Are you entitled to additional pay when you work on holidays? That is often a question asked by employees and employers alike and the answer will depend on who you are working for and your company’s policy. Holiday pay refers to additional pay that employees receive when they work on a designated holiday (such as, Christmas, July 4, New Year’s Day).

Holiday pay is not simply money, but as fair pay, motivation, and adherence to regulations. This guide will clear up the definition of holiday pay, how it works, how to calculate it, and how employers and employees can deal with it.

Key Highlights:

- Meaning of holiday pay

- Importance of holiday pay

- Working of holiday pay

- Benefits of Offering Holiday Pay

- Holiday Pay Calculation

- Create a Holiday Pay Policy

What is the meaning of holiday pay?

Holiday pay is additional pay that employees earn when they work on designated holidays. Designated holidays can be federal or public holidays, or holidays specifically noted by the employer, or recognized by the company as culturally significant.

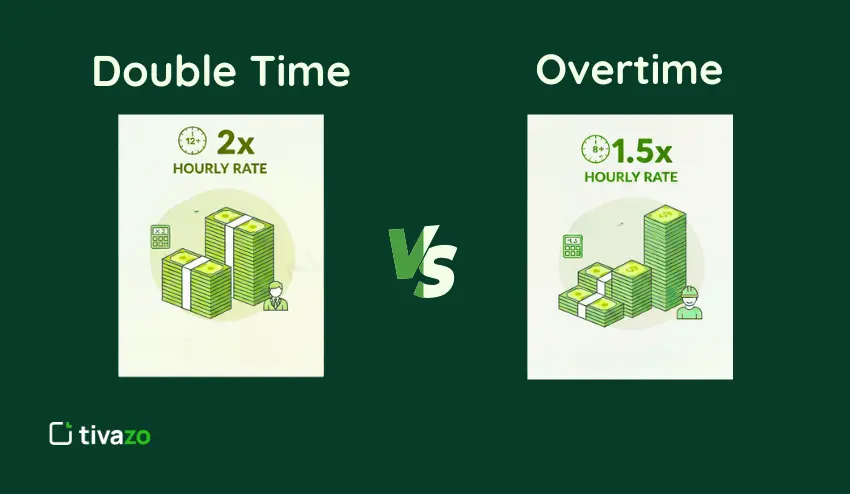

When compared to regular pay, holiday pay usually has a premium attached, meaning holiday pay is greater than its usual rate for an employee. Common premium rates for holiday pay are:

- Time-and-a-half (1.5x) – An employee who earns $20/hour regularly would earn $30/hour working a holiday shift.

- Double time (2x) – The same $20/hour worker would earn $40/hour for holiday hours worked.

Why Is Holiday Pay Important?

Holiday Pay is more than another paycheck, it affects satisfaction, increases productivity, and compliance in the workplace. Here is why it is important for all involved:

1. For Employees: Financial Security and Recognition

Holidays can be disruptive. It can take away from time with family, friends, and personal downtime. Holiday pay is an important recognition of their time and effort.

- Extra money. Holiday premium rates (such as time and a half or double time) can improve the employees income even more, throughout the year.

- Motivation. Employees value being recognised for their extra work.

- Work-life: Employees can plan personal time at the holidays, knowing they will be compensated fairly.

2. For Employers: Productivity and Staffing

Holidays tend to be peak seasons for certain industries and jobs (retail jobs, healthcare, hospitality, or customer service). Offering holiday pay can help incentivize you employees to commit to working during these peak times.

- Enhances reliability in staffing: Employees will be more likely to cover holiday shifts.

- Enhances resiliency of employee: Fair pay compensation avoids resentment and overworking.

- Enhances morale and loyalty: Employees fairly compensated will have their incentives aligned with the outcomes, which will encourage them to remain at your company.

3. For Compliance: Legal Safety and Fairness

If you have policies in place for holiday pay, it can help to avoid misunderstandings and stay compliant with labor laws and employment contracts.

- Ensures that you treat all employees who are entitled to holiday pay fairly.

- Reduces the risk of employee complaints or union grievances/solicitors.

- Keeps the company above board with a professional and transparent workplace culture.

How Does Holiday Pay Work?

Holiday pay is not guaranteed for most private employers in the U.S. under the Fair Labor Standards Act (FLSA). Employers may choose: which holidays to recognize, who becomes eligible, and what premium rate to pay.

- Federal employees are paid for 11 federal holidays plus Inauguration Day.

- Private employers may recognize worked holidays with time and a half or double time, or they may recognize paid holidays when the employee does not work.

- State exceptions: Rhode Island has a law to provide certain employees premium pay.

Global view:

- UK: Employees receive 28 days respectively, paid leave, which includes most public holidays.

- India: Paid holidays vary from state to state, and national/festival holidays are usually considered holidays.

- EU: Guarantees at least four weeks of leave and paid annual holidays, public holidays may or may not be included.

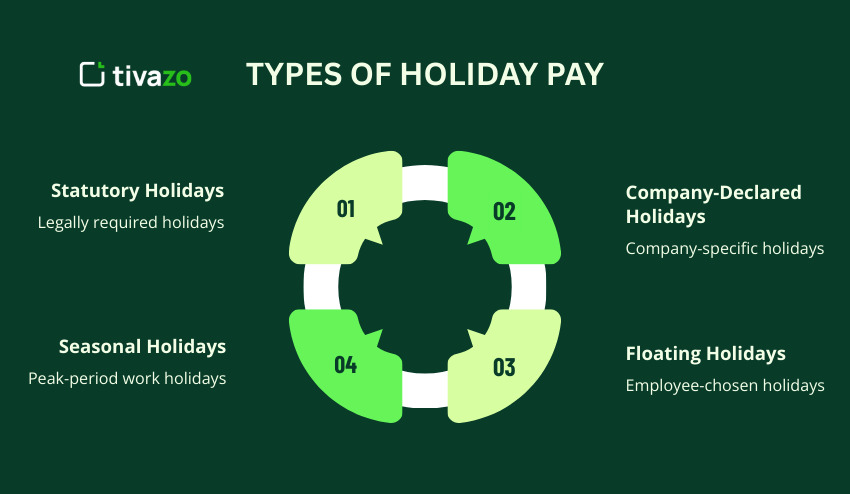

Types of Holiday Pay

There can be many classification of holidays when it comes to pay. Employers may often recognize all kinds of holidays differently, and use that difference in the way they organize compensation:

1. Statutory Holidays

Holidays that are mandated by law and the employer has no discretion over, such as Independence Day and Christmas in the US, or the Bank Holidays in UK. Employees who work statutory holidays may or may not be provided with extra pay, depending on local regulations or company policy.

2. Company-Declared Holidays

Every industry, or company, may have special extra pay holidays that are directly supported, but are company or industry-based holidays, like a company anniversary or staff appreciation day, etc. Company holidays are set internally and could vary greatly among companies.

3. Floating Holidays

An employee may be entitled to certain flexible holidays that utilize the employee’s discretion, typically related to cultural or religious celebrations. Floating holidays give the employee the chance to recognize important dates which do not impact payroll negatively.

4. Seasonal Holidays

Retail, hospitality, and health-care industries often require additional staff to cover peak operational periods (ex: Black Friday, Christmas, summer tourist season). It encourages employees to work additional hours during busy periods.

Benefits of Offering Holiday Pay

Providing it is more than simply providing a little extra cash for the employee; it is a significant win-win for the employee as well as the employer. Below are some of reasons it is important:

1. Boosts Productivity During Busy Seasons

Holidays, such as Christmas, typically coincide with peak business days, such as Christmas retail or deadline-driven end-of-year workloads. Offering a paid holiday can also motivate workers to agree to work on these busy occasions, easing the employer’s workload.

2. Increases Employee Motivation and Morale

Holidays need to be recognized if the employer is to have better holiday motivation and morale. When workers are fairly compensated for working on holidays employees feel valued, and it can significantly impact morale and a positive attitude.

3. Reduces Turnover and Retention Costs

Employees are much less likely to leave when they feel fairly compensated. When supported with pay employees will be more likely to feel valued, allowing the employer to keep their skilled employees, reduce hiring or training costs, as well as retain a team environment during peak demand.

4. Strengthens Employer Brand

Simple, fair, and transparent pay allows the employer to market themselves as an employer of choice within different industries and sectors. Employees want to work where their company recognizes the need for a work-life balance, which in return allows the company to hire top talent.

5. Promotes a Positive Workplace Culture

Holiday pay communicates to employees that the company values their time and labor. This develops loyalty, trust, and teamwork ultimately boosting a stronger, more committed workplace culture overall.

Exempt vs Nonexempt Employees

It also depends on employee classification:

| Employee Type | Holiday Pay Treatment |

|---|---|

| Exempt (salaried) | Receive their salary regardless of hours worked; no extra pay required. |

| Nonexempt (hourly) | Eligible for premium rates (e.g., 1.5x or 2x) for working holidays. |

How to Calculate Holiday Pay

The standard holiday pay formula is:

Calculating holiday pay is straightforward once you understand the formula. The basic formula is:

Holiday Pay = Hourly Rate × Holiday Premium × Hours Worked

This allows employers to provide fair compensation for employees working on designated holidays.

Examples

📌 Example 1: Double Time

- Employee hourly rate: $22/hour

- Holiday premium: 2x (double time)

- Hours worked: 8

Calculation:

$22 × 2 × 8 = $352

📌 Example 2: Time-and-a-Half

- Employee hourly rate: $22/hour

- Holiday premium: 1.5x (time-and-a-half)

- Hours worked: 8

Calculation:

$22 × 1.5 × 8 = $264

Holiday Pay vs Overtime Pay

Though both pay and overtime pay provide extra compensation, they serve different purposes and have different calculations. Both employers and employees should understand the difference for the sake of appropriately paying and avoiding payroll errors.

- Holiday pay is a reward to spillover employees who work on specific, designated holidays. It confirms the sacrifice of working when most people are not working; and usually offers a premium rate (e.g., 1.5x or 2x).

- Overtime pay rewards employees for working extra hours over to their regular pay hours, often referring to any working hours greater than 40. Overtime ensures that an employee is properly compensated for working longer than anticipated or scheduled, even on a regular week day.

💡 Note: Employers absolutely must have a clear, consistent definition of overtime and holiday pay to prevent payroll errors.

Holiday Pay Around the World

While holiday pay policies can very greatly from one part of the world to another depending on local labor laws, local culture, or even employer policy; ensuring global awareness, knowledge, understanding, and recognition of these differences is critical when local law applies or when working abroad with a multinational employer.

United States

In the United States, holiday pay is not mandated under federal law for private sector employers. Each company is able to determine their holidays, as well as the premium amount of pay for employees that work on holidays, if any. Federal employees, are entitled to 11 federal holidays in addition to Inauguration Day, which is a federal holiday. Some states, like Rhode Island, require premium pay for certain holidays.

United Kingdom

In the United Kingdom, employees receive 28 days of paid annual leave, which can include public holidays or bank holidays. Many employers extend paid holidays to include some additional paid holidays for occasions that are traditional or cultural or religious. Holiday pay ensures that an employer provides employees paid time off while compensating those employees fairly who may work.

India

Holiday pay in India is determined by state laws established under the Shops & Establishment Act. Paid holidays are typically national holidays, festival holidays, and company holidays as declared by the company. Some companies may allow floating holidays to accommodate religious or cultural holidays.

European Union

EU law requires at least four weeks of paid annual leave and approximately 3 paid time off (PTO) holidays, which are frequently included in annual leave entitlements. A national law may additionally regulate how holidays are dealt with in an in-country business, and each in-country business must pay regard to its premium pay days and particular paid holidays. For example, in Germany and France, there are both national holidays and regional holidays that employers must keep in mind.

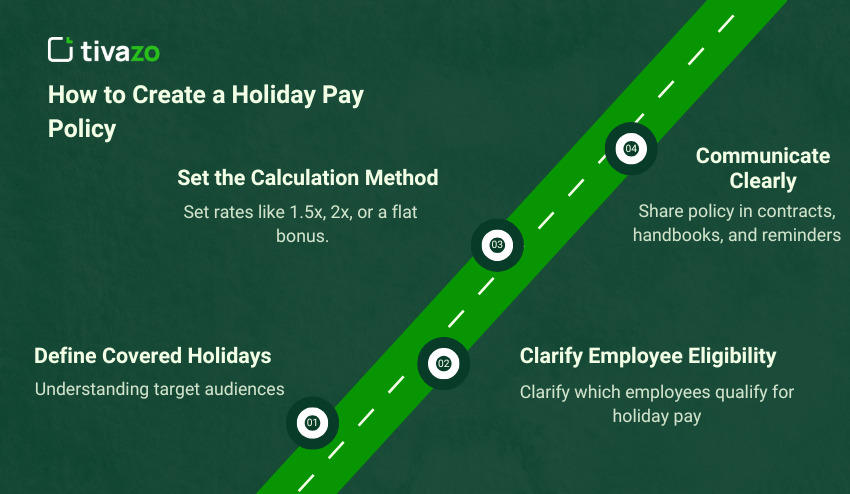

How to Create a Holiday Pay Policy

A clear policy regarding holiday pay will help to ensure that employees are compensated appropriately and will alleviate confusion, while also keeping your business compliant with employment standards. Here’s how employers may implement a holiday pay policy.

1. Define Covered Holidays

Determine whether holidays will include:

- Federal or general holidays (e.g. Christmas, Independence Day)

- Religious or cultural holidays relevant to the workforce

- Company recognized holidays, like a Foundation Day, or team appreciation day

2. Clarify Employee Eligibility

Decide whether the following types of employees will receive holiday pay:

- Full-time employees

- Part-time employees (possibly pro-rated holiday pay)

- Seasonal or temporary employees

3. Set the Calculation Method

Define how holiday pay will be computed:

- Time-and-a-half (1.5x)

- Double time (2x)

- A Flat bonus per holiday worked

You may want to include examples as an appendex to your policy, so employees know what calculation will apply and how.

4. Communicate Clearly

The policy should be clear enough for an employee to understand by:

- Including it in employment contracts

- Posting in the employee handbook

- Sending reminders prior to each holiday

Tips for Managing Holiday Schedules

Holiday scheduling can be a challenge when you are in the thick of business. Planning ahead and effective communication of holiday schedules will keep employees happy while maximizing productivity:

- Plan ahead: Distribute holiday schedules as early as possible so employees can plan around them.

- Fairly rotate: Give employees the opportunity to either work the holiday (if and when there is demand and work available) or have the days off at peak holidays.

- Consider staffing needs: When deciding who works during peak holidays, look at planned workload and employee needs and availability too.

- Clearly communicate holiday schedules: Make sure employees realize what holidays they will be receiving extra pay (if eligible).

Conclusion

In summary, holiday pay is not simply a monetary gain, holiday pay is a tool to help both the employee and employer. For the employee, holiday pay acknowledges their effort and thus, encourages retention and commitment to the organization, and compensates them for working when most people are with friends and family.

For the employer, holiday pay encourages employees to stay productive during a vital time of year and limits turnover, while providing a positive workplace culture. Additionally, clear holiday pay policies help the organization stay compliant with applicable federal, state, and internationally recognize employment or labor laws by removing the possibility of disputes, and promoting the organization as an employer of choice.