Managing multiple businesses under one umbrella involves much more than basic planning. Every unit has its own unique needs, resources, and financials that must be addressed with no room for error. As companies grapple with the identified challenges, they are able to search for systems that can keep data accurate and running efficiently. Merging data, dealing with compliance, and running payroll cycles reliably become top of mind. At this juncture of solution deployment, technology solutions become one of the stars of the show. Effectively managing payment solutions can mitigate headaches, free up time, and solidify trust with employees. Exploring all the moving parts helps provide evidence on the reasons to use payroll systems for growing companies.

Key Highlights:

- What is Payroll Software

- Reasons Payroll Software Is Essential for Businesses

- Centralized Process for Streamlined Operations

- Key Features of Payroll Software

- How Payroll Software Drives Business Growth

- Data Security: Keeping Information Safe

What is Payroll Software?

Payroll software is an automated payroll solution that supports the management of the complete payroll process. It enables companies to calculate and pay their employee wages, account for working hours, calculate any taxes, deal with compliance and reporting, and prepare financial statements all in one place. Payroll software provides a single application that completes manual tasks, reduces errors, and saves companies time. This becomes particularly helpful for companies managing multiple entities while confirming they submit payroll cycles consistently and accurately.

5 Reasons Payroll Software Is Essential for Businesses

For most businesses, specifically those that need to manage multiple entities effectively, payroll software is a true disruptor for their people processes. Below are five primary benefits of implementing payroll software to help your organization operate more efficiently and grow:

1. Time Savings through Automation

Payroll software can automate labor-intensive, administrative tasks, including, but not limited to, calculating hourly wages, calculating taxes, and ensuring compliance etc. This time-saving enhancement can free human resources and accounting groups from hours of work, reduce human error, and eliminate repetitive manual data entry. This helps companies focus on high-level, strategic tasks rather than more cumbersome administrative tasks.

2. Improved Accuracy

As a result of automating human capital management, payroll software can help reduce the mistakes made in payroll calculations, meaning you will make fewer errors with paying employees, taxes, and both mandated and other deductions. Presenting employees with accurate payroll systems creates trust that will lead to greater levels of satisfaction and loyalty. Moreover, as wage pain requires periodic changes for county, state, or federal tax rates, or alters deductions for benefits offerings, simply use the payroll software to make those changes and add them to calculations as the law allows. This will lower disputes among employees and help maintain an accurate, historical record for your business.

3. Simplified Compliance

With all of the fluctuating tax laws and labor laws, keeping up can be a complete headache for businesses in multiple states or countries. One of the nice things about payroll software is that it automatically updates with the newest legal requirements, saving businesses the fear of fines and penalties, benefit assessments, etc. The payroll software can also auto-generate reports and tax filings to help avoid unintentional mistakes through the audit process. This makes compliance simple and ensures your company has the latest updates to tax obligations.

4. Streamlined Communication

Payroll software stores all data related to employee pay in one system. This allows managers, HR team members, and employees to easily navigate to the necessary information, instead of reaching out to a designated contact. Employees can navigate self-service portals to access pay slips, leave balances, or any other payroll-related information through the payroll software. This form of transparency provides less confusion and allows the employee to have control over the payroll processes.

5. Cost Efficiency

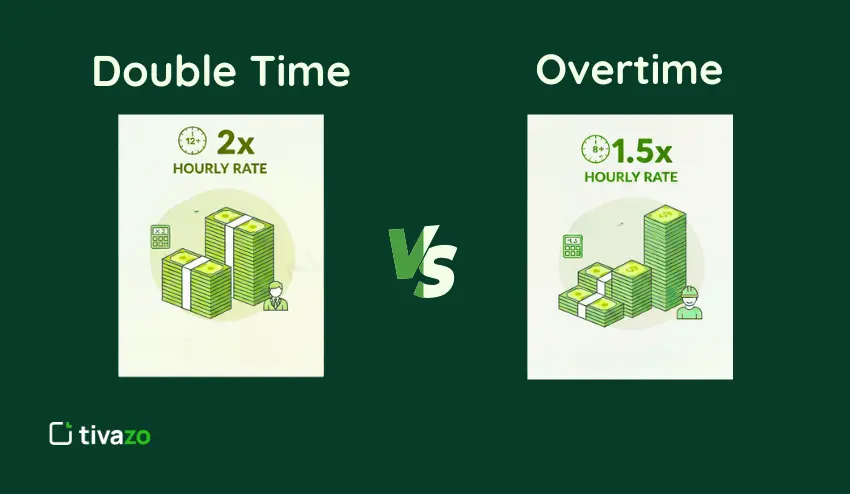

By automating processes you won’t need as much staff to do payroll, which will decrease costs in staffing expenses. Furthermore, avoiding errors and related penalties can save you from making expensive financial mistakes saving businesses money over time. Aside from payments and deductions, systems can also help with overtime and employee benefits to ensure you’re not overpaying in one area to cut costs in another. This kind of precision on the financial side of things allows you to budget and forecast better.

Centralized Process for Streamlined Operations

Having scattered payment records can cause unnecessary errors when a business operates across more than one company; it’s more likely to encounter unnecessary errors associated with separated payments. Centralization assures every detail will be stored, managed, and updated in the same spot, which allows for smoother operation and coordination for teams.

Modern Payroll software will also help integrate tasks like recording employee particulars and tracking time and attendance in a central and organized system.

- Centralized Data Management: Payroll Software consolidates employee details and attendance tracking into one system.

- Secure to Prevent Errors: Centralizing eliminates concern over duplication or loss of data.

- Improved Efficiency: Businesses with multiple units will be less confused and more organized.

- Simplified Coordination: All teams in multiple units can update or obtain information as needed.

Time Efficiency

Processing payroll across multiple companies can take a significant portion of working hours, especially if you have complex data and changes in regulations to factor in. By utilizing the appropriate payroll software, the amount of time spent on the task can be greatly reduced, increasing productivity for all teams. This is how payroll software enhances the time it takes to process payroll:

- Templates that can be reused: Payroll software allows you to save templates of tasks you repeat. Those templates can be reused from one business unit to another. This means that you do not have to re-enter payroll data for each entity you have, saving time and reducing inaccuracies.

- Automated Calculations: Payroll software allows for complex calculations, such as tax deductions and overtime to be calculated for you. This reduces the overall time spent on payroll while ensuring accuracy in the pay process.

- Centralized View: Managers can overlook multiple payrolls without having to utilize multiple systems. This provides a single view into the payroll, which allows for a more efficient monitoring and assessment of payroll.

- Faster Correction of errors: All of the records are saved in a single area, allowing for errors to be easily identified and resolved. Hours spent on resolving errors will be reduced, ensuring a smooth payroll process with accurate and on-time payments.

Key Features of Payroll Software

The payroll software will have many features to help modern companies especially those that are working as multiple entities.

- Automated Tax Calculations: Payroll software will automatically calculate taxes based on the most current rules and regulations to limit the amount of time workers spend inputting numerical data and reducing manual entry mistakes.

- Employee Self-Service Portal: An employee self-service portal is offered so that each employee can access pay information, request time off, and update any changes in their personal information.

- Integration with Accounting Systems: Payroll software will work easily with your accounting system, keeping your financial records simple and easy to push through your accounting software.

- Direct Deposit: Payroll software provides employees with direct deposit to allow automatic depositing into employee bank accounts.

Ensuring Compliance with Ease

One of the most difficult areas to keep up with when a company has more than one employee, the rules are dependent on a company’s employee count, the industry type, and the industry regulations. Businesses are required to maintain tax records, complete tax payments, and complete other compliance reporting as required by industry regulations. With all those requirements, it can feel overwhelming if you are not equipped with the right tools and processes.

Payroll software provides significant support to organizations by simplifying any compliance changes, reducing tax penalties, and protect businesses from human error. If you have a reputable system that adjusts for compliance changes as they occur, you can grow your business while ensuring you have not missed compliance items.

How Payroll Software Drives Business Growth

Payroll software is a great tool to not only streamline everyday tasks and bookkeeping but also provide critical aspects of overall long-term growth and scalability for a business. As a business grows, so will payroll complexity corresponding to a business subunit, location, or type of employee. Payroll software offers scalable solutions that grow with you, while also ensuring a seamless service experience and consistency in growth. Payroll Software can also provide you the tools necessary to make more informed data-driven decisions, which increases efficiency overall and employee satisfaction specifically. Below is a list of key ways payroll software supports business growth:

- Scalable Solutions: Payroll software will grow with you, and adjusting for other subunits or employees will not require ripping and replacing payroll software in the future.

- Improved Decision-Making: Business leaders have the clarity from financial summaries associated with real-time data to make improved decisions with payroll software.

- Employee Trust: Employees are more likely to trust your business when they are paid consistently, accurately, and on time, thereby increasing morale and productivity.

- Cost Savings: Payroll software streamlines manual processes and determines the cost of errors, reducing operational and bookkeeping costs.

Effective Cost Management

Overseeing finances across several businesses can be complicated, especially when done without effective support systems (or manually). Without appropriate tools in place, businesses risk incurring added expenses because of the errors of human error and inefficiencies resulting from a lack of clear visibility into financial data. Payroll software provides greater visibility into financial data, which allows leaders to ensure proper cash flow and resource allocation. This reduces operating costs and increases the likelihood of making costly errors.

- Reduced Overhead Costs: Payroll software reduces expenses associated with paper-based records and repetitive manual tasks.

- Optimized Staffing: The Number of staff required to perform payroll tasks is decreased, which can result in redistributing resources to other strategic functions.

- Prevents Financial Losses: The system helps to reduce the risk of errors, such as missed deadlines or incorrectly calculated wages.

- Clear Financial Summaries: Financial statements provide leaders with the data necessary to make informed, reasonable decisions regarding their finances.

Data Security: Keeping Information Safe

When multiple agencies work together, it is crucial to protect data at all times. This includes data such as salary statements, employee identification numbers, and tax codes that must be secured so that it is not visible to unauthorized individuals. Payroll software secures your data through several layers of security, through locked storage, and by allowing the right people in the right areas.

Rather than having unsecured files scattered, all data is securely stored in a system that is monitored with strong safeguards to reduce the risk of misuse. This greatly reduces the risk of losing that data and of causing a privacy violation. Regular data backups and protecting data in the cloud also

Scalability for Growing Businesses

As businesses grow and expand into several units, payroll management becomes complicated. Payroll software provides a scalable solution that shifts as your business grows, and it adapts to changing circumstances, such as new employees, locations, or entities. This scalability allows businesses to maintain the flow of business as they grow, instead of requiring constant updates, as businesses expand without issue.

- Adapts instantly when new employees or entities are added without requiring heavy lifting of setup work.

- Allows integration with other systems to create ideals aligned with other forms of the business.

- Keeps longer-term costs lower because the upgrade to the payroll system is easier than replacing outdated systems.

- Allows executives to prepare for expansion with confidence that they will maintain the level of payroll and restrict growth.

Conclusion

Managing units among businesses cannot be done by simple tools and requires a business-oriented way of thinking to facilitate moving through the normal activities to performance and grow. Payroll software is your partner and offers the high-level labor and vendor service along with other non-valuable data for its users. The payroll system expedites payroll, while managing costs, being compliant, and protecting data to create an orderly operation around the all-important data measurement needed for growing businesses. Payroll software is dedicated served beyond simply paying the correct amount each period, it creates metal structure for your long-term aspiration.