Comprehending non billable meaning is instrumental for all businesses, but is especially important for companies in service-based industries such as consulting, law, marketing, and IT. It does not matter whether you are a project manager, freelancer, or team leader; understanding the difference between billable and non-billable hours, expenses, and services can greatly impact both profitability and workflow efficiency. The ability to accurately track and manage billable and non-billable hours or expenses is incredibly beneficial for improving resource allocation, client transparency, and ultimately, business growth. Clarity around non billable time also helps with decision-making and increases team productivity by allowing employees to be dedicated to revenue-generating activities.

This guide aims to provide insights about non billable meaning, offers definition(s) of related terms, addresses a few FAQs, and shares actionable tips that can help you better manage your projects.

Key Highlights:

- What Does Non-Billable Mean?

- Billable vs Non-billable: What’s the difference?

- What Does Non-Billable Work Mean?

- What Is A Non-Billable Charge?

- Some Examples of Non-Billable Expenses?

- What are Non-Billable Employees?

- What Are Non-Billable Services?

- What is considered a Non-Billable Expense?

- Ways to Measure Billable vs Non-Billable Hours Consistently

What Does Non-Billable Mean?

Non billable meaning refers to time, activities, or expenses that a business or professional cannot charge to a client. Non-billable work is basically work that has to be done but is invisible invoice time to the client because it is not attached to a paid project or service.

Some examples of non-billable time can include internal meeting times, training time, administrative time, or time spent on proposals.

- Even though non-billable work does not contribute to business income, it is a critical component of any business.

- It serves to help fulfil wider business goals such as employee retention, employee development, and employee growth.

- For employees’ education and facilitation sessions (in training), establish an opportunity to spend on-project time that minimally or indirectly benefits the client with knowledge of current project expectations and industry standards, while ensuring that the work is being done with skilled staff on their project.

- Administrative work such as scheduling, reporting, and travel may also be non-billable, but they are essential and provide a communication framework for non billable work, as they keep teams continually engaged, keeping their structure.

- In summary, non-billable time decreases current revenue (short-term) and reduces the time available to charge clients for work on their project.

- Effectively managing non-billable time creates efficiencies and thus more immediate and long-term earnings, while preventing burnout by managing workload over time.

- By understanding what non-billable means, businesses will be able to better allocate non-billable tasks and time, and set client expectations around project time and costs.

Billable vs Non-billable: What’s the difference?

| Aspect | Billable | Non-billable |

| Definition | Work billed to client | Work not billed to client |

| Examples | Project development, phone calls with the client | Admin work in the office, training employees |

| Impact on Revenue | Single revenue | Source No revenue |

| Tracking | Billable hours | Tracked separately or not |

| Employee Focus | Client work | Internal work |

What does “Billable” mean?

Billable is the definition given for tasks or time that can be billed to a client as part of a service agreement. These are hours and/or expenses that can be directly related to the delivery of the project or work for the client. For Example, consulting hours spent on solving a client’s problem, hours spent designing or building a website.

What Does Non-Billable Work Mean?

Non billable meaning at work refers to any work or time spent on tasks that help the business or support the client’s work, in ways that can’t be directly billed for. This can include:

• Internal meetings

• Training

• Administrative work (i.e., checking email, organizing calendars)

• Proposal writing (unless billed separately)

• Business development

While these activities are important, they don’t immediately generate revenue.

That said, non billable meaning work, even if it is not generating direct income at the time, is important to the sustainable health and growth of an organization. It helps build internally-facing knowledge, helps with collaboration and effectiveness, and helps to organize and prepare to work with the client. Proposal writing is considered non-billable, but has the potential to become new business.

Furthermore, business development-related work (i.e., networking, market research, etc.) can frequently be classified as non-billable work and is a core part of how you sustain long-term success. correctly acknowledging and managing non-billable work will help teams remain busy and engaged in their work, while also aligning with the organization’s objectives, all while juggling client deliveries.

What Is A Non-Billable Charge?

Non-billable charges are costs incurred in the business that cannot be charged to the client. These may include:

- Software licenses for internal use

- Employee payments for time not working with the client

- Office supplies

- Utilities

While non-billable costs affect gross profits, they are an expense to be incurred to run the business.

Some Examples of Non-Billable Expenses?

Employee training costs

These could include training materials, instructor costs, and employee time spent in training.

Internal software maintenance

This includes time and resources spent when developers work to fix bugs in software systems or maintain systems that are not related to client projects.

Office Supplies

This includes items like stationery, printer ink, and more general supplies needed for office services in a typical workspace.

Utilities

- Costs for electricity, internet, water, and other services that keep a business running and its workplace operational.

Benefits Expenses - Costs related to employee health insurance, retirement contributions, and other long-term perks associated with employee work.

Internal travel

Travel for attending internal team meetings, company events, and general administrative meetings.

Non-billable expenses

- May be essential to the performance and day-to-day running of a business, but they won’t create any direct revenue for the company.

- Taking the time to properly manage and report non-billable expenses is key to the company’s budgeting processes and maintaining profits.

- Familiarity with non billable meaning expenses helps businesses to calculate their true cost of deliverables to the client.

What are Non-Billable Employees?

Non-billable employees are staff who cannot be charged directly to a client considering work hours (or work product).

Examples would be:

- HR professionals

- Administrative assistants

- Marketing team

- IT support

These employees serve in critical functions that allow the business to operate but do not add directly to the company’s revenue through client billable hours.

Understanding the non billable meaning with employees is important because although these “resources” are non-billable, ultimately they allow billable employees to concentrate on delivering work to the client. Their work improves internal processes, increases employee satisfaction, and ultimately improves company performance. Understanding and accounting for non-billable employees appropriately allows a business to effectively manage overhead costs and manage and plan its workforce needs according to its available resources. Realizing and understanding the non billable meaning of these positions is important for budgeting and resourcing purposes, so each business can identify how to allocate its resources for long-term profitability.

What Are Non-Billable Services?

Non billable meaning on services are services provided by a business that are not billed to the clients of the business. Common examples of these services include:

- Internal IT support

- Staff development sessions

- Client onboarding support (if not charged)

- Volunteer work

- Internal process improvement projects

- Quality assurance, quality monitoring, or quality testing not tied to client work

- Internal reports or performance reviews

- Marketing or branding initiatives for the business itself

- Networking or industry-based or business development opportunities (not charged)

- Internal documentation or knowledge bases.

Each of these services contributes to businesses being able to function as intended, supports the development of employee capabilities, or facilitates a better relationship with clients, but does not assist with direct revenue generation. Understanding the non billable meaning of these services is very important for effective cost management and allocation of resources.

What is considered a Non-Billable Expense?

A non-billable expense is any expense incurred by a business that cannot be charged or billed to a client. Some examples of non-billable meaning expenses are:

- Travel costs related to internal meetings

- Office rent

- Employee benefits

- Software subscriptions for internal use

- Office supplies (stationery, toner)

- Utilities (electricity, internet, water)

- Long-term equipment maintenance not directly related to a client project

- Business-related marketing and advertising costs

- Professional development, training, and development costs

- Legal and accounting fees related to business operations

- Company events and employee engagement opportunities

These expenses are necessary to ensure that you can run your business properly. Non-billable does not mean unimportant, and many of these expenses contribute to the overall health of your business. Understanding the non-billable meaning of these costs matters as it will help your business budget effectively and allocate towards future profits.

Why It’s Important to Know Non Billable Meaning for Your Business

Knowing the non billable meaning supports you in:

- Accurately estimating project profitability

- Recognizing efficiencies and optimizing processes

- Improving time management and resource utilization

- Setting realistic expectations for client billing

- Avoiding or at least reducing losses from hidden non billable meaning on expenses

Moreover, the understanding of non-billable work allows businesses to assign workloads better by acknowledging that internal tasks are integral to supporting client work. This can lead to higher employee satisfaction and lower risk of burnout – as teams can plan and allocate their time more evenly between billable work and non-billable work. In addition, a clearer view of non-billable work enables managers to make worthwhile decisions with regard to pricing, staffing, and project timelines. Overall, navigating the non billable meaning is key to maintaining a healthy profit margin and growing a sustainable business over time.

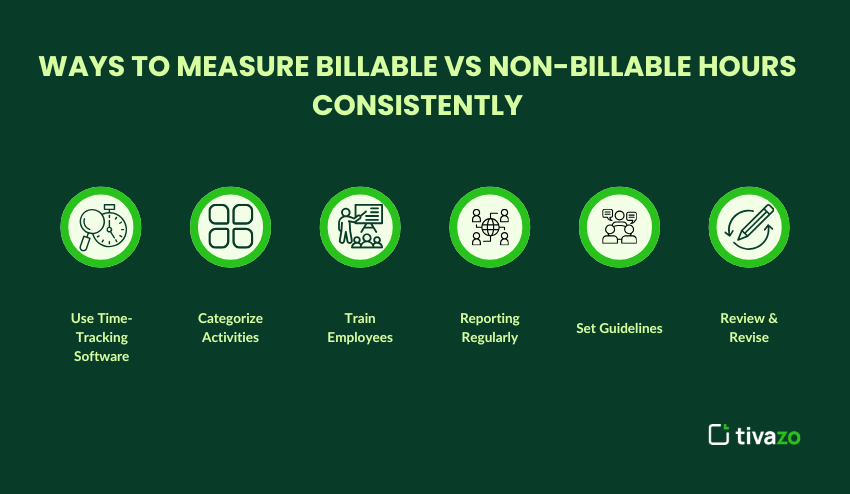

Ways to Measure Billable vs Non-Billable Hours Consistently

Use Time-Tracking Software

Time-tracking software such as Toggl, Hubstaff, or Harvest helps you get an accurate measure of hours spent in two ways: it tracks hours and then categorizes billable hours vs non-billable hours when reporting on the time logged. This categorization makes it easier to generate reports and analyze productivity with clients to gain better insights into the project. Understanding the non billable meaning, when logging hours, you will be in a position to classify correctly and ensure accountability.

Categorize Activities

Always have one or more categories that help delineate client work (i.e., billable) from internal tasks (i.e., non-billable) as a matter of clear definition. This will help with employees understanding exactly what can be billable and what doesn’t, providing clarity to ensure non billable meaning is reiterated correctly.

Train Employees

When training employees, emphasize the importance of accurate time reporting for project profitability and resource planning. It is important to stress the non billable meaning as to understand staff clearly, distinguishing between billable tasks and overhead tasks.

Reporting Regularly

Monthly reviews on billable ratios and associated non-billable costs can help identify trends, inefficiencies, and excess non-billable activity that may need correcting.

Set Guidelines

Having a company policy on how to log time, indicating examples of non billable meaning regarding any tasks and what can be classified as non-billable will reduce uncertainty and improve data quality.

Review & Revise

Regularly review annual logs or timesheets to adjust existing workflows, redistribute workload, or train staff on how to better use their hours as necessary for improving overall utilization.

Reducing Non-Billable Time without Sacrificing Quality

- Automate all repetitive tasks

- Outsource any administrative tasks

- Reduce any unnecessary meetings

- Establish effective guidelines when talking with clients

Non-Billable Meaning Across Industries

| Industry | Typical Non-Billable Tasks |

| Consulting | Internal training, proposal-writing, |

| Legal | Internal knowledge base research |

| IT & Software | Internal meetings, systems maintenance |

| Marketing | Internal reporting, strategy meetings |

Conclusion

Understanding non billable meaning is crucial if you are in a service-based business that will ultimately want to maximize your profitability and productivity. Accurately separating billable from non-billable work allows businesses to allocate resources more effectively, come up with proper pricing, and provide clarity around what may be happening.

A solid understanding of non billable meaning will identify areas that are losing time and resources without a conscious choice on the part of the organization. Understanding the relationships among billable tasks together with the impact of non-billable tasks will highlight the non-billable aspects, so action can be corrective as soon as it is observed.

To get your team working as efficiently as possible, establish key time tracking metrics that accurately show both billable and non-billable hours. Make sure your employees know the importance of the billing process and the active aspect of the non billable meaning & processes. Evaluate your non-billable charges frequently and understand how you can improve this area of your fledgling service-based company. You will be providing full disclosure of effort and cost, using accountability for process improvement, and working proportionally to the amount of effort and real business growth.