teams that previously spent time maintaining servers were redirected toward creating customer innovations — artificial intelligence for risk analysis and personalized investment advice.

Fintech company Stripe, built entirely on the cloud for finance, thanks to scalability, managed to grow from a startup to a global leader in online payments, processing over 500 million transactions per day without a single physical server. What once required dozens of data centers now exists in the cloud — flexibly, stably, and without limitations.

Challenges and Hidden Pitfalls

However, cloud computing financial services are not a magic bullet. Like any transformation, it has its challenges.

- Choosing a provider. Whether it’s Amazon Web Services or Google Cloud doesn’t matter globally—each company in different countries will have its own favorites. The main thing is that the platform meets your needs and suits you in terms of pricing and capabilities. You can even diversify data across multiple platforms, as the “lock-in effect,” or dependence on a single provider, can make switching to another system expensive and complicated.

- Regulatory requirements. Different countries have different rules for storing financial data—some stricter, some more lenient. The EU requires that data remain within Europe (GDPR), while China insists on data localization. This complicates system architecture and increases compliance costs, but it is essential to consider it to avoid fines and other consequences that could potentially shut down your business.

- Culture and people. Changing technology is still easier than changing the mindset of some people. Teams that have worked for decades under a “traditional” approach tend to be quite conservative. Likewise, service users are not immediately ready for the necessary changes and often resist new approaches. So, if you decide to implement cloud solutions, inform your team before bringing in specialists. Also, consider training to support process adaptation.

In any case, these challenges are temporary. Thousands of companies have already gone through this journey, and they would never go back to their previous way of operating—the benefits are far greater and become apparent almost immediately.

Cloud Computing for Financial Services – Not a Choice, But a Necessity

Cloud computing in finance is a strategic tool for those who want to remain competitive in the digital era of 2026 and beyond. The cloud provides what traditional infrastructure cannot: flexibility, scalability, security, real-time analytics, and speed of innovation.

Cloud for finance also opens the door to a new business model. Experiments become inexpensive, innovations can be implemented quickly with a limited budget, and customers can be offered personalized solutions. Companies embracing this transformation gain not only a technological advantage but also the freedom to think and act strategically.

Those who still cling to old IT infrastructure risk being left behind. In a world where the speed of decision-making equals the speed of growth, delaying the transition means losing the future.

The world of finance is no longer just moving to the cloud — it lives there. The question is not whether to migrate, but how quickly you are ready to do it.