Employers usually offer employees perks and benefits that are out of range of salary. These perks do not necessarily have to be cash-based although most of them are taxable as per the IRS. It is here that imputed income comes to play. It is important that employees and employers understand what it is and its impact on their taxes.

Understanding the imputed income, both employees and employers can manage their finances better, and also employers will be able to have their payroll and tax reports right. This avoids tax season surprises and allows one to ensure adherence to the IRS regulations.

Key Highlights:

- Definition of Imputed Income

- Tax Impact

- Examples of Imputed Income

- Excluded Benefits

- How It’s Calculated

- Taxation

- Employer Responsibility

- Employee Responsibility

- Best Practices

What is Imputed Income and Why It Matters

Imputed Income is the amount of non-cash benefits an employee obtains from his employer but it becomes taxable but, no money was actually paid. The IRS perceives such benefits as income as they have financial worth. This value is included in the taxable type of wages that the employee has, and it adds to the gross income that the employee can use to pay taxes. This amount should be monitored, computed, and disclosed by employers to remain compliant.

The significance of this type of income is that it influences payroll taxes, employee take-home pay, and reporting to the IRS. With the knowledge of its impact, both employers and employees steer clear of tax surprises.

How Imputed Income Works in Real Life

The value of a benefit provided by an employer and which has personal value e.g., a company car used to make personal trips or life insurance over the set limits, should be included in the taxable wages of the employee. The employer determines its Fair Market Value, minuses any payment made by the employee, and incorporates the rest as in payroll.

Although the employee does not get cash compensation, the IRS considers it income. That is, income taxes and FICA (Social Security and Medicare) could be used.

Is Imputed Income the Same as Fringe Benefits?

Although fringe benefits are any form of additional benefits an employee gets, including health insurance, company cars or tuition reimbursement, not all fringe benefits can be described as imputed income.

This income in particular, is a taxable amount of non-cash benefits that the IRS still considers as incomee which you have to report. For example:

- Personal use of a company car is a fringe benefit, and the personal-use value of a car is imputed.

- Fringe benefits also include employer-paid life insurance in excess of 50,000.

The point to remember is that all the imputed income is a result of fringe benefits, though not all fringe benefits result. Fringe benefits, but not this income, include all the benefits that satisfy IRS exclusions, such as minor perks or making contributions to an HSA.

Common Examples of Imputed Income

3.1 Group Term Life Insurance Over 50000 Dollars

When an employer offers group term life insurance, and the amount that the employer offers to cover an individual is more than 50000, then the excess price of the cover is taxable and should be treated as imputed income.

3.2 Personal Use of Company Vehicle

A example is that of personal trips with a company car. The employer should establish the value of use of personal usage by the use of IRS valuation methods that include cents per mile and annual lease value rule.

3.3 Employer Paid Domestic Partner Health Insurance

Imputed income is a health insurance of domestic partners or non dependents since they are not tax dependents according to the IRS rules.

3.4 Employer-Provided Housing and Accommodation

When the employer is providing free or discounted housing the value of that housing will be an imputed unless it is necessary to that job, furnished upon business premises and a condition of employment.

3.5 Cash Equivalents and Gift Cards

Gift cards, prepaid debit cards or any cash equivalent are completely taxable irrespective of the sum. Even when the amount is small.

3.6 Tuition and Educational Assistance Over 5250 Dollars

Employer-funded education is not included until a limit of 5250 dollars in a year. Any assistance above this limit is subjected to tax.

3.7 Dependent Care Assistance Over 5000 Dollars

The benefits that employers can offer to dependents are up to 5000 dollars every year. Anything over that limit is considered imputed income.

3.8 Gym Memberships, Wellness, and Fitness Perks

The gym membership made available by the employer is normally regarded as imputed unless the gym is at the place of work and it is used in the course of business.

What is Excluded from Imputed Income

Not all benefits are taxable. Here are common exclusions:

- De minutiae benefits: periodic snacks, coffee, small holiday gifts or the use of company equipment on personal grounds.

- The contribution of the employer to Health Savings Accounts.

- Meals and accommodation are provided at the convenience of employer.

- Transportation benefits, such as commuter transportation and parking restrictions, are qualified.

- Life insurance cover of 50000 dollars.

- Free education up to 5250 dollars.

- Dependent care costs as much as 5000.

These fringe benefits have been excluded due to their minimal values, necessity to business or due to IRS specific exemption.

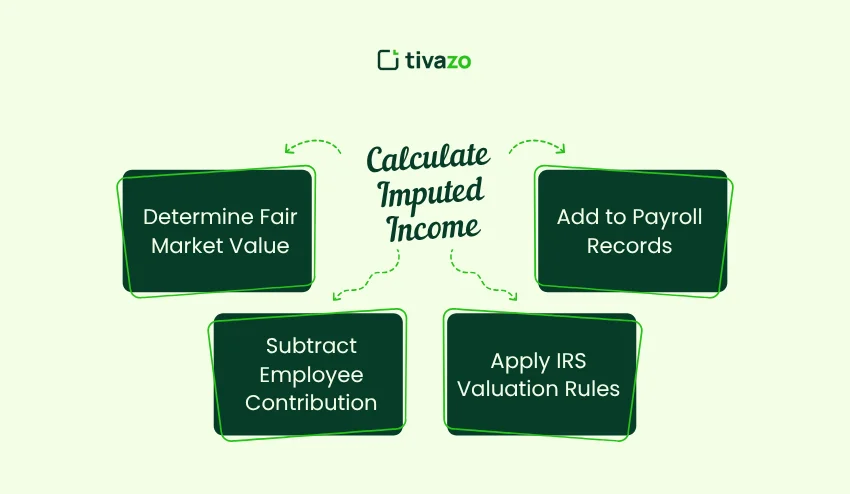

How to Calculate Imputed Income

5.1 Determine Fair Market Value

Begin with the determination of the Fair Market Value. This is the price at which the benefit of the same would be bought separately in the market.

5.2 Subtract Employee Contribution

Pay a subtraction to the amount paid by the employee towards the benefit.

5.3 Apply IRS Valuation Rules

Some benefits have to be pursued by the official IRS valuation procedures by employers:

- Annual lease value method

- Cents per mile method

- Special commuting rule

5.4 Add to Payroll Records

The calculation is then added to the payroll and indicated in the Form W 2 to pay taxes.

Example

Assuming that the personal use of a company car is 2500 dollars annually and the employee is paying 500 dollars, 2000 dollars will be included.

How Imputed Income is Taxed

The imputed income is subject to taxation just like any other wages; therefore the value is regarded by the IRS to be a part of the gross income of an employee. This is to make sure that employees pay the right tax on the benefits that have monetary value though they may not be the ones who received them as cash. The inclusion of this income on taxable wages may occasionally move the workforce into a higher tax bracket, and thus it is essential to comprehend the implications on the taxable wages to do the tax preparation properly.

- Federal income tax

- Social Security tax

- Medicare tax

It raises the taxable wages, gross income and may have an impact on the overall tax bracket of the employee. Nonetheless, it does not necessarily affect retirement savings such as 401 (k) based on the company policy.

Where to Find Imputed Income on Pay Stub and Form W-2

The imputed income is likely to be recorded on the pay stubs or annual Form W-2, which are given to employees. To ensure compliance with IRS reporting, employers report it separately. Knowledge of where such amounts are assists employees to confirm that they have the right amount of money to pay in terms of the tax returns and prevent any surprises during tax filing. Form W-2 would have as shown below:

- Box 1: Wages, tips and other compensation.

- Box 3: Social Security wages

- Box 5: Medicare wages

- Box 12: Code C in excess group term life insurance.

To demonstrate transparency and compliance with the IRS, employers record it separately.

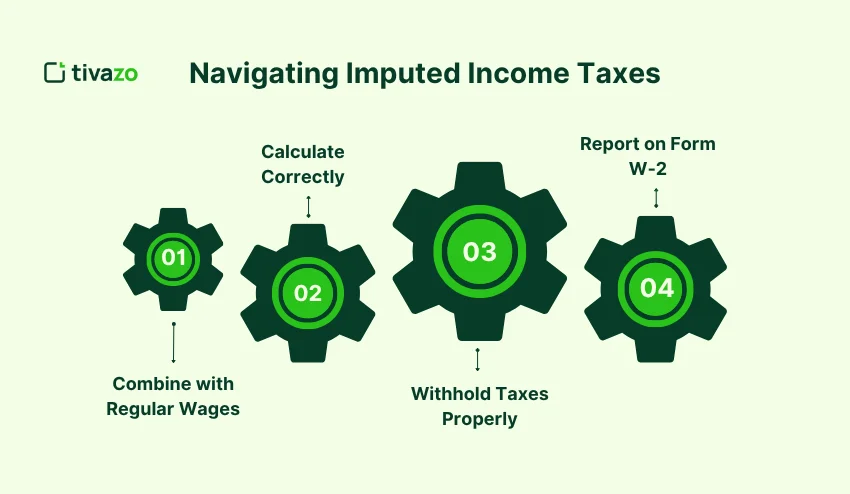

Navigating Imputed Income Taxes

Imputed income may be a puzzle to handle, however, knowing how taxes are applied will keep employees and employers on track and prevent an unexpected outcome. Here’s what you need to know:

1. Combine with Regular Wages

To the gross wages of the employee, this income is included to the federal income tax, social security, and Medicare.

2. Calculate Correctly

The available benefits should be valued by the employers at fair market value (FMV) minus any employee contributions and apply the IRS provisions to taxable benefits.

3. Withhold Taxes Properly

The employers have a duty to withhold federal and FICA taxes. Compliance can be facilitated by having the right payroll systems.

4. Report on Form W-2

Show income on employee W-2 in the relevant boxes (Box 1, 3, 5 and commonly Box 12 with a 109C group term life insurance).

Imputed Income for Employers: Key Responsibilities

Employers should make sure that they have appropriate tracking, calculation, reporting and disclosure of such taxable benefits. They should:

- Keep fringe benefits records.

- Apply good faith IRS valuation.

- Train payroll and HR teams

- Fail to pay the right amount of payroll.

- Insert accurate information in Form W-2.

Imputed Income for Employees: Financial Impact

The imputed income is used to add to the income of an employee yet there is no cash received. These can decrease the take-home pay because federal income tax, Social Security, and Medicare taxes are imposed on the worth of such benefits. Increased taxable income can also change eligibility to some tax credits or deductions, including the earned income credit or child tax credit.

The employees are also supposed to check their pay stubs keenly to determine whether there is this income and to know the taxable benefits. Unexpected tax bills can be avoided by planning ahead such as adjusting tax withholding or setting up a savings account toward taxes. Typical examples are personal use of a firm vehicle, life insurance exceeding 50,000 or tuition paid by the employer beyond the IRS income brackets.

Imputed Income and Payroll Compliance: Employer Best Practices

To maintain compliance:

- Automate Fringe Benefit Tracking using payroll software.

- Fair Market Value of Documents.

- Tax benefits by communicating to employees.

- Keep IRS audit history straight.

Payroll compliance will assist in avoiding underreporting and expensive fines.

Tips to Avoid Imputed Income Mistakes and Surprise Tax Bills

- Do not give cash equivalents with automatic triggering tax.

- During open enrollment and benefit enrollment, inform the employees.

- Report decreased value of employee contributions to taxes.

- Explain what benefits have to be taxed and what ones do not.

Training of the HR staff and staff members can be done to avoid the undesirable financial blow.

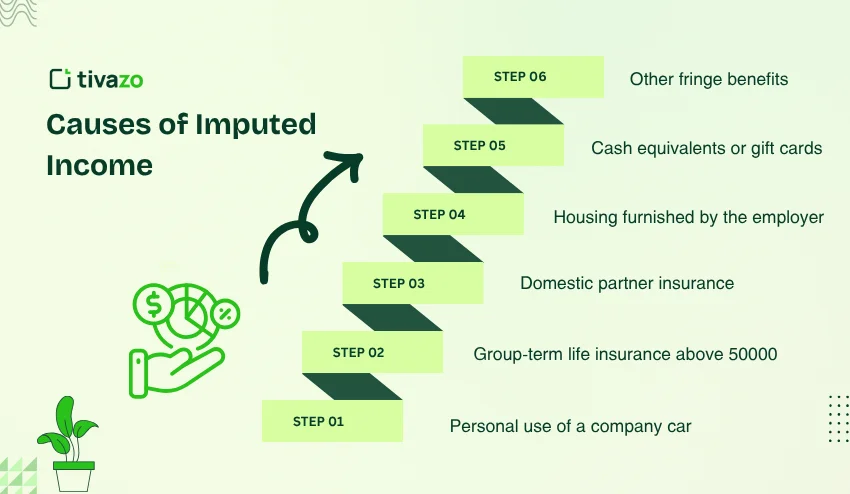

Causes of Imputed Income

The imputed income occurs when the employee of the employer gains a non-cash benefit which is taxable according to the IRS. Although direct payment is not done, these benefits are monetary in nature and require inclusion in taxable salaries of the employee. The knowledge of the causes allows the staff and the employer to handle the payroll and prevent unpleasant surprises in the form of taxes.

Common causes include:

- Personal use of a company car the value of using a company vehicle as a personal car.

- Group-term life insurance above 50000 above the IRS limit, then it will be taxed.

- Domestic partner health insurance or non-dependent insurance premiums are paid against people who are not tax dependents.

- Housing furnished by the employer, in case the value falls short of the IRS exclusions.

- Cash equivalents or gift cards are always taxable, irrespective of the amount.

- Other fringe benefits above the IRS limits including dependent care benefits of more than 5,000 a year.

By understanding such reasons, employers and employees can correctly report this income, which allows them to be compliant and prevents any tax surprises.

Final Thoughts: Making Imputed Income Work for You

There is nothing bad about the imputed income. It merely makes the fringe benefits to be considered fairly and taxed accordingly. When properly handled, it assists employers in providing a competitive benefits package without going out of compliance.

The trick is to get it right, communicate clearly, and plan intelligent taxation. Employees are able to have desirable benefits as they are made aware of the way they affect their taxable income.