In the digital era, where convenience and efficiency are the key factors, recurring payments have become an essential instrument for both businesses and consumers. These are automatic and scheduled transactions beyond the ease; they are also concerned with creating predictable revenue streams, customer retention and simplifying the payment process. However, what are recurring payments? How do they work? But, above all, what can businesses do to be successful in 2026 by capitalising on them?

In this article, you will be guided through all you need to know about these payments, the types, pros and cons of these payments, and how you can use them efficiently to your advantage as a business.

Key Highlights:

- What Are Recurring Payments

- Types of Recurring Payments

- Manage for Subscriptions

- Benefits for Businesses

- Benefits for Consumers

- Challenges of Recurring Payments

- Best Payment Processors

- Avoid Issues with Payment Processing

- Prevent Fraud

What Are Recurring payments?

In its simplest form, a recurring payment is automatically carried out at a repeated time. Be it a subscription fee to a service or a monthly bill, or a membership fee, these payments are sure to keep both businesses and consumers on the same page, and payments are made without manual operations.

To put it simply, it is establishing a pay-and-forget system. When a plan of payment has been put in place, the payments are made automatically depending on the agreed payment schedule, whether weekly, monthly or annually. This automated process lessens the requirement to pay by hand each time, by customers and companies do not need to worry about the issue of chasing money.

This model is effective for both big and small businesses. It is all about generating steady, predictable income that is useful in budgeting, scaling and forecasting. To the consumers, it will provide convenience and a sense of comfort that they will not miss a crucial payment.

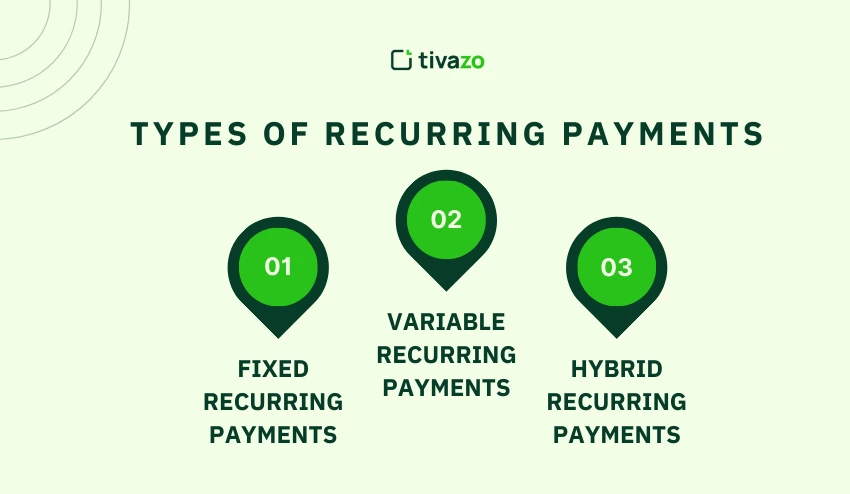

Types of Recurring Payments

1. Fixed Recurring Payments

This form of recurring payment is a regular payment where a fixed amount is charged at a specific period. Typical ones are subscriptions to Netflix, gymnastics, or software. Both the business and the consumer can predict this model. To the consumers, the payment remains constant each month, and therefore, it is not difficult to budget. In the case of businesses, it guarantees a continuous flow of revenue.

2. Variable Recurring Payments

These payments are not fixed, as is the case with fixed payments. Consider utility bills, cloud storage services or phone plans; all these payments vary as the amount of usage of the service increases or decreases. The greater the amount of electricity or water you consume, the greater your bill will be. Companies that have variable payments can price depending on the amount consumed by the customer are thus paid according to what they consume.

3. Hybrid Recurring Payments

A hybrid model means a combination of fixed and variable aspects. Gym membership can be fixed (monthly membership fee), and a personal training session or specialised classes can be an addition. The model provides flexibility both to a business and a consumer, as they can make regular payments, but with the chance to subscribe to additional services.

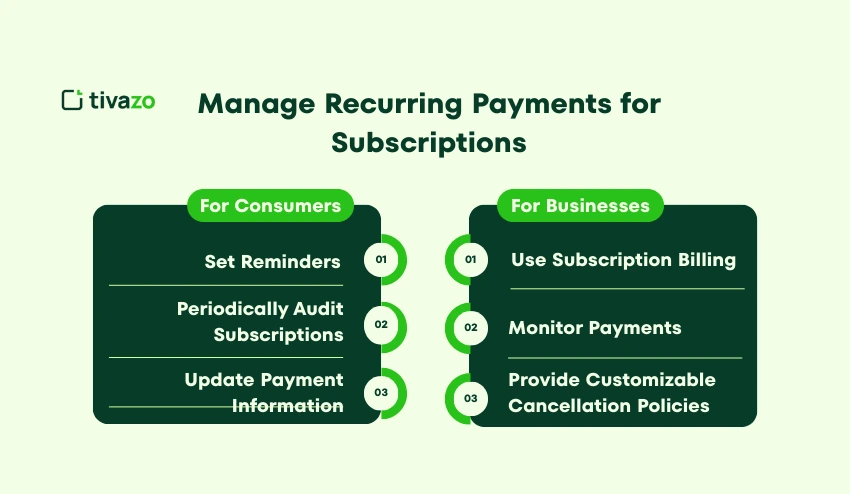

How to Manage Recurring Payments for Subscriptions

Recurring payment management is a two-edged sword. On the one hand, they lead to predictability and efficiency, and on the other, they make businesses observe and be attentive to the payment process. These are some of the ways through which they can be managed by both businesses and consumers.

For Consumers:

- Set Reminders:

- It is important to keep track of subscription renewals and payment periods, even though these payments are automatic. A reminder can be set on your phone or on your calendar so as to prevent unexpected charges.

- Periodically Audit Subscriptions:

- Periodically, we lose track of subscriptions that have been idle. Check on your subscriptions frequently so that you do not pay to get services that no longer have any value to you.

- Update Payment Information:

- Your payment information should also be up to date, so that it does not lead to failed transactions or service interruptions. It is crucial, in particular, with payment gateways.

For Businesses:

- Use Subscription Billing:

- This can be facilitated by automating billing software like Stripe or PayPal to streamline the recurring billing process. These platforms incorporate the payment systems, process the transactions automatically, and conduct the billing cycles efficiently.

- Monitor Payments:

- Any type of payment failure, chargeback, or cancellation. One example is to make sure that a payment gateway is stable enough to accept such payments without collapsing.

- Provide Customizable Cancellation Policies:

- Customers should have the option of cancelling subscriptions, and this should be made easy so that trust is built. Well-defined recurring payment cancellation policies are the essentials of decreasing churn and improving customer satisfaction.

How Recurring Payments Benefit Businesses

Recurring payments have not only made things easier on businesses, but it has also been a game-changer. They offer various practical advantages that can make the operation of a business easier, more predictable and profitable and ultimately increase profitability.

1. Predictable Revenue Streams

This is because such payments enable businesses to have a stable inflow of cash and this enables the prediction of the future cash flow. In fixed-rate recurring billing, the business is able to know the amount of revenue he/she can receive in months or even years in advance. This enables planning, budgeting and expansion.

2. Improved Customer Retention

The more your customer deals with your business, the better the chances of them staying. Recurrent payments provide a condition in which the customers are constantly involved with your service, be it in subscriptions, memberships, or utility bills. Such a stable relationship brings loyalty and minimises churn.

3. Increased Efficiency

Online payment saves money and time. The companies do not have to manually pursue payment or process a billing matter individually. Through payment automation systems, companies have the chance to develop their main products instead of being stuck with administrative procedures.

4. Easier Customer Acquisition

Potential customers would like flexible subscription billing models. They prefer the concept of making small payments over a period of time, rather than a huge upfront payment. It reduces the obstacle of entry and may result in increased conversion rates.

5. Better Cash Flow Management

Due to the automaticity of recurring payments, businesses are able to plan better in terms of expenditure, investment, and wages of the employees. This alleviates financial stress and ensures a consistently sufficient cash flow to meet operational requirements.

How Recurring Payments Benefit Consumers

The advantages of these payments to consumers are many as well and ensure that daily purchases to consumers are made easier and hassle-free.

1. Convenience

The most apparent advantage was that there is no need to remember to pay bills, subscriptions or memberships monthly. Automated payments make sure that customers do not have to worry about late or missed payments.

2. Budgeting Made Easy

Recurrent payments are predictable, hence making budgeting easy. Customers are aware of the specific price they will pay per month, and that will give them better control of their finances.

3. Reduced Risk of Service Interruption

In the case of services such as utilities, internet or phone bills, recurring payments can be made where such services will not be cut off because of default in making payment. This tranquillity is priceless to the customers who depend on the important services.

Challenges of Recurring Payments for Businesses and Consumers

Although these payments are associated with numerous benefits, they do not lack any consequences.

1. Fraud and Security Issues

Fraud is also one of the greatest risks of recurring payments. In case the payment details of a customer are compromised, the company will experience chargebacks or revenue losses. The mitigation of this risk will be to ensure that payment processors implement the best security practices.

2. Customer Churn

Although recurring payments can ensure customer retention, the problem of customer churn remains be challenge by businesses. When the customers are under long-term subscriptions, failure to cancel when the service will no longer be of use will force them to cancel. Churn can be decreased by providing flexible subscriptions or easy cancellations.

3. Handling Failed Transactions

The other issue is the problem of failed transactions. Businesses require a good chargeback management system, whether it is because of the lack of funds or out-of-date cards, the company cannot afford to lose revenue and ensure good relationships with customers.

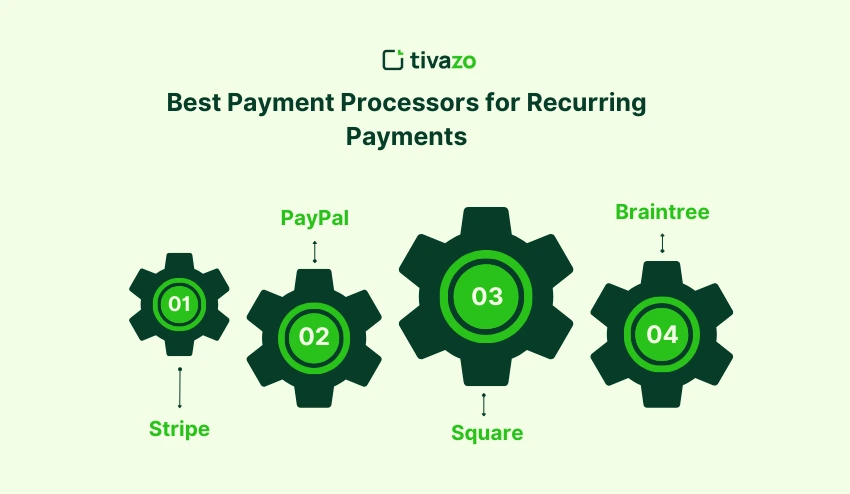

Best Payment Processors for Recurring Payments

You are convinced about these payments, then; how do you accept them? It is very important to select the appropriate payment processor. The following are some of the most recommended payment processors in 2026 for recurring payments:

- Stripe: Automated payments are easy to integrate and can take various billing models, and the reporting is detailed.

- PayPal: Easy recurring billing platforms, easy installation, and secure processing for large and small businesses.

- Square: Multipurpose subscription platform with both fixed and fluctuating recurring bills models.

- Braintree: PayPal service with more functionality to automate such payments that would be useful in the case of subscription-based businesses.

The most appropriate processor is limited to the model of business that you have and the nature of your subscription billing.

How Recurring Payments Improve Cash Flow for Businesses

They are a game-changer as far as cash flow management is concerned. The consistency of such transactions assists the businesses in planning, which minimises the risks of delayed payments or unpredictable sales cycles. In automated recurring payments, businesses will be able to be certain that they are constantly making money without having to pursue payments.

In the case of a SaaS company, the billing of its software services can be done automatically, and each customer will receive his/her bill on time. This stable cash flow is vital in investment planning, expansion and recruitment of new talent.

How to Avoid Issues with Recurring Payment Processing

In order to maximize on recurring payments, businesses must put in place proper strategies to help them avoid the possible pitfalls.

- Choose the Top Payment Processors: Select payment processors to use in subscription billing that have quality services, are low-cost, and secure.

- Keep an eye on Fraud: automation systems of secure payments must be used, and these must adhere to payment processors’ compliance requirements and aid in early detection of fraud.

- Talking to the Customers: Be transparent by clarifying pricing structures, cancellation procedures and payment periods at the initial stages. Effective open communication would minimise the number of misunderstandings and enhance the satisfaction of customers.

How to Prevent Fraud in Recurring Payment Systems

Recurring payments are a real-life issue in terms of fraud but there are several strategies that you can apply to reduce this risk:

- Encryption: It is important to encrypt all payment data and store it in a secure manner.

- Install multi-factor authentication: Provide an additional level of security to the account by making the customer identify themselves when making a payment.

- Watch transactions: Keep a keen eye on such kinds of payments and enquire on any form of suspicion.

Conclusion

In 2026, recurring payments go beyond a payment method; it is a business strategy that can be used to promote customer loyalty, provide a streamlined business process and increase cash flow. Using the solutions of recurring billing, the businesses will be in a position to ensure that they have a constant stream of revenue at the same time, providing the consumers with the convenience they desire.

Whether you are a business owner contemplating the idea of using these payments or a consumer going through the tumult of subscriptions, knowledge of the best way to handle these payments will result in more financial benefits on both parties.