Have you ever looked at a paycheck and felt that it does not correlate to an increase in salary or overtime work? That is where retro pay comes in. Retro pay, also known as retroactive pay, is a compensation method used to make sure that the employees are fairly compensated with regard to previous work that was either underpaid because of a missed raise or a fixed amount of hours, or an error in the payroll. A retro check helps to close a gap between the payment and what one should have earned.

We shall discuss all there is to know about retro pay in this blog: the reasons why employees are often given retro pay, who is entitled to retro pay, how retro pay is paid, and step-by-step calculations of retro pay. We are also going to define retro pay and back pay, cover the tax aspect, calculate retro pay for hourly and salaried employees, point out retro pay in healthcare workers, and give tips on how to make retro pay right with Tivazo.

By the close, you will have a comprehensive guide on how to manage retro pay in an efficient manner. Let’s dive in.

📖Related: How Many Pay Periods Are in a Year? A Guide for 2026

What is Retro Pay in Payroll?

Retro pay in payroll is defined as the extra amount paid to the employees when there was a pay adjustment, like a raise, promotion, fixed hours, or overtime, and this was not reflected in a past paycheck. The difference between what an employee received and what he or she should have received for past work is referred to as the difference. Retro pay is given by the employers to rectify payroll errors, meet legal requirements in the labor market, and to be fair in compensation. Retro pay is normally included in the upcoming payroll period as a special line item in order to reflect the adjustment.

What is a Retro Check?

A retro check is a paycheck that is issued to compensate employees with retro pay, or money that was due as a result of past work that was initially paid at an incorrect rate. It deals with the disparity between the pay that an employee was given and the pay that he or she should have been given following a raise, a change in hours, or an adjustment of overtime. Retro checks are usually given in isolation from the usual payroll to ensure that the correction is evident and that it is easy to trace.

What are common reasons for retro pay?

Retro pay is paid out in cases where employees are underpaid as a result of an error or alteration in their wages. The knowledge of the usual causes of retroactive pay assists the employer in keeping the payroll records accurate, and also the employees get their deserts.

1. Pay Raises or Promotions

In some cases, an employee is not given a new rate as soon as a pay increase or a promotion is given. Retro pay will take care of the difference between the old rate of pay and the new rate of pay, which is applied over the period the employee works at the old rate.

The employers compute retroactive remuneration on increases by multiplying the variation between the previous and new remuneration rate by the number of affected hours or pay periods. This will make sure that there are correct payroll adjustments and wage disputes are avoided.

2. Missed Overtime or Hours

The employees can sometimes work overtime, which was not recorded or paid accordingly. These hours that are missed are corrected by paying retro, so that employees do not lose out on proper compensation for all work done.

Payroll departments work out the amount owed by multiplying the number of hours worked, which have not been paid, by the appropriate hourly wage, including overtime wages in some cases. Proper retroactive overtime payment averts court cases and employee trust.

3. Payroll Errors

Errors, such as underpayment, wrong deductions, or wrongly calculated bonuses, may happen when processing the payroll. Retro pay is used to compensate employees for such payroll errors.

Retro check is the best way to fix the payroll errors, as it will keep the labor laws in place and keep the employees satisfied. It also gives a clear audit trail to be used in future payroll.

4. Contract or Union Adjustments

The alterations in the employment contracts or union agreements can necessitate the alteration of the past pay periods. Retroactive pay makes the employees get the new terms of wages.

This is a form of retro pay that is particularly prevalent in unionized workplaces where collective bargaining agreements indicate retro pay increases. One of the ways to prevent disputes is to calculate and communicate properly.

Retro pay plays an important role in rectifying historical underpayment, be it through increases, uncompensated hours, errors in payroll, or adjustments to the contract. These are some of the common reasons that are understood by employers to implement correct retroactive payments, payroll compliance, and to make sure that employees are justly rewarded.

📖Related: Payroll Software: 5 Reasons It’s Essential for Businesses

Who qualifies for retroactive pay?

Underpaid employees who are not paid the correct amount because of a pay raise, promotion, missed overtime, or payroll mistakes are normally entitled to retroactive pay. This is also applicable to the workers who are under the revised employment agreements or the union agreements, in which the wage adjustments that are meant to be made are backdated. Retro pay is a guarantee that such employees get the amount of money they should have earned due to the work they did in the past, in comparison to the amount they were actually paid.

The period and reason of underpayment are the determinants of eligibility. Payroll departments compute retroactive payments at the right rate of pay, number of hours worked, or revised salary conditions. Besides ensuring the accuracy of payroll, the timely payment of eligible employees to the organization through retro checks will ensure that the organization is operating within the labor laws and provide the staff with trust.

How long does it take to get retroactive pay?

The retroactive pay is subject to the schedule of payment by the employer according to the payroll and the complications of the adjustment. The missing raise or overtime can be made up by the simple retro pay in the next paycheck, and more complicated changes, including a series of pay periods or union contracts, can take weeks before it is processed.

In most cases, it takes employers time to compute retroactive remuneration, revise the payroll records, and verify that the rules on tax and labor are followed. Communication with the employees is clear on the anticipated timelines, which in turn reduces the expectations and avoids confusion, so that the retro check can be issued correctly and on time.

How to Calculate Retro Pay

Calculating retro pay ensures employees receive the correct wages for work that was previously underpaid due to raises, missed hours, or payroll errors.

Basic Formula:

Retro Pay = (New Pay Rate − Old Pay Rate) × Hours Worked or Pay Periods

Step-by-Step Calculation Process:

1. Determine the Old and New Pay Rates

- Identify the employee’s previous pay rate and the updated pay rate that should have applied.

- For hourly employees, use the hourly wage.

- For salaried employees, divide the annual salary by the number of pay periods.

2. Identify the Retroactive Period

- Determine the period during which the employee was underpaid.

- This could be days, weeks, or months, depending on when the raise, promotion, or correction should have taken effect.

3. Calculate the Pay Difference

- Subtract the old pay rate from the new pay rate to find the difference per hour or per pay period.

4. Multiply by Hours or Pay Periods

- Multiply the difference by the total hours worked (for hourly employees) or by the number of pay periods (for salaried employees) during the retroactive period.

Example Calculation:

- Old Hourly Rate: $20

- New Hourly Rate: $25

- Hours Worked During Retro Period: 80

Retro Pay = (25 − 20) × 80 = 5 × 80 = 400

Result: The employee would receive $400 in retro pay for the 80 hours worked at the underpaid rate.

By following this method, employers can accurately calculate retro pay, maintain payroll compliance, and ensure employees are fairly compensated for past work.

Is retro pay taxed

Yes, retro pay is considered taxable income and is subject to federal, state, and local income taxes, just like regular wages. It is also subject to Social Security, Medicare, and other payroll deductions. Employers include retroactive pay in the employee’s paycheck, and taxes are withheld accordingly.

Key Points to Keep in Mind:

- Retro pay is reported on the employee’s W-2 for the year in which it is paid.

- The amount of taxes may be higher in a single paycheck if a large retroactive payment is issued at once, because it is added to regular wages.

- Proper payroll processing ensures that both employees and employers remain compliant with tax laws.

By understanding that retro pay is taxable, employers can manage payroll accurately and employees can plan for withholding adjustments if needed.

📖Related: Is Overtime Taxed More? Shocking Facts for 2026

Retro pay vs back pay

| Retro Pay | Back Pay |

| Additional pay for past work when wages were underpaid due to raises, promotions, or payroll errors. | Compensation owed for unpaid wages due to legal disputes, wrongful termination, or labor law violations. |

| Corrects pay discrepancies like missed raises, overtime, or contract adjustments. | Results from court orders, settlements, or legal claims. |

| Usually for employees affected by payroll errors, missed overtime, or retroactive pay agreements. | Usually for employees involved in legal cases or claims for unpaid wages. |

| Issued by payroll as part of regular payroll processing or a separate retro check. | Paid as part of a settlement, judgment, or legal resolution. |

| Taxable as regular income, subject to withholding and payroll taxes. | Generally taxable, but depends on the nature of the settlement; consult tax guidelines. |

| Ensures fair and accurate compensation for previously underpaid work. | Provides financial remedy for legal wage disputes or violations. |

How to calculate retro pay for hourly and salaried employees

For Salaried Employees

Calculating retro pay for salaried employees involves determining the difference between the old salary and the updated salary over the retroactive period. Salaried employees are usually paid a fixed amount per pay period, so the calculation focuses on the number of pay periods affected.

Steps:

- Determine the old annual salary and the new annual salary.

- Calculate the pay difference per pay period:

Pay Difference per Period = (New Annual Salary − Old Annual Salary) ÷ Number of Pay Periods in a Year - Multiply the pay difference by the number of affected pay periods:

Retro Pay = Pay Difference per Period × Number of Retroactive Pay Periods

Example:

- Old Salary: $48,000/year

- New Salary: $52,000/year

- Pay Periods per Year: 12

- Retroactive Period: 3 months

Pay Difference per Period = (52,000 − 48,000) ÷ 12 = $333.33

Retro Pay = $333.33 × 3 = $1,000

The employee would receive $1,000 as retro pay for the 3-month period.

For Hourly Employees

For hourly employees, retro pay is calculated based on the difference between the old hourly rate and the new rate, multiplied by the hours worked during the retroactive period. Overtime hours must also be included if applicable.

Steps:

- Determine the old hourly rate and the new hourly rate.

- Identify the hours worked during the retroactive period.

- Calculate the pay difference per hour:

Pay Difference per Hour = New Hourly Rate − Old Hourly Rate - Multiply the pay difference by the hours worked:

Retro Pay = Pay Difference per Hour × Hours Worked

Example:

- Old Hourly Rate: $20/hour

- New Hourly Rate: $25/hour

- Hours Worked During Retro Period: 80

Pay Difference per Hour = 25 − 20 = $5

Retro Pay = 5 × 80 = $400

If there are overtime hours, calculate them separately at the correct overtime rate and add them to the total retro pay.

This method ensures both salaried and hourly employees are fairly compensated for any underpayment during the retroactive period.

Retro pay for Healthcare Workers

Healthcare workers are now paid retro, where nurses, doctors, and other medical personnel are fairly paid for prior work when their salaries have not been increased accordingly, their contracts revised, or their payrolls miscalculated. Since the employees in the healthcare sector frequently have irregular working schedules, overtime, and on-call time, retroactive pay should take into consideration such differences in order to guarantee proper compensation. Retro pay can also be used as shift differentials, like night, weekend, or holiday work.

Retro pay may also be offered to healthcare workers who have been covered by union agreements or employment contracts when they need their wages adjusted. Proper calculation of hours missed, adjusted rates, and so on is essential for compliance and employee satisfaction.

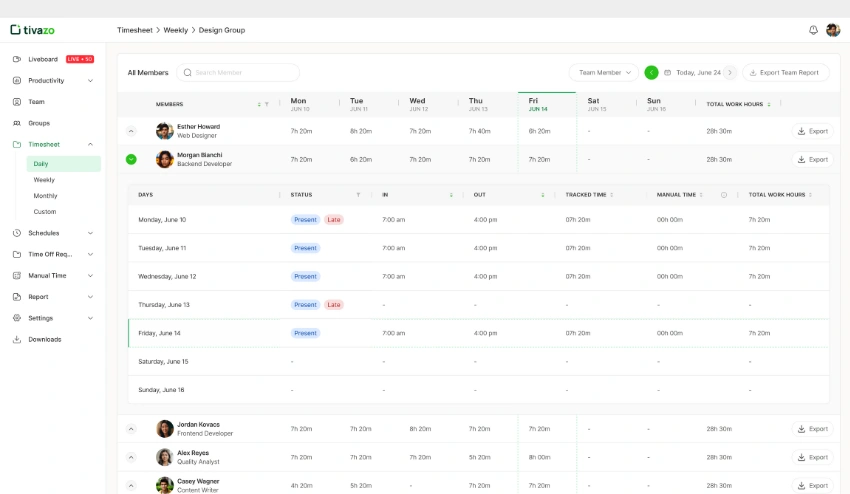

Make Retro Payments accurate with Tivazo

Retro pay is not always easy to manage, particularly when involving many employees, pay adjustments, overtime, and union contracts. Tivazo assists in automating and simplifying the process to enable employers to ensure that the calculation of retroactive pay is accurate for all the affected employees. Through Tivazo, payroll departments will be able to minimize errors, save time, and remain in compliance with labor laws.

Tivazo enables employers to monitor pay rate changes, missed hours, and payroll changes easily in real time. It also makes sure that retro checks are true in terms of wages, overtime, and benefits, whether in an hourly, a salaried position, or a specialist position such as a healthcare worker. Automated calculations and reporting, Tivazo assists organizations to make retro pay in a timely and accurate way and ensuring transparency, enhancing employee trust, and simplifying the payroll process.

Conclusion

Retro pay is very important because it helps to pay employees fairly according to the previous work that could have been underpaid because of raises, missed hours, payroll corrections, or contract corrections. Regardless of whether it is hourly, salaried, or healthcare workers, knowing how to compute retro pay, the tax consequences of retro pay, and the eligibility requirements will assist employers in keeping their payrolls accurate and compliant with labor regulations. Effective management of retroactive pay brings in trust, avoids conflicts, and makes employees feel appreciated.

The accuracy and efficiency of retro payments can be achieved through the use of such tools as Tivazo that automate calculations and track the changes in the pay and manage overtime or shift differentials with ease. A planned retro pay process can enable organizations to ensure accurate and timely retro checks, ease payroll management, and help employees become satisfied with their jobs at any position.