When it comes to payday for employees, every minute makes a difference. Despite this fact, many businesses still utilize time rounding for payroll purposes. Over time, this seemingly simple method can become a source of confusion, disputes, or worse yet, a compliance issue if not properly handled.

Time clock rounding is timekeeping that adjusts employee clock-in and clock-out times to the nearest time increment, such as five, six, or fifteen minutes. While rounding can improve payroll expediency, it is important to note that if the rules are not applied consistently or are not applicable by law, rounding can cause issues.

It is important to understand how rounding works, when it is permissible, and how to utilize it effectively to genuinely benefit both employer and employee. This guide will outline the rules of time clock rounding, ways to be compliant with labor laws, and best practices to ensure accuracy and trust in your workplace.

What Is Time Clock Rounding?

Rounding Time Clock is a common procedure where an employee’s clock-in and clock-out times are rounded to the highest set period, usually five or six minutes, or a multiple of those, such as fifteen minutes. This practice can help simplify payroll and create a set time record.

For instance, if an employee clocks in at 8:53 and your systems round to the nearest 15 minutes, the employee would start their shift at just after 9:00. If they clocked out at 5:07, their shift can now be rounded to either 5:00 or 5:15, again dependent on your rules.

The benefit of rounding time for employee time tracking is that it allows businesses to stop tracking every minute of time worked and find an alternative way to calculate employee pay. It is also somewhat fair, provided the rounding stays consistent and within the limits of state laws, assuming the policy is communicated to employees.

Standard Rounding Increments

Businesses usually rely on one of the following rounding methods:

- 5-Minute Rounding: This rounding method rounds time to the nearest 5 minutes.

- 6-Minute or 1/10th Hour Rounding: This rounding method rounds time to the nearest tenth of an hour.

- 15-Minute Rounding: This is the most standard method and is also known as the quarter-hour rule.

Utilizing a table or chart to represent the increments can be helpful for employees and managers to better understand how rounding works.

Is Time Clock Rounding Legal? (Understanding FLSA Rules)

The FLSA and Rounding Compliance

Time clock rounding is permissible under the Fair Labor Standards Act (FLSA), provided that it does not automatically or regularly underpay an employee. In fact, employers are permitted to round time both ways, as long as the rounding is done in a neutral way (or better in favor of the employee). Again, unfavorable rounding, which is defined as rounding every punch in favor of the employer, is legally actionable and could subject the employer to potential fines or damages.

The Simplified 7-Minute Rule

The important parameter is a 7-minute rule. The rule dictates how you round up or down time.

- For clocking in or out within 7 minutes before the quarter hour, round down.

- If it is 8 minutes or more after the quarter hour, round up.

Example:

- Clock-in at 10:07 → Round to 10:00

- Clock-in at 10:08 → Round to 10:15

This rule ensures fairness over time, balancing small gains and losses so employees are paid accurately.

Common Legal Mistakes You Should Avoid

- Rounding all clock-ins up and clock-outs down to the benefit of the employer.

- Applying rounding rules inconsistently across employees or shifts.

- Not documenting the rules clearly in employee handbooks or policies.

Following these rules protects your business and makes sure employees are paid for all hours actually worked.

Advantages and Disadvantages of Time Clock Rounding

Pros for Employers

- Time clock rounding can reduce payroll processing and time tracking burden. Some of the major pros include:

- Simplified Payroll Calculations – Employers can avoid tracking minutes for every employee.

- Time-Saving – Payroll staff will have to spend less time adjusting small time-related differences.

- Set Expectations – Having consistent attendance records makes it easier to manage shifts.

Cons and Risks

- Time clock rounding is not without its downfalls:

- Wage Disputes – Employees may feel that not all of their work time has been compensated.

- Compliance Risks – Rounding the time clock improperly or unreasonably could lead to issues under the FLSA and lawsuits.

- Data Inaccuracies – Too much rounding can cause inaccuracies in total time worked over a longer period of time, which can negatively affect productivity.

Note: Automating time-tracking software can minimize almost all of the risks while allowing the pros of rounding to remain.

Real-Life Time Clock Rounding Examples

Time clock rounding is easiest to understand with examples, so let’s walk through how the most common rounding increments are applied in real life.

5-Minute Rounding Example

- Clock-in at 9:02 → Rounded to 9:00

- Clock-in at 9:03 → Rounded to 9:05

- Clock-out at 5:57 → Rounded to 5:55

- Clock-out at 5:58 → Rounded to 6:00

This rounding method is straightforward and perfect for most companies that appreciate rounding to avoid a long payroll task.

6-Minute or 1/10th Hour Rounding Example

- Clock-in at 9:04 → Rounded to 9:06

- Clock-in at 9:10 → Rounded to 9:12

- Clock-out at 5:34 → Rounded to 5:36

This rounding method is appropriate when employers utilize tenths of an hour to calculate payroll. This method is especially useful in hourly billing situations or for project work.

15-Minute (Quarter-Hour) Rounding Example

- Clock-in at 8:53 → Rounded to 9:00

- Clock-in at 9:08 → Rounded to 9:15

- Clock-out at 5:37 → Rounded to 5:30

- Clock-out at 5:38 → Rounded to 5:45

This rounding method is the most popular, as it is relatively simple to apply and is most compliant with any state or local labor laws, particularly for larger teams or hourly employees.

Time Clock Rounding Examples Table

| Rounding Method | Clock-In Example | Rounded Time | Clock-Out Example | Rounded Time |

|---|---|---|---|---|

| 5-Minute | 9:02 | 9:00 | 5:57 | 5:55 |

| 9:03 | 9:05 | 5:58 | 6:00 | |

| 6-Minute / 1/10th Hour | 9:04 | 9:06 | 5:34 | 5:36 |

| 9:10 | 9:12 | 5:40 | 5:42 | |

| 15-Minute / Quarter-Hour | 8:53 | 9:00 | 5:37 | 5:30 |

| 9:08 | 9:15 | 5:38 | 5:45 |

Which States Allow Time Clock Rounding?

Federal vs. State Rules

Under the Fair Labor Standards Act (FLSA), employers may utilize time clock rounding, as long as it does not result in a failure to pay employees for all of their hours worked. However, additional states have stricter requirements and/or laws regarding rounding practices. The employer must ensure that they comply with both federal and state law if they operate in several states.

States with Specific Rounding Regulations

There are some specific states that have defined regulations for rounding:

- California: California is very strict about rounding. Employers must ensure that no employee is underpaid when rounding is utilized and that all time worked by the employee, including overtime, is properly recorded.

- New York: New York’s requirements follow the FLSA guidelines, but require communicating a rounding policy will be communicated to employees.

- Illinois: Employers must apply time clock rounding equally, fair to all employees consistently, and written policies should be communicated to employees to eliminate unpredictable wages as the reason for disputes.

Multi-State Compliance Tip

- Be sure to thoroughly review federal and state labor laws on a regular basis.

- Clearly describe your rounding policies in your employee handbook.

- Apply the rounding rules consistently to every employee and every shift.

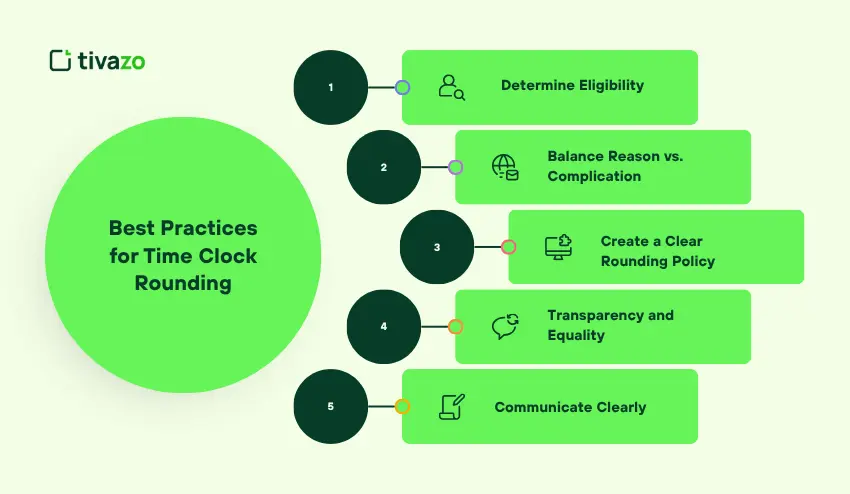

Best Practices for Time Clock Rounding

To take advantage of time clock rounding while remaining in compliance, businesses should adhere to the best practices:

1. Determine Eligibility

Not every business will need to utilize rounding. If your team is already using digital time tracking, forwarding, and accurate tracking, rounding actually may not be required. You should think about whether rounding is meeting a need your organization is addressing in the administration of payroll, or if rounding simply creates complications.

2. Balance Reason vs. Complication

Rounding can speed time keeping and may reduce mistakes in payroll. But it can also create wage disputes or errors in calculating overtime. Make sure that the downsides are not more than any benefits that may justify a policy.

3. Create a Clear Rounding Policy

Once again, consistency is key, and knowing what method of rounding is being used will help the process of keeping time to pay accurately. Also, once you have selected the rounding, your entire staff and all pay periods should use the same rounding. You should also note any rounding rules in your employee handbook.

4. Transparency and Equality

Employees should know how rounding looks to their particular work scenario. Applying the rules to a way that is neutral to slightly favor the employee is a good practice. Rounding only in an employer’s advantages can be grounds for illegal compliance.

5. Communicate Clearly

You should clearly communicate your rounding practices to all staff, from management down to payroll then to employees. Communication and transparency will empower your employees, earn trust, and help mitigate misunderstandings about pay.

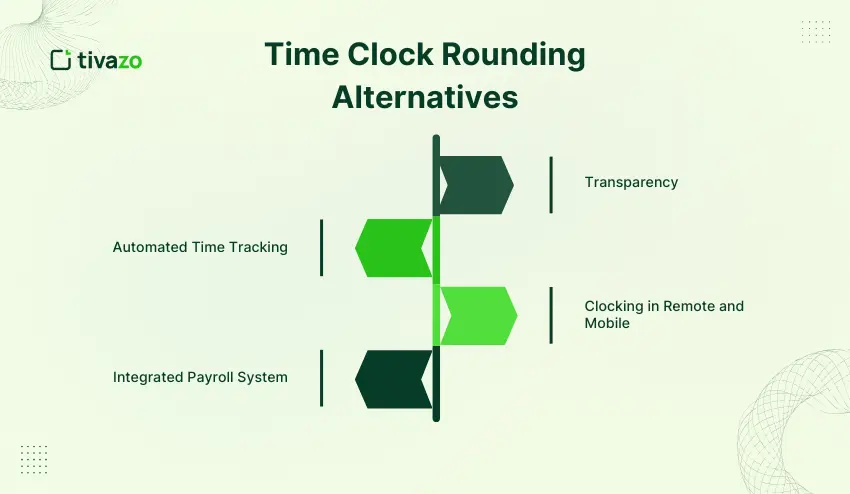

Time Clock Rounding Alternatives

While rounding time clock hours is a common practice, there are better options available that can reduce errors and increase employee satisfaction in modern businesses.

1. Transparency

If a time tracking system has reports to view, then you can see your own timesheets and reports, which will allow for higher trust as well as avoiding pay disputes. Ensuring everyone is aware of how their hours are captured and recorded.

2. Automated Time Tracking

Utilizing a digital time tracking system allows employees to clock in and clock out accurately. A digital time clock captures the exact hours worked, eliminating the rounding. This maintains payroll accuracy and is compliant with labor laws.

3. Clocking in Remote and Mobile

A time clock should allow employees to clock in from their mobile devices or computers, it will help reduce discrepancies caused by punch clocks, especially for remote and field staff.

4. Integrated Payroll System

Many time tracking systems are integrated with payroll systems. The system will calculate your hours, eliminating human error and ensuring you are paid every single minute you are clocked in.

How Tivazo Makes Time Clock Rounding Simple

Managing payroll and compliance with timekeeping laws can be a challenge for any organization. Tivazo simplifies this process since employees simply clock in and clock out digitally, including timestamps. There is no guesswork in how long an employee has been working – it is captured and recorded precisely.

The platform also provides access to real-time employee timesheets for everyone – staff and managers are even able to view their hours worked at any moment. This varies as a feature creates trust, can avoid legal disputes over payroll timing, and can ensure that employees have more confidence that they will be paid for the full time they actually worked.

Ultimately providing a seamless payroll integration reduces administrative tasks and speeds up the payroll process of putting together the payroll each week. The platform even allows organizations to run reports to communicate more precise attendance, manage efficiency, and ensure compliance with labor laws.

Overall, Tivazo helps organizations simplify time management, reduce administrative tasks, and achieve a fair employee system by tracking time accurately, providing real-time reports, and integrating payroll into their platform.

Conclusion

Rounding time clock entries for employees is a great way to ease payroll management and provide some consistency to employer timekeeping, but it has its own rules and risks. However, by using a consistent rounding method and following federal and state guidelines, as well as having a transparent and consistent policy, employers can limit their risk of having issues.

There are modern alternatives to time clock rounding, including the use of automated time tracking software, which would remove the need for rounding altogether. Automated time tracking would provide accurate payroll for each and every minute an employee worked.

In the end, time clock rounding, if done consistently, in compliance, and with transparency between the employer and employees, can be a successful routine. Use best practices, audit time clock shifts, and make sure employees are informed, in order to develop a fair and efficient time clock rounding system.